History of Bitcoin Prices First Until Now

Almost 10 years have passed since Bitcoin, which was originally just an idea on paper and code inside a computer, into a currency that is used by people busy. Bitcoin is originally worth less than USD $ 0.01 (2010) and Bitcoin transactions are considered a hobby of cryptographic enthusiasts. Bitcoin is worth almost USD $ 4,000 (September 2017) at the time of writing and is now nearly USD $ 9,000, x and more than 13 times the value of Ethereum, the second largest crypto currency after Bitcoin.

O all the steemians, are you a historical person? In this post I will tell you about the history of Bitcoin prices rather than the beginning of its creation so now.

October 31, 2008 - USD $0.00

Whitepaper written by Satoshi Nakamoto (still unknown real identity so now) about an electronic eyewitness that may be dispatched between two parties directly (peer-to-peer) without a third party has been issued.

January 3, 2009 - USD $0.00

The first Genesis block was identified when Bitcoin's first transaction was made, and it had started a block network called Blockchain. The block also has input reference data to headlines on that day:

The above news is a follow-up of the financial crisis involving most of the world in 2007-8, starting from the collapse of the housing market in the United States and worsening with the collapse of the large investment bank Lehman Brothers.

Six days after the Genesis block, Satoshi Nakamoto has released programs and also Bitcoin-related code.

October 5, 2009 - USD $ 0.0007-77 ↑

#New-Liberty-Standard, a BitcoinTalk user has issued a Bitcoin exchange schedule with USD, and the first exchange rate is USD $ 1 = 1,309.03 BTC where the USD value is maintained as 1. The calculation method used is dividing USD $ 1 with the average electricity consumption to run the computer with the CPU a high of one year (1331.5 kWh) was multiplied by the average cost of electricity in the United States in the previous year (USD $ 0.1136 per kWh). This amount is then subdivided by 12 to get the average cost per month, and eventually multiplied by Bitcoin amount generated through 30-day mining activity.

October 15, 2009 - USD $ 0.0099 ↑

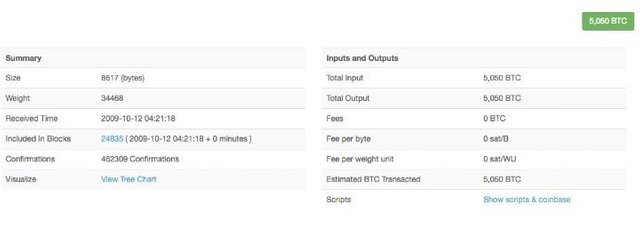

#New-LibertyStandard bought 5,050 BTC from #Marrti-Malmi or better known as Sirius, founder of Bitcoin Forum at USD $ 5.02. Payment for the transaction is made via PayPal.

February 6, 2010 - USD $ 0.0067 ↑

The first Bitcoin exchange platform, Bitcoin Market was established by the dollar, a BitcoinTalk user. The platform commenced operations on March 17, 2010 and the dollar put an initial exchange rate of 500 Bitcoins at USD $ .0067 / BTC.

May 22, 2010 - USD $ 0.0025 ↑

Do you know Bitcoin real-world transactions are to buy two pizzas in Florida for 10,000 BTC? In May 2010, a BitcoinTalk user had offered the Bitcoin amount to anyone who bought it pizza. Although the transaction is not directly between the buyer and the seller, it has proven Bitcoin has a real world value.

It also put a clear and obvious price for Bitcoin taken from the price of the 2 pizzas (about USD $ 25 at that time), making the Bitcoin pricing around USD $0.0025.

July 7, 2010 - USD $ 0.08 ↑

Bitcoin version 0.3 was released and announced on slashdot.org on July 11, 2010. Slashdot.org is a well-known website that features news on technological developments, and its readers are technically sensitive people. Bitcoin fans are increasing and people's demand causes Bitcoin's price to rise 10-fold in 5 days from USD $ 0.008 to USD $ 0.08.

July 17, 2010 - USD $ 0.07 ↑

Mt. exchange platform Gox was founded by Jed McCaleb, a programmer famous for peer-to-peer programs, eDonkey. At that time the value of 1 BTC equals USD $ 0.07. Jed McCaleb sold the mtgox.com domain to a French developer, #Mark-Karpelès, who resided in Japan at that time.

For years, Mt. Gox is the largest exchange platform in the world of Bitcoin. Mt. Gox finally closed in February 2014 due to the loss of 850,000 BTC users worth over USD $ 450 million at the time.

