Big short stock market and big long BTC? I think so!!

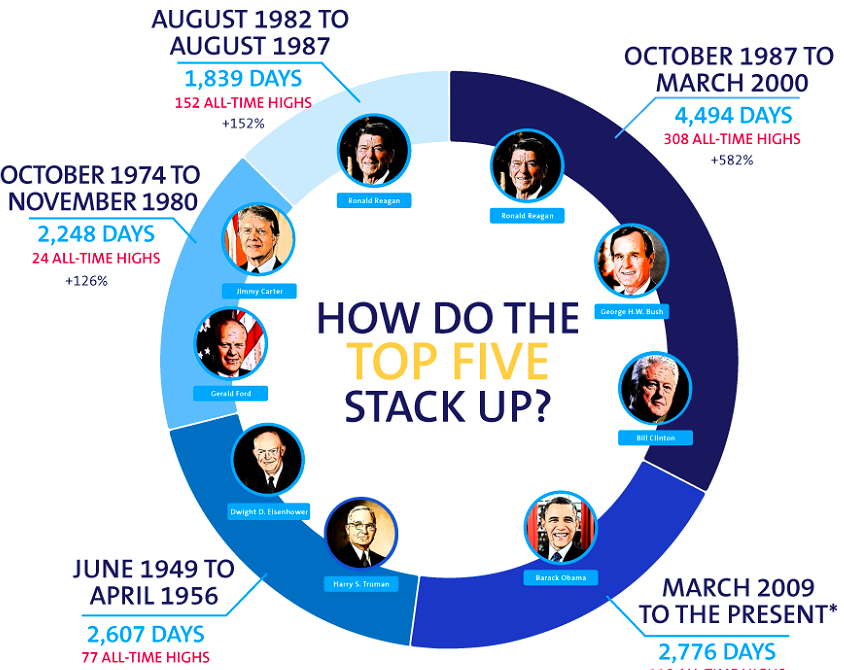

Bitcoin just been through a crash of around 70% and the Dow Jones is in a 9 year long bull market. With a 9 year uptrend this is the 2nd longest bull market ever! This on itself is already a reason to expect a crash soon. But there are more indicators………….

note that this the recent bull market is already 3285 days instead of 2776 days

In The last recession nothing got solved

The stock market crash of 2008 was bad, and many people around the world lost their job, house or life savings. Many companies, banks and even countries became insolvent. Normally a recession builds a strong fundament for recovery by wiping out the weak entities and force the stronger ones to optimize their proces and get rid of inefficiency.

In 2008 the worse companies that actually created the crisis didn't disappear, but got bailed out by the governments. This was a HUGE message to all the big businesses how to behave in the future:

- Risky investments are great, when you succeed you will make big money and when you fail the government will bail you out.

- Banks can keep their reserves at the legal minimum, because if they can’t pay their clients the government will be there to save them.

These facts makes me heavily suspect that there are many companies around that invested in a very risky way and have almost no reserves for a rainy day. Also the governments that did the bail outs in 2008 are near insolvent themselves and will have a real hard job to do another round of bailouts.

The recent bull market was driven on free money and low interest rates

Beside the bailouts there was another reason that the recession came to an end. The FED printed astronomical amounts of new money out of thin air (bubble?!?!) and the interest rates got driven down. This made the bull market return without giving the recession the time to clean out the economy. The start of a new bull run was not driven by strong fundamentals, but by free money!

Does free money exist? I don't think so! The money that got printed diluted the value of all dollars. Since the entire world uses the dollar for oil and other commodities, it became more expensive to buy them and everything is based on oil or created by energy. Decennia of money printing by the fed is probably the biggest cause of poverty around the world (not even speaking about the wars to protect the petrodollar and central banking system to enrich themselves over the back of humanity).

In a free market, low interest rates are a signal that people have a lot of savings in the bank and want to consume in the future. In a free market low interest rates stimulate production because there will be more consumers in the future. When central banks lower the interest rates artificial, many investments will take place where the market doesn't signal demand for.

The extremely low interest rates over the last ten year (even negative in some countries) gave consumers, companies and governments money to invest, almost for free. Because almost no interest had to be paid, many mall investments are done over time. People have been buying things they not really need and companies and governments made investments that were not really necessary and often not profitable (with dept)

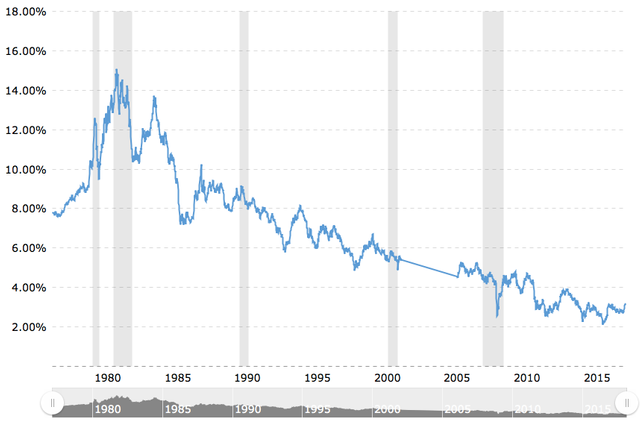

Rising interest rates is A HUGE DEAL!

