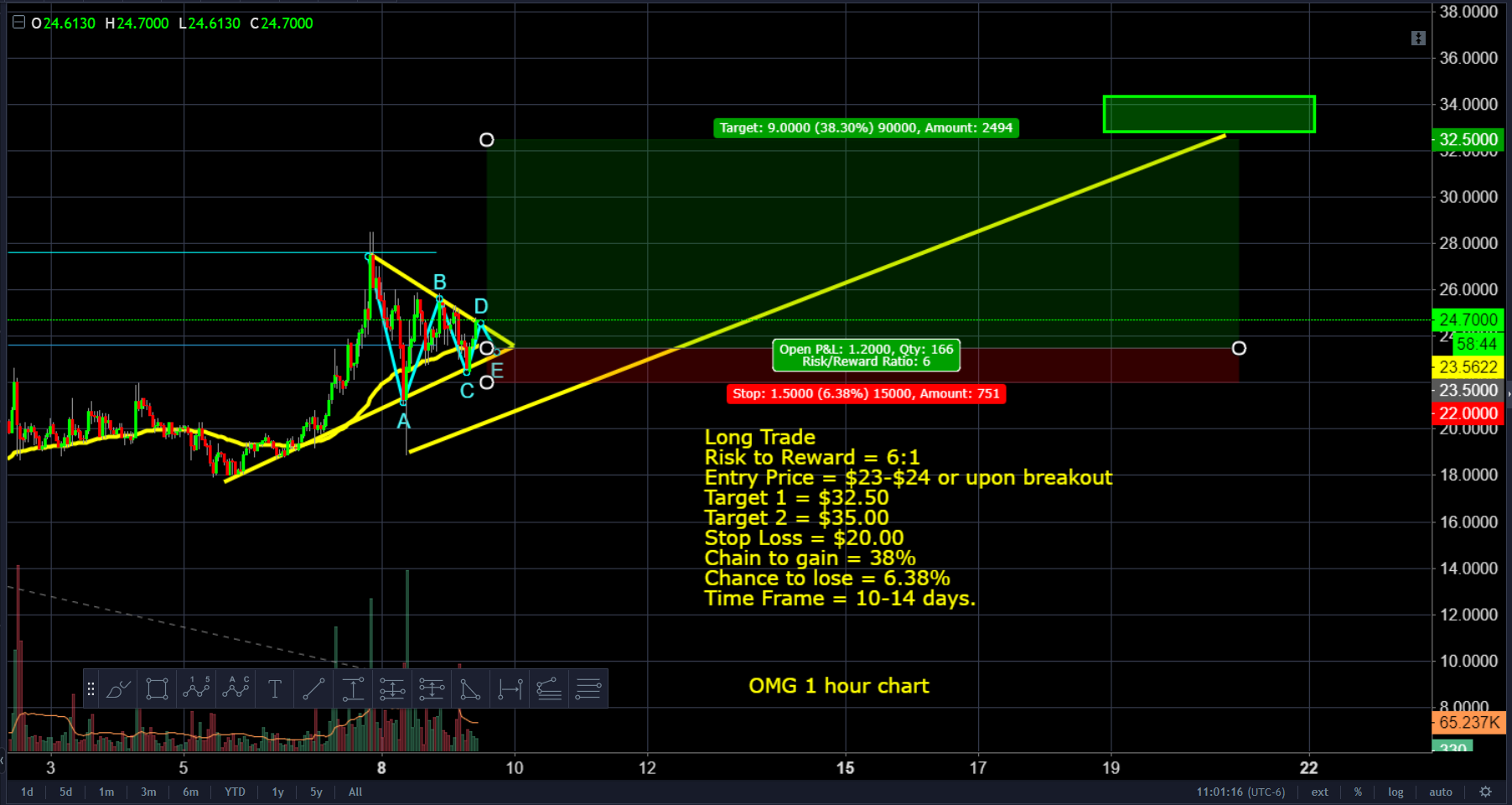

OmiseGo OMG - Jan 9 Technical Analysis, Long Entry $23-$34, Target 40% @ $32.50

OmiseGo was an underdog that moved up the ranks below the radar. Once debating about buying it or not at $6 was a solid investment is now a thing of the past.