September 18, 2010 - USD $ 0.06-65 ↑

Under the MIT licensing, puddinpop (BitcoinTalk users) issued CUDA clients for Bitcoin mining using Windows systems. The client code was contributed by jgarzik (BitcoinTalk users), under the Bitcoin Store, an exchange of 10,000 BTC at a price of USD $ 0.06-0.065 then.

November 10, 2010 - USD $ 0.50 ↑

Bitcoin market volume reached USD $ 1 million. This amount is calculated by multiplying the amount of Bitcoin distributed with the amount of Bitcoin exchange at Mt. Gox. The Bitcoin price then reached USD $ 0.50 for 1 BTC.

February 9, 2011 - USD $ 1.00 ↑

After only two years on the market, the Bitcoin value eventually reaches the equivalent of USD $ 1 in Mt. Gox. News about Bitcoin began to spread on Slashdot, Hacker News, Twitter and other social media, the sudden increase in traffic on Bitcoin.org's website caused it to be closed temporarily.

March 27, 2011 - USD $ 0.83 ↓

On March 27, 2011, Britcoin launched the first exchange platform for Bitcoin trading using the British Pound Sterling (GBP). A few days later, on March 31, Bitcoin Brazil unveiled Bitcoin's face-to-face services to Brazilian Reals (BRL) and U.S. Dollars. On April 5, BitMarket.eu began offering Bitcoin converting services to Euros (EUR) and also some other currencies.

The Bitcoin price at that time was USD $ 0.83.

June 2, 2011 - USD $ 10.00 ↑

Bitcoin prices reach USD $ 10 on Mt. Gox. In the previous day, an article was published entitled, "The Underground Website Where You Can Buy Any Drug Imaginable", featuring a story about SilkRoad, a website to buy drugs using Bitcoin which opened in January 2011.

The article also places links to Mt. Gox that causes increased demand. A week after the article was released, the Bitcoin price reached USD $ 31 before falling to USD $ 10, only after 4 days. This event was named "Great Bubble of 2011".

June 13, 2011 - USD $ 15.00 ↑

A Bitcoin Forum user, #allinvain, claims to have lost over 25,000 BTCs from his wallet. Price 1 BTC when it is USD $ 15.

June 19, 2011 - USD $ 17.51> USD $ 0.01 ↓

Mt. Gox encountered a massive cyber attack that led to fraud in Bitcoin trading. A total of 4,019 BTCs were stolen from 600 wallets and user personal information such as keywords and email addresses were also stolen in the incident.

Mt. admin account Gox hacked and through which thousands of orders to sell hundreds of thousands of Bitcoin have been released, causing the Bitcoin price to fall from USD $ 17.51 to USD $ 0.01. Consequently, the Tradehill and Britcoin exchange platforms have also temporarily halted operations for security checks.

February 22, 2013 - USD $ 31.91 ↑

For the first time since 2011, the Bitcoin value reached USD $ 30. A week later, the Bitcoin value in Mt. Gox topped the highest price in June 2011, which was USD $ 31.91.

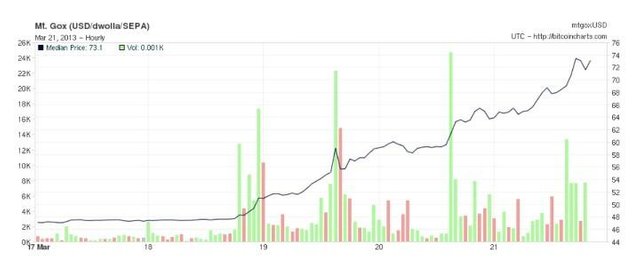

March 21, 2013 - USD $ 74.90 ↑

Bitcoin prices jump over 70 percent to USD $ 74.90. And a week after that, Bitcoin's market volume reached USD $ 1 billion.

* #source:https://www.dailydot.com/business/bitcoin-value-spike-bubble-cyrpus-spain/*

* #source:https://www.dailydot.com/business/bitcoin-value-spike-bubble-cyrpus-spain/*

April, 2013 - USD $ 266> USD $ 105 ↓

Bitcoin pricing reached USD $ 266 on April 10, 2013, before falling over USD $ 160 to USD $ 105 ten days later, when Bitcoin Central was hacked.

