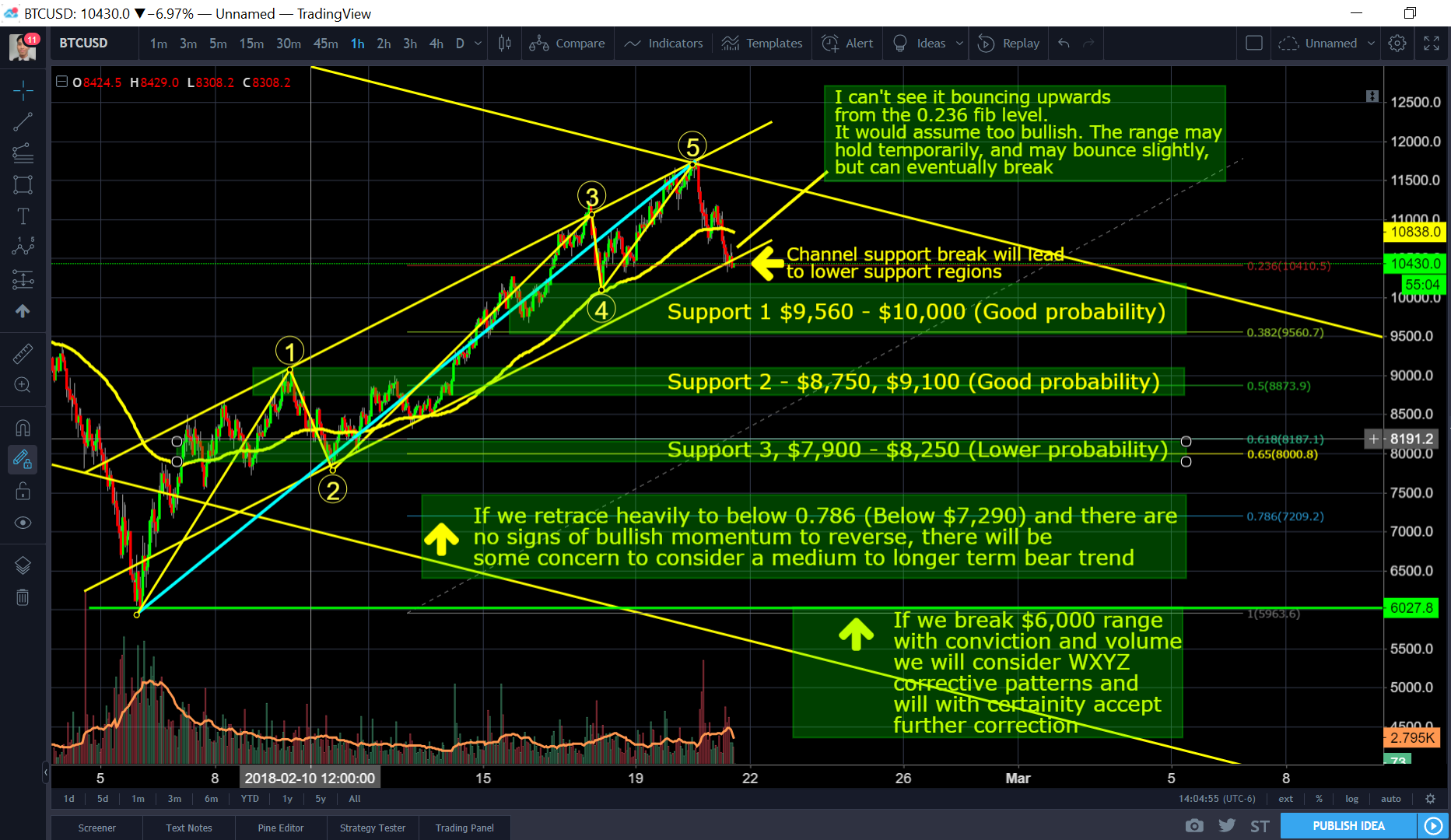

Bitcoin BTC - Feb 21 - Detailed Technical Analysis - Support Ranges, Targets

A risk analysis and probability video will be released soon to give

examples of how to play these support ranges

General Tone: Correction is in process

Support Zones are suggested

Recommendation is to watch indicators for signs of reversal,

and laddering buys accordingly

Long Term Bias (6+ months) - Bullish

Medium Term Bias (Next Week) - Bullish

Short Term Bias (Today) - Bearish

Long Term Target Prediction - Primary Wave 3, $35,000+ by 2019

My Comprehensive List of Tutorials

Please consider upvoting if it has helped you

Please consider purchasing me a 33 ft' yacht

if you have reached incredible success

Lesson 1 - Bitfinex Tutorial - How to Customize and Set Up Bitfinex

Lesson 2 - How to Analyze Candlesticks Charts with Strategy

Lesson 3 - Moving Averages

Lesson 4 - Relative Strength Index RSI with Advanced Strategy

Lesson 5 - MACD and Histogram

Lesson 6 - Margin Trading Long, Shorting, Leveraging

Lesson 7 - Basic Risk Management

Lesson 8 - Fibonacci Retracement Part 1

Lesson 9 - Fibonacci Extension Part 2

Lesson 10 - Laddering

Lesson 11 - How To Interpret Time Frames

Lesson 12 - Swing Trading Advanced 55 EMA Strategy

Lesson 13 - Introduction To Elliot Wave Theory

Lesson 14 - Using a Basic Excel Tracker for Risk Management

Lesson 15 - Automatic Stop Sell/Buy Executions

Lesson 16 - Advanced 55 EMA Strategy with Time Frames and MACD Part 2

Lesson 17 - 6 Hours Live Trade Scalping. Growing $2,000 Account into $3,500

Lesson 18 - Bitcoin BTC Feb 6 - BTC Update - Summary of ABCDE with live play.

Lesson 19 - Elliot Wave Theory, Fibonnaci Retracement & Extension (Combined with Feb 11 BTC TA)

Lesson 20 - Advanced Elliot Wave WXY With Feb 11 Technical Analysis

Lesson 21 - Using Elliot Wave, Fibonacci, And Extensions To Obtain Targets (Combined witFeb 11 BTC TA)

Lesson 22 - Risk Management, Channels, Fib Retracement, Fib Extension. Summarizing Feb 11 BTC

Twitter - https://twitter.com/PhilakoneCrypto

Youtube - https://www.youtube.com/user/philakone1

If you think I've helped you tremendously, donate crypto to my dog's tequila / vodka problem.

BTC: 1PruhmsYXU2gPkNw574xZSMyBG4YW5Wnq9

NEO: AaZu8fiiMW3vnizUaSkRj6JoobswkeCKPQ

EOS: 0x2538b728f9682fc1dc2e7db8129730f661753850

Ethereum: 0x2538b728f9682fc1dc2e7db8129730f661753850

LTC: LPeaZpGiF3XdCw5XPN7LXztDagTEZAMgYd

Bitcoin Cash: 1AY2FPANCe5URB71Nvy6tkCgoTS8iHgmZD

