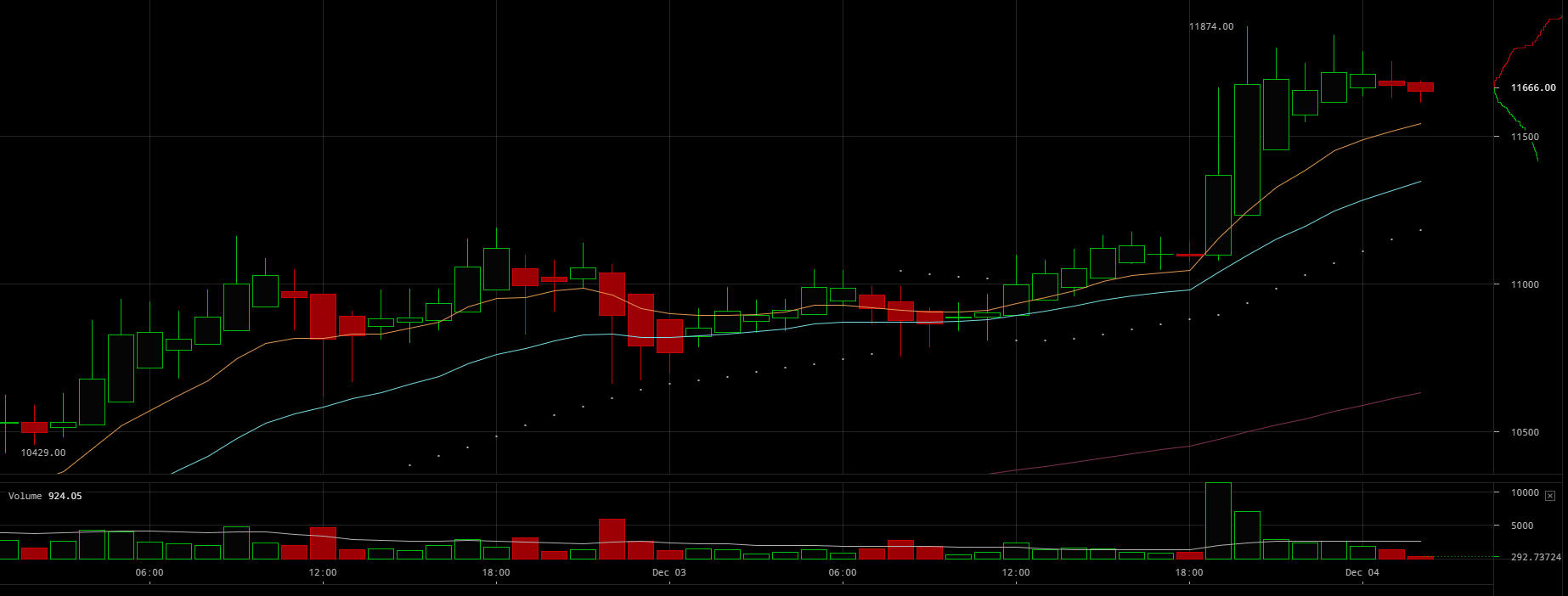

$11,874: Bitcoin Price Achieves New All-Time High, But It is Only the Beginning

Earlier today, on December 3, the bitcoin price achieved a new all-time high at $11,874, for the third time this week, after its full recovery from the previous major price correction.

Analyst: Bitcoin’s $10,000 Doesn’t Reflect its True Value

Miguel Cuneta, the co-founder at Satoshi Citadel, a major cryptocurrency-focused investment firm in the Philippines which operates some of the country’s largest bitcoin brokerates and remittance apps such as BuyBitcoin and Rebit, stated that the $10,000 hype was generated by the media earlier this month. Moments after the bitcoin price surpassed $11,000, it dropped to $9,000, and almost immediately after, the mainstream media was eager to publish a series of articles on the next bitcoin crash.

“News outlets haven’t even had 24 hours to let the ‘10k’ news simmer and it already went up to $11,500. By the time they published the ‘11K’ piece, it already dropped to $9,000. As soon as they entered the last word on their ‘Bitcoin is crashing!’ article, it’s back at $11,000 per BTC,” wrote Cuneta.

With the price of bitcoin nearly at $12,000, bitcoin is now the world’s sixth most valuable circulating currency in the world, within eight years since its launch in 2009. Hence, while the majority of mainstream media outlets and analysts in the traditional finance sector are fixated on the short-term price trend of bitcoin, Cuneta explained that bitcoin will likely become much larger than most can imagine, as it goes about separating money and state.

“So, we could be watching one of the biggest financial bubbles in history unfold with this cryptocurrency mania. Yet on the other side of the coin, there is also the non-trivial possibility that we are witnessing something remarkable happening before our very eyes — the return of the separation of cash and state,” Cuneta noted.

Currently, bitcoin is a robust store of value and an alternative to traditional assets like gold. But, with efficient scaling and widespread adoption, in the upcoming years, bitcoin will likely compete against reserve currencies and government-issued money.

Long-Term Future Beyond $12,000

Bitcoin has surpassed the $11,000 mark and is expected to surpass $12,000 within December, given the entrance of institutional investors and tens of billions of dollars in capital. As institutional money flows into the bitcoin market through bitcoin futures, the $165 billion market cap of bitcoin will increase rapidly, providing more liquidity.

The network effect of bitcoin and the dominance of the cryptocurrency will continue to attract more investors in the global finance market to bitcoin. As Cuneta added:

“Over one third of a trillion dollars. That’s the total amount of cryptocurrencies in the world. $165 Billion belongs to Bitcoin alone, which just shows how dominant network effects can be. Because of Bitcoin technology, the power to create money was granted to every human being on earth and taken away from kings, oligarchs, and governments.”

For this particular reason, several respected investors within the cryptocurrency space have expressed their optimism towards bitcoin price reaching $45,000 by the end of 2018, achieving a $1 trillion market cap.

Nice post! I upvoted and followed you. Can you check my last blog post about crypto: https://steemit.com/cryptocurrency/@cryptoizotx/crypto-market-sentiment-update-december-3-2017 ?