Cryptocurrencies Provide Path to Freedom Amidst Banking Liquidity Crisis

Banking Liquidity Crisis

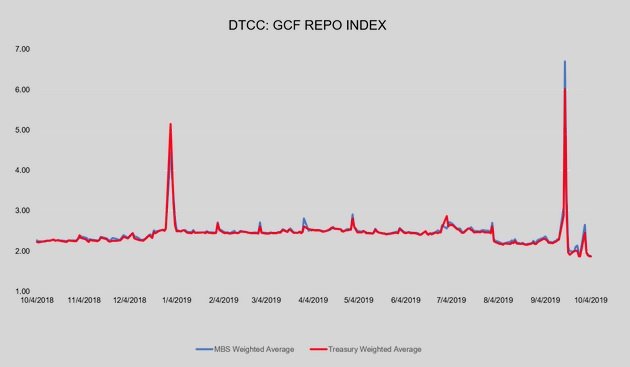

A major sign of problems in the financial system occurred this September in the repo market as 'the spike in overnight borrowing rates forced the New York Federal Reserve (NY FED) to come to the rescue with a special operation aimed at easing stress in financial markets'. By November 14, the NY FED announced it would 'continue to offer at least $35 billion in two-week term repo operations twice per week and at least $120 billion in daily overnight repo operations'.

(Watch this brief tutorial on the repo market for further explanation - Update: David Haggith recently posted an in-depth review of the 'repocalypse')

In retrospect, as liquidity continues to be injected in the system, the initial operation no longer seems so 'special'. In a strike against transparency, the NY FED rejected a request to disclose the recipient(s) of these loans stating it is not 'subject to the Freedom of Information Act ("FOIA") although it complies with the spirit of FOIA when responding to requests of this type'. The current crisis in the repo market is clear evidence of something broken in the banking industry. While the global debt bubble was set to burst at the end of last year, the Federal Reserve (FED) suddenly (and after pressure from the White House) refrained from additional interest rate hikes. Since July, the FED has deftly lowered interest rates three times. But, global debt has now surpassed $250 trillion by the end of the 2nd quarter and the total amount of cash owed to lenders is worth more than three times the global GDP. This level of debt is clearly unsustainable.

Trump Administration Policy

As a candidate, President Trump said the U.S. was 'in a big, fat, ugly bubble'. But as President, he has been the biggest cheerleader for a stock market that continues to make all-time highs. So, did the 2016 election make the bubble go away? Does the U.S. national debt (now over $23 trillion) no longer matter? While there has been positive economic progress over the past three years, stock market gains have been completely illusory. Low interest rates have enabled corporations to borrow money to fund stock buybacks (estimated to hit $480 billion this year) and contribute to the artificial rise in stock prices. The current administration has taken the bubble they inherited and encouraged it to get blown even bigger. Curiously, President Trump tweeted on September 11, 2019 (around the same time as problems began in the repo market) that the FED should 'get our interest rates down to zero, or less, and we should then start to refinance our debt'. For myself, that is the exact problem with our existing system. No one person (not the President, the FED Chairman or anyone else) should have the authority to devalue a nation's currency. It is unlikely that the U.S. can have a sound economy with negative interest rates as even FED policymakers are skeptical.

So, why has the Trump administration kept this bubble in place? I believe there are two key reasons. First, there is a strong feeling that the onset of mild economic contraction would prove impossible to contain and lead to economic depression. The second answer relates to geopolitical considerations. As covered last year, the Trump administration views China (and by extension the China - Russia - Iran axis) as a more immediate threat to U.S. interests than the FED. Since the U.S. dollar is the world's reserve currency, the U.S. holds an inherent advantage over any other country. A strategic decision has been made to keep the financial system afloat (and keep the U.S. dollar as the world's reserve currency) while using economic war via sanctions to weaken U.S. enemies.

Recently, Iran has dealt with an economic crisis as a result of these sanctions. CNBC reported that Iran's 'oil exports have dropped from 2.5 million barrels a day after the lifting of sanctions in 2016 to 400,000 barrels per day and perhaps as little as 200,000'. Newsweek recently declared that the result of sanctions has 'created unrest that is weakening the Tehran government at home and abroad'. According to this report, it is the banks that 'pull money out of people's pockets as deposits and invest in profitable business sectors such as tower construction, import projects, and brokerage through the private chain and satellite institutions and companies, rather than lending to factories and institutions. Eventually, profits of these investments turn back to the pockets of the banks' shareholders, who are affiliated with the government'. Perhaps, Iranian protesters were targeting some of these banks that they burned down during the recent uprising. In addition, multiple Chinese banks have been in crisis in recent months. To counter U.S. influence, the BRICS (Brazil, Russia, India, China, South Africa) nations have discussed issuance of a cross-national digital money in order to reduce the dependence of their economies on the U.S.