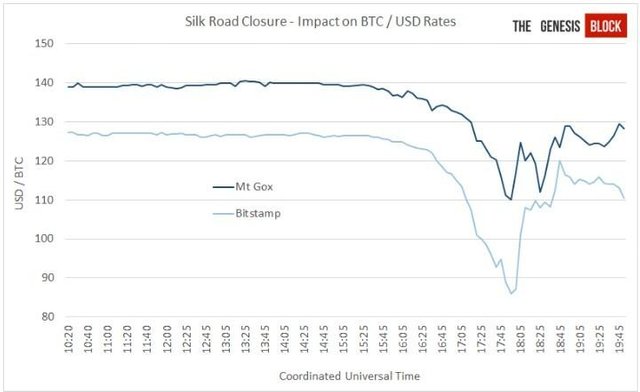

October 2, 2013 - USD $ 109.71> USD $ 128 ↑

Closure Mt. Gox caused Bitcoin's price to fall from USD $ 139 to USD $ 109.71 in just 3 hours, before the Bitcoin price recovered to USD $ 128.

* #source:https://www.wired.com/2013/10/bitcoin-market-drops-600-million-on-silk-road-bust/*

* #source:https://www.wired.com/2013/10/bitcoin-market-drops-600-million-on-silk-road-bust/*

November 17, 2013 - USD $ 503.10 >> USD $ 1,242 ↑

Bitcoin prices doubled in Mt. Gox, reaching USD $ 503.10. And after the Senate conference in the United States discussed Silk Road and the challenges and currency controls on November 18, 2013, the Bitcoin price jumped twice to reach USD $ 1,242.

December 5, 2013 - USD $ 839.93> USD $ 458.54 ↓

The Chinese government's prohibition against financial institutions from managing Bitcoin transactions led to Bitcoin's price falling by more than 20 percent to USD $ 839.93. By mid-December 2013, Bitcoin's price was severely affected and dropped below $ 500.

April 10, 2014 - USD $ 381.88 ↓

The restrictions and pressures from the People's Bank of China resulted in many banks issuing deadlines to the exchange platform in the country, urging them to shut down its operations before April 15, 2013. Following that, Bitcoin's price has dropped, reflecting the ever-growing Bitcoin trading volume, so it fell to USD $ 381.88.

Over the next few months until the Bitcoin price suddenly spiked in 2017, the Bitcoin price went up slowly and its price was relatively stable within the range of USD $ 500-800.

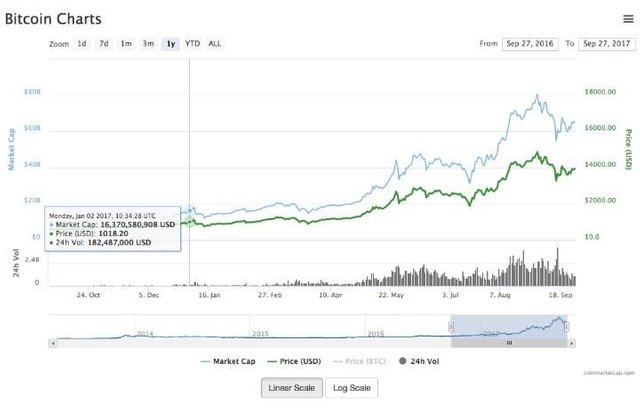

January 2, 2017 - USD $ 1,018.20 ↑

Bitcoin finally managed to reach USD $ 1,000 for the first time in 3 years. News about Bitcoin's price has started to spread widely, attracting more investors into the world of Bitcoin.

* #source.coinmarketcap.com*

* #source.coinmarketcap.com*

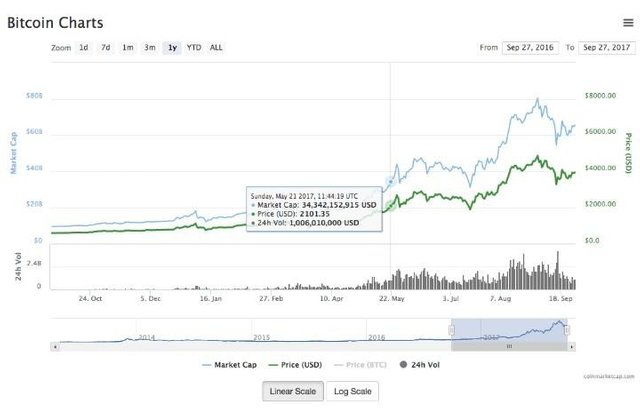

April 1, 2017 - USD $ 2,101.35 ↓

News of the Japanese government recognizes Bitcoin as a valid payment method in the country causing Bitcoin demand in Japan to rise. Bitcoin prices rose and reached over USD $ 2,000 on May 21, 2017, reaching a new record in Bitcoin prices.

