Bitcoin Market Lies in Full Threat in China in 2017

China's currency is making bitcoin trade collapsed in 2017 as a result of government pressures.

He regained his dominant market position in early 2014.

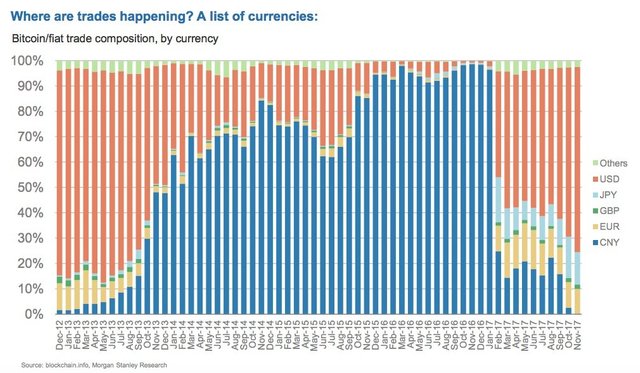

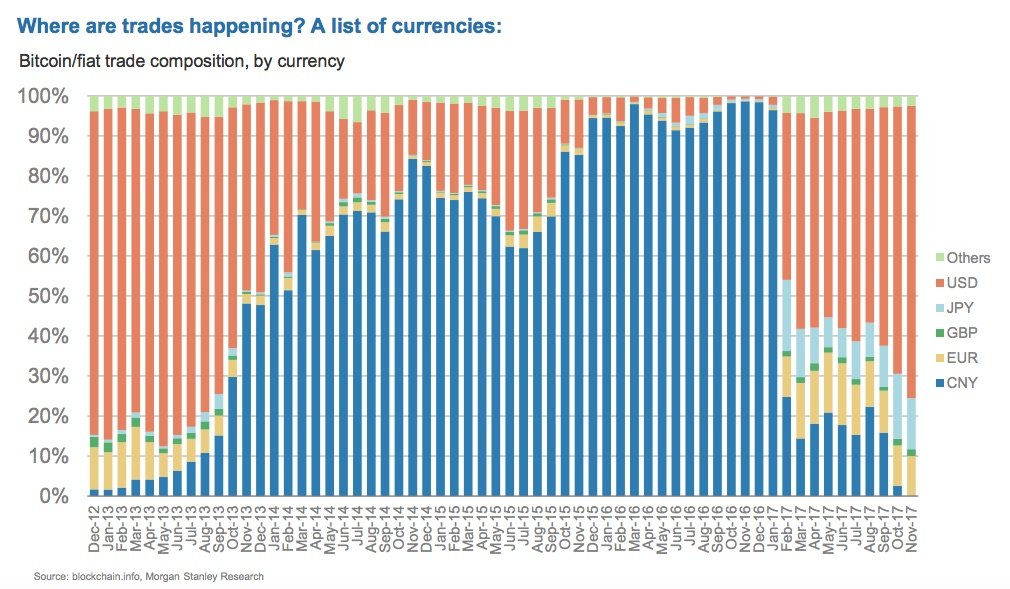

Morgan Stanley's 'Bitcoin Decoded' album chart shows the variable position of bitcoin-FIAT sales by years:

It is worth keeping in mind that the above table is not a clear indication of the geographical distribution of bitcoin trade. For example, American dollars have been used in many countries outside the United States. But we can say that bitcoin is a general indicator of the global distribution of commerce.

The Yuan-bitcoin exchange rate has dropped from about 90% in December 2016 to about 30% in January 2017. This massive collapse in the market coincides with the same investigation that the Central Bank of China has launched in the biggest bitcoin markets in the country in search of possible market manipulations, money laundering activities and attempts to form unofficial financial resources.

The collapse of the Chinese market reached its peak as cryptographic currencies were banned in September and the operation of large platforms stopped. According to Morgan Stanley's table, the yuan-bitcoin volume ratio in November is down to 0%.

With the fall in Yuan volume, there is an increase in the US dollar, the Japanese yen and the bitcoin market in euro trading. Bitcoin's uptrend of 1.500% against the dollar in 2017 has led many investors across the US, including institutional investors, to turn to digital currency.

The volumes in Japan increased as the Japanese government adopted BitCoin as an official payment method in April of this year.