Cryptocurrency in India

In response, the Indian government is allegedly mulling the creation of its own form of digital currency to compete with the bitcoin called ‘Lakshmi’ (named after the Hindu goddess of wealth and fortune). This would be a largely unproductive strategy, given that the appeal of cryptocurrency is its independence from governments.

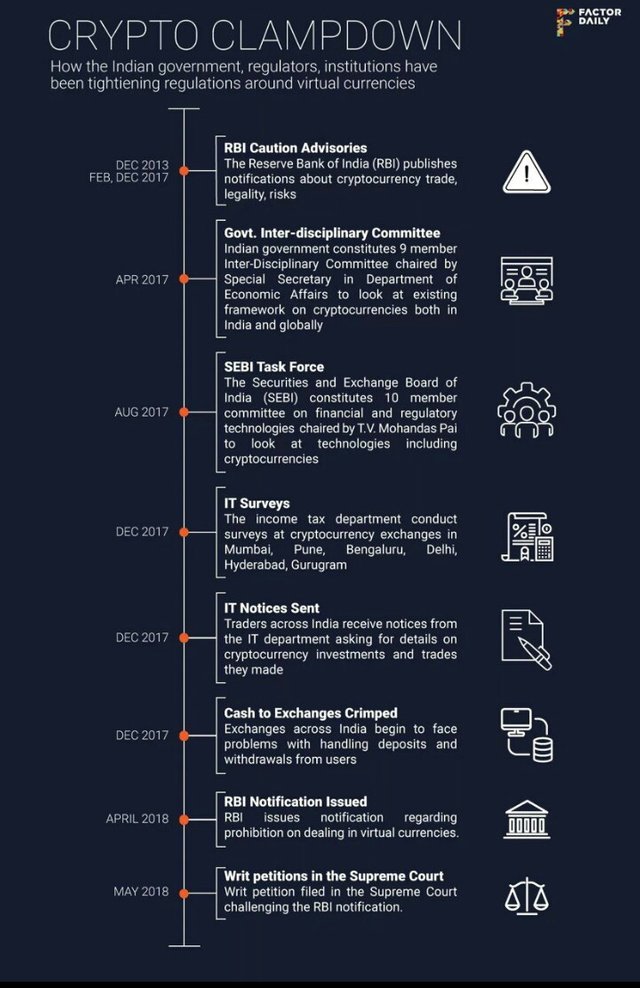

Many observers assume that cryptocurrency will come under the gambit of the RBI, though Digital Currency Exchanges may also have to register under the Securities and Exchange Board of India (SEBI). The Indian government will most likely make cryptocurrency taxable and create guidelines for Initial Coin Offerings (ICO) in which cryptocurrency ventures raise funds in bitcoin and other digital monies.

A central concern for the Bitcoin community in India, however, is how the government will define cryptocurrency. Though referred to in terms of currency, given its slow transaction times and volatile value, bitcoin operates more like an asset. A decision to classify it as a currency instead of an asset would necessitate a large regulatory apparatus – constituting a serious discouragement for bitcoin usage in India.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.india-briefing.com/news/cryptocurrency-bitcoin-india-usage-regulation-15343.html/