* #source.coinmarketcap.com*

* #source.coinmarketcap.com*

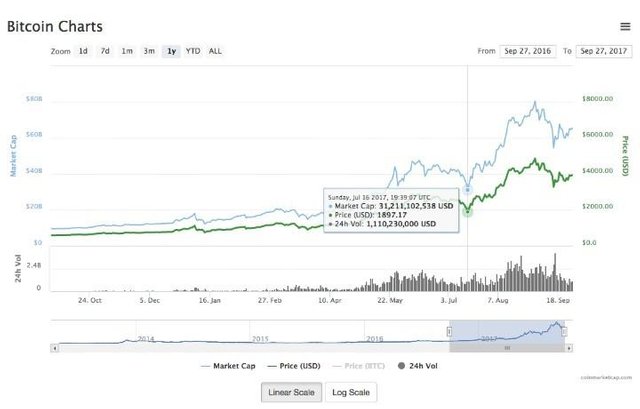

July 16, 2017 - USD $ 1,897.17 ↓

Disputes in Bitcoin community about the scalability issues that have dragged on for years are almost to the end. Following the Bitcoin separation or hard fork that will be implemented on August 1, 2017, the Bitcoin market as well as the cryptographic currency were affected and the Bitcoin price dropped to USD $ 1,897.17 on July 16, 2017.

However, by August 1, 2017, the price of Bitcoin recovered and rebounded over USD $ 2,000.

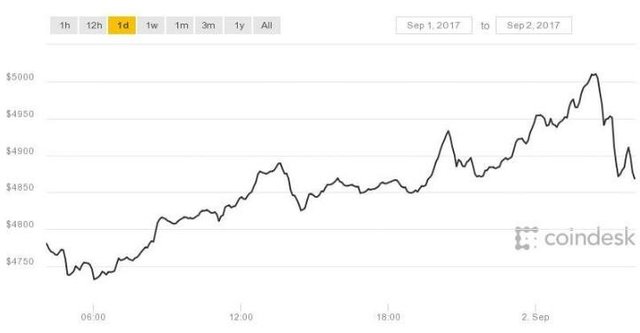

September 1, 2017 - USD $ 5,013.91 ↑

Bitcoin prices hit USD $ 5,000! Within hours of trading, Bitcoin's price dropped to $ 4,887.36, according to CoinDesk's website.

* #source.coindesk.com*

* #source.coindesk.com*

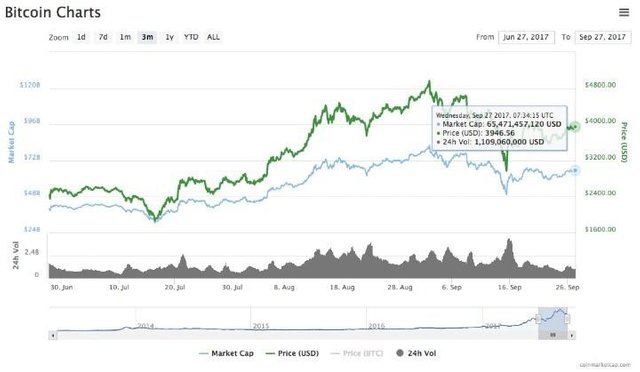

September 15, 2017 - USD $ 3,945.00 ↓

The recent major event was the Chinese government's restriction on the ** Initial Coin Offering ** (ICO) activity in the country. At the same time, the Chinese government also started investigating over 60 platforms in the country. This event has caused Bitcoin's price to fall from as high as USD $ 5,000 to nearly $ 3,000. As of today Bitcoin's price is still below $ 4,000, but looking at Bitcoin's rise and analysis rate, we can predict Bitcoin's price goes up again organically if no major events occur in the near future.