Long Trade

Risk to Reward = 6:1

Entry Price = $23-$24 or upon breakout

Target 1 = $32.50

Target 2 = $35.00

Stop Loss = $20.00

Chain to gain = 38%

Chance to lose = 6.38%

Here we have a solid risk to reward setup that can yield incredibly high returns with little risk. Based on Elliot Wave, I'm predicting one more subwave to finish the 3rd primary.

Twitter - https://twitter.com/PhilakoneCrypto

https://www.youtube.com/user/philakone1

If you enjoyed this video, please like, subscribe, follow, share, upvote, on YouTube, Twitter, Steemit. If you specially liked it, please donate Tequila to Luna's cryptocurrency fund.

Luna's personal bitfinex account:

BTC address: 1PruhmsYXU2gPkNw574xZSMyBG4YW5Wnq9

Ethereum: 0x2538b728f9682fc1dc2e7db8129730f661753850

LTC: LPeaZpGiF3XdCw5XPN7LXztDagTEZAMgYd

Bitcoin Cash: 1AY2FPANCe5URB71Nvy6tkCgoTS8iHgmZD

EOS Address: 0x2538b728f9682fc1dc2e7db8129730f661753850

ETP Address : MTR3P7m5KwHfE1aY51ha2YAQWQhRMPm1VA

OMG Address: 0x2538b728f9682fc1dc2e7db8129730f661753850

Please always remember we trade using probability and not all trades are winners. We manage our risk with stop losses and try to win over time. Those that don't understand this, and expect only to having winning trades, will always lose money over time.

The ultimate goal is to help the crypto community because I think there's a lack of these type of videos. I want to share everything I've learned because knowledge is only power if passed on. These are educational videos intended to teach how to think through thought-out rationalization.

DISCLAIMER:

I'm not a financial adviser, nor am I giving you any tips on when to buy, sell, etc. I'm simply stating my opinions and what I personally look for. Those that follow my trades blindly and don't understand risk management, will always lose over time. I manage risk differently. Not all trades are winners. We manage our risk with stop losses and win over time. Even if we've entered at a similar price, I can micro manage my risk, by shedding, adding, reducing, etc, but those calls aren't made. Therefore despite entering near the same price, I may come out well ahead while you may take a loss, even if we exit at the same price when the market goes against my call. Remember, I always profit OVER TIME, and am not focused on winning every single trade. As long as we win more than we lose over time. I want to be very clear so you understand the outcomes will always be different even if we take the same trade. I MANAGE RISK and see this game as a probability. Therefore, be forewarned.

good work

Thanks for sharing !!!

I learned EW because of your youtube channel, great to see you here too !!!

Just a question, are your sure w3 is done ? Maybe we're in just subwave 4 of w3, so a subwave 5 neede, then a big w5 could bring price way more higher ? Maybe I just get greedy here, not having $ to trade this, but greed is everywhere even when you hodl nothing :-))

Nice one! Thanks Phil. I appreciate your work and sharing.

Thanks Phil. OMG Go

ohhh my gossshhh :)

Thank you so much. I really enjoy your videos, learn so much on it. Today I printed the 'bible' (as you called it in a video) and will try to understand the Elliot waves better. Keep up the good work!

haha yeah i call it that. i hope you have fun learning it.

Buy the book, it's really worth it having it in your library :-)

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.youtube.com/channel/UCeu9yMweVfTCftF9gvnuGeAi bouth this one without any research just because i like the oh my god thing and im already about 60% higher...

Not the best strategi but its working fine... hahha

on the other hand my advise is "stay with ethereum" that one is constantly and slowly going up....