How To Start Bitcoin Mining

How to mine bitcoins: all the steps to follow

Don't know how to mine Bitcoins ? There are two options: go through a cloud mining company, or buy and use specially designed hardware. For us, cloud mining represents the safest investment for your money, and we will explain why. In any case, neither of these two options is cheap, and this is something you should be clear about from the beginning.

As in any business, prior research is essential here. Keep in mind that nothing in the world of cryptocurrencies is guaranteed. Any investment could be lost, so inform yourself well before taking out your credit card.

And finally: what we give you below is an informative guide, and for no reason should you consider us as advisers or financial advisors.

Mining vs. investment

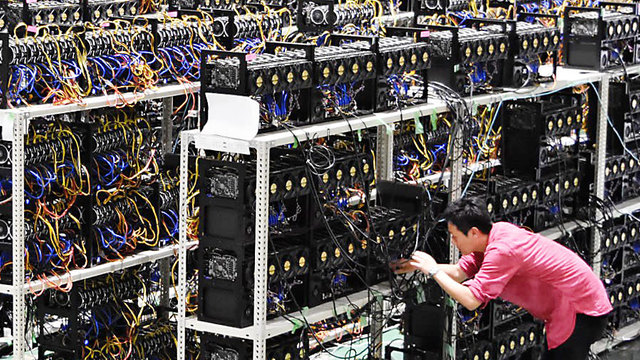

When Bitcoin made its appearance in 2009, the process of mining the world's first cryptocurrency needed little more than a home computer, and it didn't even have to be very fast or modern. Currently, the entry point for the world of cryptocurrencies is much more complicated if you want to make a profit, although that does not mean that it is impossible: it is no longer the cottage industry that it once was.

Before we discuss how to mine bitcoin for yourself, it is important to note that while there is uncertainty in all things cryptocurrency, mining is probably the most volatile decision. Hardware price fluctuations, changes in the difficulty of mining bitcoins, and even the lack of a payment guarantee at the end of your hard work make it a riskier investment than even buying bitcoins outright.

Because of this – and the volatility of the market in general – it can be challenging to know how to profit from bitcoin mining. 2018 saw the mining market plummet in profits and skyrocket in terms of barriers to entry. Unless there is a significant change in Bitcoin technology, business as usual is likely to remain the same. A bitcoin is valued at around $50,000 today, but mining it can come at a huge cost.

In the end, buying bitcoins directly at least gives you something for your money immediately. Clearly this is worth considering before going down the mining route.

Step 1 – Choose your mining company

Cloud mining or "cloud mining" is the practice of renting mining hardware, and having someone else do the work for you. Generally, you get paid for your investment in bitcoin, even if the hardware is not used to mine bitcoin. As with any investment in general, it's important to do your research, because even companies that claim to be the best have a number of detractors and complaints from previous investors.

Several mining companies have come and gone over the years, including ones we have spoken to and validated directly, such as Hash Flare, who told Digital Trends in an interview that every one of their clients has made a profit using their services. You're currently better off with a company like Coinbase , an established and respected cloud mining company. It is expensive to start, but it is one of the best options.

For a wider variety of options, CryptoCompare has a list of mining companies with user reviews and ratings, though you should be on the lookout as there are plenty of reviewers looking to take advantage of the situation.

Step 2 – Choose a mining package

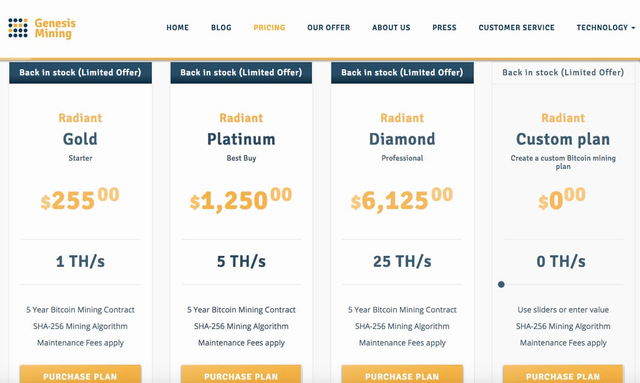

Once you have chosen a cloud mining company and signed up, you need to choose a mining package. That will usually involve choosing a certain amount of power, and combining that with how much you can afford. In general, paying more should give you better performance or a faster profit, although that is not always the case.

