MARKETS AND PRICES

The operation had been in progress for a considerable length of time. Had all gone to plan, Coinbase and Gdax clients would have awoken on Wednesday morning to find that bitcoin money exchanging had at last been included. Merchants would savor the liquidity this new market would bring, the trades would gather up more charges, and bitcoin center maximalists would soon have the capacity to offload their bitcoin money. In the occasion, everything went more regrettable than anticipated.

The Best Laid Plans

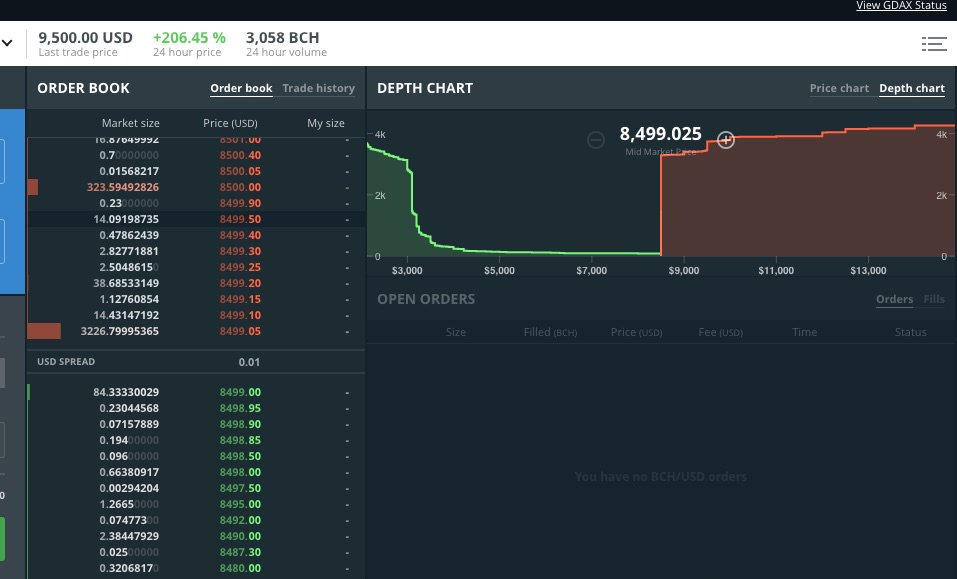

Not long after Coinbase reported exchanging of bitcoin money was live, its cost – which had just been climbing – soared over all trades. Without further ado a while later, things quickly went amiss. Dealers heaped into Coinbase's sister trade Gdax, where BCH surged to a premium of $8,500 per coin inside only four minutes. It was then that Coinbase pulled the fitting, suspending exchanging and leaving purchasers without a friend in the world without any methods for leaving before the coin adjusted to levels reliable with different trades.

Crypto Twitter went into emergency, and allegations were flung around proposing that Coinbase's inward circle had been permitted to benefit off the news ahead of time. The trade was compelled to issue a counter emphatically denying these cases, however their requests failed to attract anyone's attention. One lawful personality opined that Coinbase could be vulnerable to a claim, expressing: "Because of the measure of the divider, it is impossible that the backer of the deal arrange is unknown to Coinbase. In the event that it is, Coinbase might just be complicit by seeming to work with the seller(s) and denying any deal underneath that sum."

Others asked the SEC to intercede, yet Blocktower Capital's Ari Paul countered: "It's truly difficult to avert. A group needs to incorporate another coin on to the stage. There's no real way to keep a mystery that requires a group's association. What's more, there's no real way to keep the individuals who know the mystery from covertly purchasing digital currency… If you need reasonable, cryptographic money isn't for you. Stay with resources that depend on believing the administrative and legitimate framework."

Various irregularities have emerged encompassing the Coinbase/Gdax failure, beginning with the 30% ascent of bitcoin trade out the days and hours paving the way to the declaration, recommending that those aware of everything were benefitting off this play. The way that BCH was propelled as a "purchase just" alternative on the trade is another warning; had clients been dispensed the forked BCH they've been tending to for over four months, this circumstance could have been kept away from.