Bitcoin - The Difference Between Price and Value - Fun Times Using the NVT Metric.

Taking the total number of bitcoins outstanding and multiplying by the current price of one btc (also known as market capitalization) does not determine value but rather the current cost to purchase the entire network. This is just the selling price and an investor should make an effort through intelligent and deliberate research to uncover a range of possible options for the true worth of the network.

So how does someone determine btc value and see if today’s offering price is attractive?

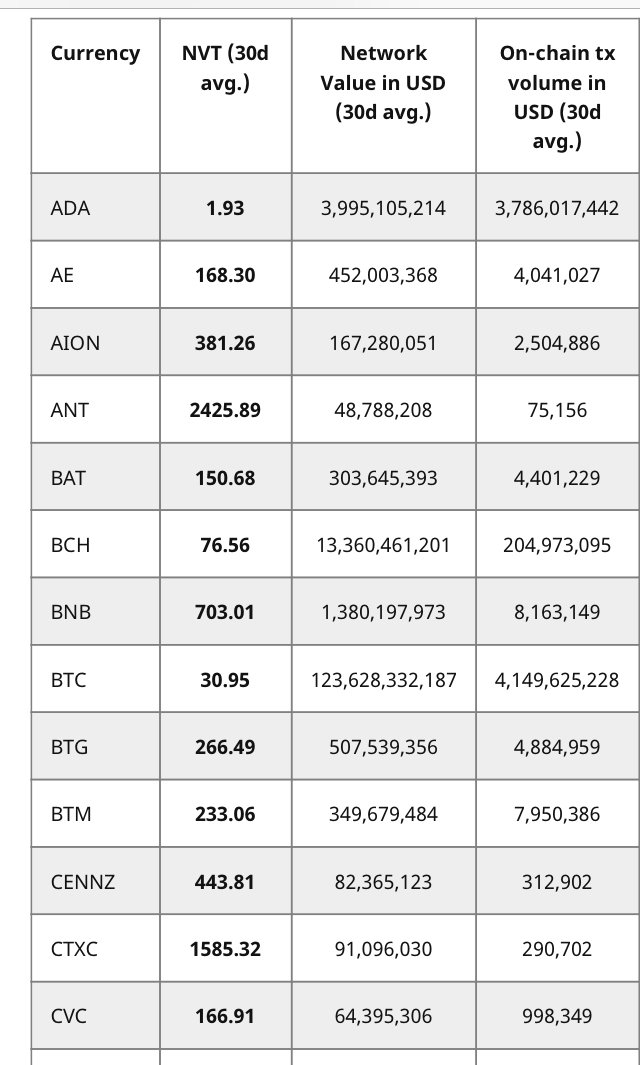

One suggestion is using the network value (market capitalization) to transactions ratio. Coinmetrics.io calls the formula NVT and is as follows:

Market capitalization/USD daily transaction volume on the network

USD daily transaction volume (dtv) varies widely on different websites. This article uses Coinmetrics data and will produce different results than other well known data sources.

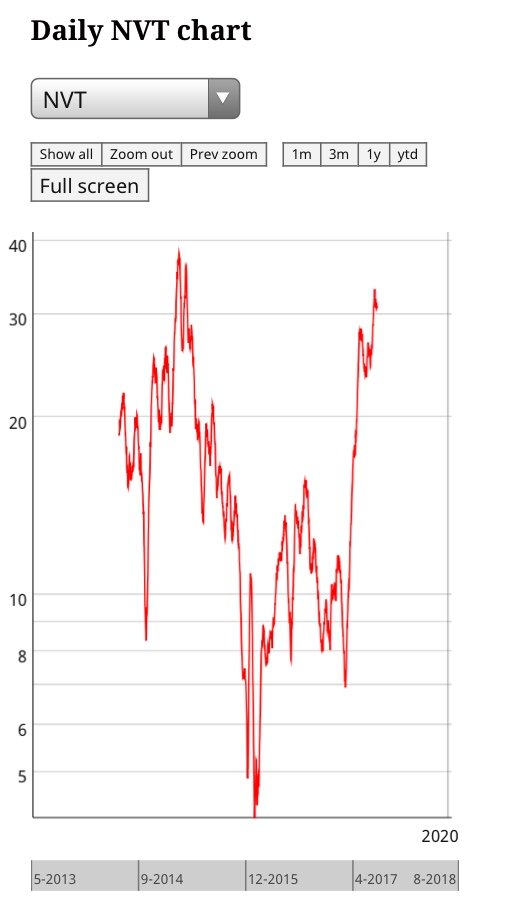

According to Coinmetrics bitcoin is currently selling at 31x dtv. Which is at the top of its range.

That doesn’t necessarily make it overvalued if the future growth rate justifies that multiple.

Transactions on the network have a nine year history of dramatic growth. According to Coinmetrics the last five years alone has seen a 40x increase in dtv from a base of $100M to $4B currently. That is equal to a compound annual growth rate (CAGR) of 109%. But this could also be misleading. Looking at the Blockchain.com transaction numbers shows a 10x increase over the same time period from $100M to ~$1B today. Again, different websites offer different numbers and going into the details of this discrepancy is beyond the scope of this article but should be recognized. Regardless, both growth rates are fantastic.

A conservative investor would consider the above growth rates unsustainable. Which is understandable but let’s consider the dtv of a competing asset before making a growth rate forecast.

According to coinmetrics the current estimated dtv on the btc network is around $4B. That is compared to gold which has a daily notional value north of $100B. It is an assumption that these two figures will converge one day but the comparison is still valuable and shows room for growth.

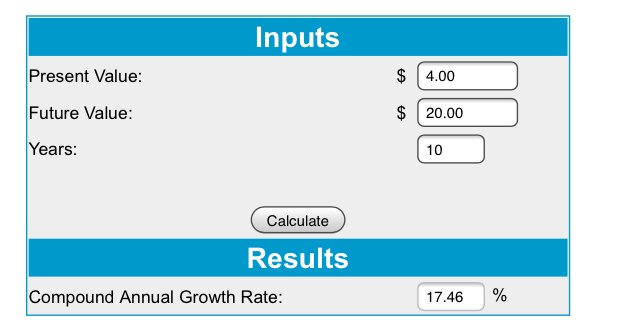

Given the above information, an estimate of the future growth rate should be possible. Assuming a $20B dtv in a 10 year time frame up from the current $4B might be a conservative estimate considering the growth history and market opportunity.

What does everyone think of $20B dtv (5x increase) in 2028? Conservative or unrealistic?

Now that the growth rate has been settled the next step is deciding on a multiplier. Since 31 NVT is at the top of the range dropping that number to 15 NVT will bring it closer to the long run average and would make sense 10 years from now in a more mature market.

So the valuation assumes a $20B dtv (5x increase) in 10 years at a 15x multiple:

15x$20B dtv = $300B mc

That is still more than a 100% return over the current market capitalization (mc) of $123B. That is a CAGR of 9.33% over the next ten years. This might not sound spectacular but considering the high NTV and conservative growth forecast it might still be attractive to certain investors.