Freedom vs Slavery

In a true 'free market', private banks should be allowed to fail. Profits should not be privatized with socialized (protected) losses. The core issue is freedom and central banks will eventually be [cornered]. Supporters of a central banking system believe that since banks are such a vital part of the economy, they should be protected. Unfortunately, if bankers are assured of getting 'bailed out', there can never be any incentive to prevent unnecessary, reckless risk taking. As I've said previously, there is no way the U.S. can consider itself a 'free' country when the ultimate power remains embedded with a cadre of bankers. Money itself does not need to be defined by banker overlords. It can be defined as whatever people want it to be. The U.S. dollar is a Federal Reserve Note and backed by nothing. In spite of 30% Americans who believe the U.S. dollar is backed by gold, every day, more people are waking up to this reality.

Alternatives to Existing System

So, to obtain our desired 'freedom', an alternative to the U.S. dollar must exist. For any currency to be effective, it must function as a unit of account, a medium of exchange and a store of value. Since an overwhelming majority of business and consumer transactions today are done digitally, any replacement must be in a digital form. In my opinion, there are potentially two viable alternatives to the U.S. dollar - a digital currency backed by precious metals and cryptocurrencies like Bitcoin. I do not view stablecoins backed by fiat currencies as much of an alternative although they can act as a gateway to proof-of-work or proof-of-stake cryptocurrencies.

Recently, there were rumors of China launching a digital cryptocurrency. Noted economist Daniel Lacalle was highly skeptical of the move. He stated that 'China cannot disrupt the global monetary system and dethrone the US dollar when it has one of the world’s tightest capital control systems, a lack of separation of powers and weak transparency in its own financial system'. Any issuer (either a sovereign country or private firm) of such a digital asset must store the underlying asset (i.e. gold, silver) somewhere and perform periodic audits. One can not discount sovereign risk (i.e. war, regime change, etc.) and counterparty risk.

The most popular cryptocurrency, Bitcoin, has a fixed supply of 21 million (after all coins are mined). No entity can create more coins than its limit and thereby debase Bitcoin's value. The argument that Bitcoin is 'backed by nothing' is highly misleading. Cryptocurrencies provide an easy way for any individual around the world to 'opt-out' of the existing system and start a new one. Bitcoin is not only a decentralized cryptocurrency but it is censorship resistant. Examples of censorship like Chase Bank that terminated banking services of conservative media personalities and HSBC Bank that banned a corporate account allegedly related to the Hong Kong protests will be a remnant of history. Bitcoin does not account for the individual or business' political leanings.

Government & Banking Industry Roadblocks

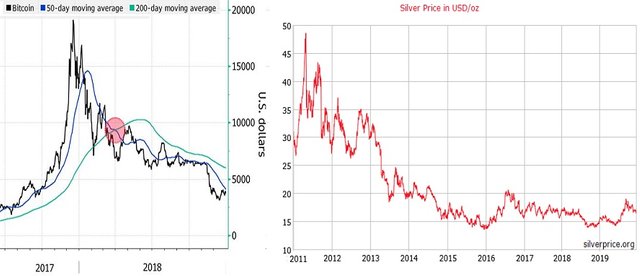

According to some economists like Alex Krüger, the price of Bitcoin has nothing to do with macroeconomics. Krüger makes a valid point that 'it is such an illiquid/fragmented market that in the absence of mass influx of new buyers, actions of a few determine direction'. Normally, with heightened global tensions, one would expect the price of Bitcoin to explode higher. Instead, the price of Bitcoin has languished the past few months. But, the following two events provide greater transparency to the present situation.

1. Precious Metals Manipulation - In September, the U.S. Department of Justice filed racketeering charges against three employees of JPMorgan Chase & Co. They described the firm's precious metals trading desk as a criminal enterprise operating inside the bank for nearly a decade.

