MicroStrategy Surges to Highest Point in 25 Years, NAV Premium at Largest Gap Since 2021

- For the first time since February 2021, MicroStrategy's net asset value premium exceeded 2.5 times its bitcoin holdings.

- As MSTR shares surge 11% compared to bitcoin's 3% gain on Friday, the disparity is widening even further.

- MicroStrategy's "Bitcoin Yield" key performance indicator rose from 4.4% in Q2 2024 to 5.1% in Q3 2025.

- The premium may persist for extended periods due to the firm's aggressive accumulation approach.

The author has a financial interest in MicroStrategy (MSTR), as disclosed in the story.

Ownership stakes in For the first time in over three years, Bitcoin Development Company MicroStrategy (MSTR) has seen its premium on the value of its holdings grow as the price of bitcoin (BTC) continues to rise compared to its value.

According to MSTR-tracker, the so-called net asset value (NAV) premium, determined by dividing MSTR's market capitalization by the value of its bitcoin stack, has climbed to almost 2.5, the highest level since February 2021. MicroStrategy's market capitalization was approximately $37.14 billion before the U.S. market opened on Friday, and the value of its 252,220 BTC was $15.1 billion.

That premium has grown even more in the time since, with MSTR rising 11% to a 25-year high—a significantly larger increase than bitcoin's 3% rise.

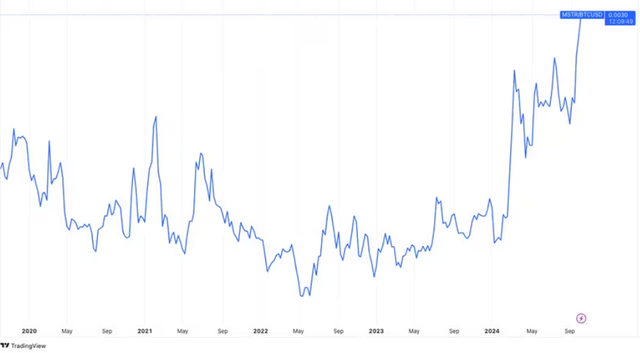

Not only is the NAV multiple at an all-time high, but MicroStrategy's stock price, divided by the price of Bitcoin, equals 0.0030. Since the corporation began using Bitcoin in August 2020, that ratio has never been higher.

When compared to Bitcoin in 2024, MicroStrategy has done better.

Thanks to the high expectations surrounding the ETFs, there was much talk about the potential performance of bitcoin-related stocks like MicroStrategy before the first bitcoin exchange-traded funds (ETFs) went live on January 11th.

However, since the ETFs were introduced, MicroStrategy stock has increased by over 240%, reaching a new peak on October 8th. Bitcoin's performance has been dismal, falling 16% since it set its record in March; this is eight times worse.

A description of the premium

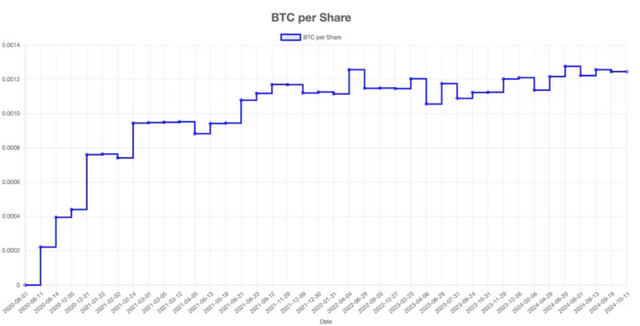

In August 2020, MicroStrategy added Bitcoin to its balance sheet. Since then, the company has raised cash through convertible senior notes and at-the-market stock offerings (ATMs) to increase its coin stash. Shareholders have benefited from the ongoing increase in bitcoin per share.

The current market price of MicroStrategy shares is 0.0012 bitcoin, which is equivalent to one outstanding share.

Shareholder dilution occurs in both equity financing and debt financing. When convertible debt is turned into equity, the number of shares used for debt financing increases. On the other hand, the sale of shares through the ATM program in equity offerings dilutes shareholders with each transaction. The critical question, though, has been whether Bitcoin holdings can outpace shareholder dilution in growth during the past four years.

Coined by MicroStrategy, the "Bitcoin Yield" is a new key performance indicator (KPI) that measures the percentage change from one period to the next in the ratio of the company's bitcoin holdings to its Assumed Diluted Shares Outstanding. This indicator rose from 4.4% in the first quarter to 5.1% in the second.

Theoretically, the NAV premium might persist for a long time due to investors' desire for returns greater than owning Bitcoin and MicroStrategy's apparent lack of intention to halt this aggressive accumulation strategy.