Most cloud mining companies will help you decide by providing an estimate based on the current market value of Bitcoin, the difficulty of mining the bitcoins, and cross-referenced to the power you are renting. However, it is important to note that those numbers can and will change, so it is important to watch market trends and estimate where Bitcoin will go before choosing your contract. What may be profitable now may not be if the value of Bitcoin crashes.

As long as companies like Coinbase continue to offer their calculators, we would suggest using other alternatives to alleviate the potential for any trends to enter the calculation.

Some cloud mining companies will sell you a contract on a “pre-sale” basis. As the name implies, that means you pay up front for a contract that won't start for weeks - or months - when new hardware becomes available. In most circumstances that is not advisable, because there is no way to guarantee that those contracts will be profitable when they start and there is not even a concrete indication of when that will happen.

Step 3 – Choose a mining pool

After choosing your contract, most companies will ask you to choose a mining pool . This is where you need to choose a global mining team to join.

It is a method of increasing the chances of earning bitcoins through mining, and is standard practice in personal and cloud mining. There are pros and cons to different groups that are beyond the scope of this article, but joining an established and proven group with low fees is likely to be your best option.

One of the most popular and trusted pools for new miners is Slush Pool, but you should always do your research. As with companies, many groups are not trustworthy.

Step 4 – Select a wallet

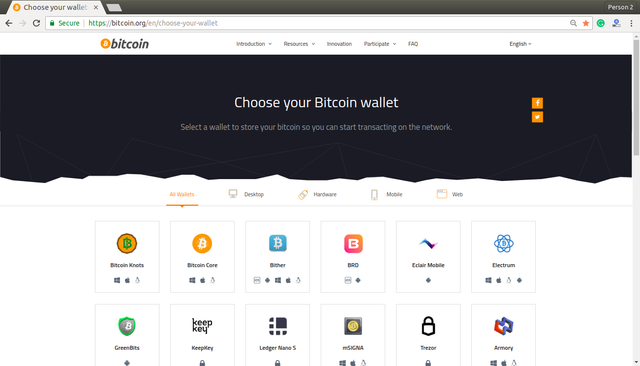

Once you have completed that last step, your cloud mining has been started. In a few days or weeks, if all goes well, you should start to see your account start to fill up with bitcoins. At this point, it is advised that the cryptocurrencies are withdrawn from the cloud and deposited in a secure wallet. However, some cloud mining companies will allow you to reinvest your earnings for more scattering power.

However, whatever you do you need to decide what you are going to do with your bitcoins in the long run. Although you can buy many products and services with bitcoins, prices can fluctuate and you may have to do even more research to see if you are getting a good deal.

Another option is “HODling”, i.e. keeping your bitcoins, this is also a viable strategy for some people. “HODlers” are those people who hold on to their bitcoins because they are convinced that their value will increase over time. Unfortunately, there is no reliable way to predict the future values of bitcoins.

Of course, we are not financial advisors and we would not suggest that you do anything in particular with your cryptocurrencies. If you decide you want to keep your bitcoins, you should consider a secure, even potentially hardware-based, wallet to store them.

What if I want to mine bitcoins with my own hardware?

Before you spend any money on any hardware or mining setup, you should use a bitcoin mining calculator to see the costs of the process. You will then be able to decide if you are likely to make a profit with all costs considered. Keep in mind that prices can also fluctuate and electricity costs can vary widely. Bitcoin mining is exorbitantly expensive for the average person and there is a very low chance that you will be able to accumulate enough profit by running your own operation.

Because it is very expensive to set up a proper system, we only recommend mining bitcoins if you have proven access to abundant and - crucially - cheap electricity. You will also need a strong network connection. When it comes to hardware, only the latest generation ASIC miners offer any hope of earning bitcoin mining, so for direct bitcoin mining, check out the AsicMinerValue site to see what you need.

An alternative to direct bitcoin mining is to use a service like NiceHash to develop your own method. NiceHash allows users to plug in their ASIC or GPU/CPU machines and rent them out for altcoin mining, with all profits sent to you in the form of bitcoins. However, it's worth checking out the profitability calculator before you start, as you'll need to consider the relative power of your hardware and the cost of your local electricity to potentially make a profit.

Your post was upvoted and resteemed on @crypto.defrag