2. Popping the Bitcoin Bubble - In October, former chairman of the Commodity Futures Trading Commission (CFTC), Christopher Giancarlo admitted to U.S. government interest (and likely involvement) in 'popping the bitcoin bubble'. He even made a bizarre statement in support of derivatives, 'If you don’t have that derivative, then all you’ve got are believers [and] it’s a believers’ market'. I am not aware of any mandates requiring government agencies to 'pop' bubbles.

These two examples show the determination of these entrenched powers to maintain the status quo. These powers continuously work to crush the perceived value of any asset (such as gold, silver or Bitcoin) that is a potential competitor to the U.S. dollar. The history of both the banking industry and government corruption validates the enormous challenges with affecting real change.

In addition, another immediate problem with Bitcoin is volatility. A legitimate global reserve currency can not depreciate, as Bitcoin did, by approximately 84% from its all time high ($20,000 --->; $3,200). Importantly, there is still a gross stigma associated with such a decline. Today, many people who have heard about cryptocurrencies in passing (or who passionately dislike it) view Bitcoin solely within the context of its price crash. (Although it increased by over 20X in one year prior to the downtrend) The price of Bitcoin will have to exceed its prior all-time high of $20,000 (and probably greater than $50,000) for this stigma to subside. But, since we do not have anything close to a free market, price discovery is especially difficult. Even Ethereum co-founder Vitalik Buterin criticized centralized exchanges, hoping they ‘burn in hell’.

How Do We Achieve Freedom

Conversely, maybe you don't care about your monetary freedom. Right now, life is good. You can go to the store and buy food, take a road trip, or go shopping at the mall. Why would anyone want wholesale changes in their lives? People like Peter Schiff have been ranting about a U.S. dollar collapse for years. Maybe these central bankers aren't so bad after all. Maybe they really care about all of us. These banking liquidity issues could not possibly be tied to any systematic failure. Cryptocurrencies are just too complicated and not needed.

Well, if you believe all of this, you should stop reading and put your head back in the sand. If you think bankers really care about you, then you are quite naive. Compare your grocery bill from 5 years, 10 years, and 20 years ago. Prices have consistently gone up. This hidden inflation is not officially reported by the government, but it is real and will only get worse.

Since it is not prudent to rely on the government for much of anything, especially to help fight off central banks like the FED, any change must arise from the will of the people. We are starting to see coordinated efforts as seen with NFL players asking for payment in Bitcoin. I envision a time where individuals come together, select a coin they like, invest in it and then demand payment in it. Of course, this would take years of coordination and planning.

The Future World Without Dependence On Banks

As we lessen our dependence on banks, many questions remain open. For example, how can we address changes to law enforcement when cryptocurrencies allow anonymous transactions? At a recent conference, the Deputy Secretary of the U.S. Treasury Department questioned how 'digital currencies can potentially be used to evade existing legal frameworks'. He also raised the following questions: 'If a cryptocurrency checked all the near term regulatory boxes today and grew to scale, what would be the process for making changes to rules governing the currency in the future? For instance, if a decade from now there were a desire for a stablecoin to go from fully reserved to partially reserved, or to shift its underlying mix of reserve currencies, would that decision be made by a private governing association? Or by a majority of coinholders? What if foreign actors had acquired a majority of the coins? In any case, would important decisions about our economic system have been taken out of the hands of representatives accountable to the people?'

In the future, I could see a scenario where Bitcoin and other cryptocurrencies compete with sovereign digital currencies backed by assets like gold. I am skeptical of central banks simply issuing digital currencies that are not backed by an asset. For something to be a store of value there must be an element of scarcity. While some would prefer the safety of a a sovereign digital currency, others may prefer Bitcoin. Today's central banks would be stripped of not only controlling the money supply but also of defining it. This change could lead to a separation of nation and currency. What happens if a rogue state like North Korea uses cryptocurrencies to evade sanctions? Geopolitics would be upended as the weaponizing of the U.S. dollar via sanctions would cease. Since U.S. citizens are so heavily dependent on government programs, it will be difficult to avoid societal upheaval. Freedom does not mean free stuff. Are we in the U.S. ready for some (if not all) government programs to go away? Thomas Jefferson once said 'I prefer dangerous freedom over peaceful slavery'. Perhaps, someday, we'll find out how all Americans feel about that.

This article was originally posted on hype.partners' Medium page.