XRP Address: rLW9gnQo7BQhU6igk5keqYnH3TVrCxGRzm / Wallet: 4110054236

The ultimate goal is to help the crypto community because I think there's a lack of these type of videos. I want to share everything I've learned because knowledge is only power if passed on. These are educational videos intended to teach how to think through thought-out rationalization.

DISCLAIMER:

Legal stuff here. I'm not financial advisor. This is just my opinion that I'm sharing with the community. All information is for yours to process how you wish.

WASA WASA WASAAAAA

I charted this out myself as well and our targets for resistance and dumps were similar (pic). I was wondering what you think about different forms of TA giving the same targets. Does EW theory have a higher confirmation rate than other patterns? I originally started out learning EW but switched to Fibonacci retracements, price action and speed resistance fans to solidify my confidence in other concepts before I start learning about counting waves correctly.

I'm in the belief that the huge market buys were a way to pump the market too quickly so a short at 11.7k~ would be certain. Shorts volume increased by a huge amount since we hit $11,000!

I personally believe we'll be hitting your support one, and if we go past $9,600 there will be strong price volatility in the low $9,000s region, but I will be watching it more closely after watching. your video Thank you for the analysis :)

By the way, the Discord server I'm in is nearly all watching your Elliot Wave videos and getting feedback from each other. It's literally become a classroom LOL

@ the 9min mark, the fee calculation had 2MM used for the change in fee totals, instead of the 20MM vol used for calculating the original fee rate. I'm sure this is very well tracked since you operate on small margins where fees would eat you, but I wanted to bring it up for anyone else reading this & learning, who thinks the fees won't make a big impact (especially when you reach the point of fee rate reduction). His total difference on a 20MM volume would be $4000 per month by having a .0002 lower rate. Utilizing Maker vs Taker will ultimately be the largest gap, but any reduction does add up, especially if you are beginning & have a lower win:loss rate or are chasing trades and racking them up by market executing.

Thanks

Great analysis

pleasure beebee

Thank you

Thank you for the update.

Thanks man..

Youdaman!

you're the man sexy beast

Moar learning :P Thx!

Thanks dude!