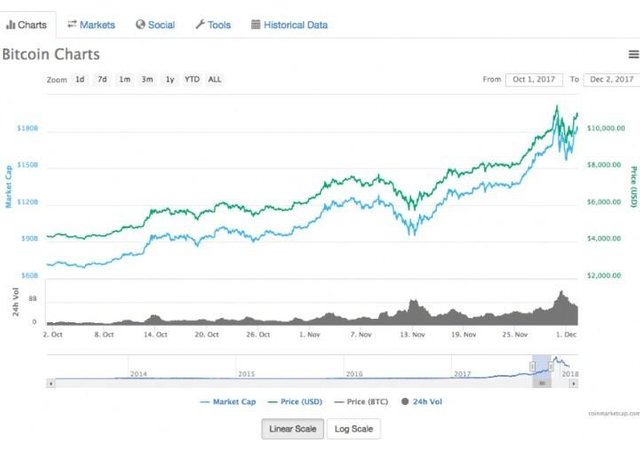

October, 2017 - ± USD $ 5,500.00 ↑

Bitcoin prices are recovering after China's ban on government news. On October 24, 2017, another fork took place after Bitcoin Cash, Bitcoin Gold on the 491407 block. The purpose of Bitcoin Gold fork is to open up opportunities for mining using the GPU, as Bitcoin mining now requires an ASIC chip that costs thousands of dollars. Bitcoin prices fall slightly before recover and rise organically until mid-November.

November 8, 2017 - USD $ 7,480.91> USD $ 5,836.41 ↓

Announcement of cancellation forcels cancellation or suspension. A few days later, Bitcoin's price dropped to below $ 6,000, for the first time after a few weeks ago. Bitcoin back up organically in November through December 2017.

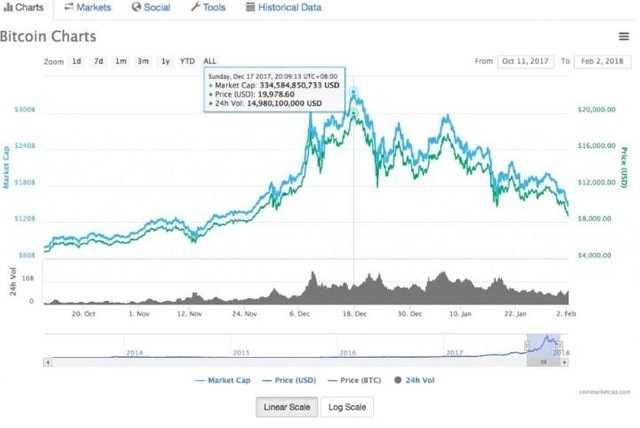

December 17, 2017 - USD $ 19,978.60

The highest price of Bitcoin is recorded at coinmarketcap.com, before it falls back. Bitcoin prices went up following the announcement of a large investment company CBOE launching ** Bitcoin Futures Contract ** on financial markets. A few days afterwards, the Bitcoin market and the cryptic currency came through correction that resulted in a loss of almost 20 percent for every cryptic currency, so Bitcoin prices began to rise to USD $ 17,712.40 in early January.

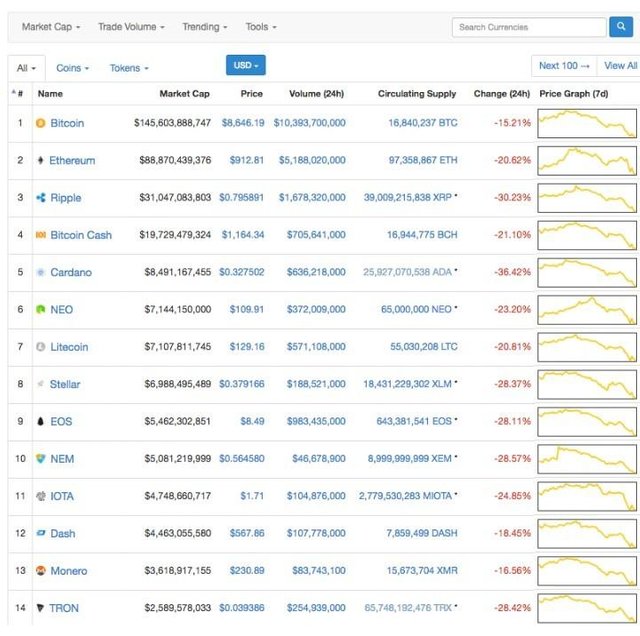

February 2, 2018 - USD $ 8,646.19 ↓

Bitcoin has lost almost 50 percent of its value since the beginning of January. Similarly with other crypto currencies. The market correction this time was seen worse than the correction in December. Various events that took place contributed to this ups and downs.

Among them is the actions of the South Korean government to stop the operation of the country's exchange platform, followed by the Indian government, theft case in the Coincheck exchange of Japan (which cost over USD $ 500 million) and recently the US Enforcement Survey (CFTC) The denominator Tethering is alleged to have no US Dollar reserves for each Tether token.

And as always, this negative sentiment caused many cryptographic owners to sell their savings in panic because fear of cryptic currency prices would not recover. It is the best example ** self-fulfilling prophecy. **

until now the crypto currency has continued to change.

if you like this post upvote and resteem