Recently the interest rate broke out of a 30 year down trend. This will immediately influence the balance sheet of governments, companies and consumers as well. The total amount of dept in the USA per person is around 250.000 USD (a child in American get born with a 250.000 USD liability! American dream? Human rights?)

This means that every percent the interest rate rises, an extra load of 2.500 USD per year will be put on the shoulder of every American (also unemployed, children and retirees). The fact that the interest rate over the last 30 years was 8% in moderate makes it really scary…… This enormous dept is not only the case in America, but over the entire world.

Technicals look bearish

A double top is forming on the chart of the Dow Jones where the 2nd top is lower than the first one. This is a very bearish sign, most of the bubbles pop like this. When the neckline of 23800 breaks it could become very messy…………..

Bitcoin is just been through a crash, but the fundamentals are extremely good

Bitcoin dropped from over 19k to a low of 6k and is already back on 11.5k. This really was the first time I saw an asset crash while the fundamentals were really good. Real signs of mass adoption came out and a lot of amazing new tech came online. All the way down I was scratching my head because there was really nothing wrong with bitcoin.

As I said the fundamentals are better than ever:

- 2nd layers with huge scalability and use cases coming out (LN and RSK)

- Exchanges are implementing Segwit and batching transactions (low fees again)

- Property around the world get sold with BTC

- First shipping company start to do trade in BTC

- Wall street comes in in a big way

- Legalized followed by huge adoption in some countries

- Governments and central banks coming in

- Bankers are flippening (from bitcoin is a fraud to becoming an investor)

At the moment it really looks like bitcoin is really going mainstream in 2018 and this will bring HUGE surges in price!

A reverse head and shoulder is forming on the bigger time frames

On a longer timeframe a reverse head and shoulder is forming on the BTC chart. This is an extremely bullish pattern and when 11k gets broken the short term target is 17k. The technicals are supporting the fundamentals.

When the crash of the Dow happens the same time as the rise of BTC…..

Reading the charts it looks like there is a good possibility that the Dow will crash at about the same time that BTC will rocket. When this happens we could get a very interesting mix of panic in the stock markets and FOMO (Fear Of Missing Out) in BTC.

Bitcoin and gold are the best known safe heavens and this reputation will strengthen for bitcoin when it rises during the stock market crash. When investors see the drop in the Dow and the rise of bitcoin they will probably rush into BTC in panic AND fomo. Since the market capitalization of all stocks worldwide is around 80 trillion at the moment, every percent that flows into the tiny market cap of bitcoin (200 billion) will theoretically quadruple the bitcoin price!

Of course this is just the math and this will not happen exactly. When a lot of money flows into BTC in a short period the sell orders in the order books will all be filled in no time and the price will rocket even harder, but it can also go slower when a part of the money flows into altcoins.

Bitcoin is uncorrelated, unseizable and a transaction cannot be censored

Bitcoin is uncorrelated, this means it is not depending on other markets. Investors can stabilize their portfolio by adding uncorrelated assets. When the regular markets drop the uncorrelated assets will remain stable or rise, this makes the portfolio overall more stable. It is expected that more and more investors will add BTC to their portfolio when they see this feature.

When a really bad crisis happens, banks go under and government don’t have enough funds for bailouts and to pay for their own liabilities the banks and governments will do everything to keep themselves in existence over the back of the civilians. First they will take their money through taxation and inflation (see Venezuela) and if they still can’t get enough through confiscation. BTC is the only asset that can not be confiscated when you store your own private keys in a smart way. Also nobody will be able to stop you from transacting with anyone in the world and you will be not affected by bank runs.

Conclusion:

It looks very bad for the stock market and very good for bitcoin. Huge trading opportunities could be around the corner and when you are heavily invested in stocks or dependent on the economy it could be a good idea to hedge your risks with BTC (and gold).

Disclaimer:

This is not investing advice but pure for education, recreation and to open a discussion. Trading is risky, do not trade in stocks or cryptocurrencies without (self) education and only with money you can afford to loose.

Next post

https://steemit.com/bitcoin/@michiel/don-t-underestimate-the-store-of-value-feature-of-bitcoin

Do you agree or disagree? Something to add or correct? Let it know in the comments below!

If you like it UPVOTE and RESTEEM!

It's hard to look at the price as based on fundamentals in a market like this. The entire market for the most part is speculation. I see improving fundamentals as more and more solid baseline support, but those levels are likely much lower when speculation is removed. This means volatility will be produced by parties looking for gains in a thinly traded market. Over time the ability to swing the market for gains will go away, and after that we'll all need a real job again. Lol. Unless you have lots of Steem Power then you can work by blogging! Thanks for the post!

It is really nice the way you have researched and presented your research in this post it is really amazing i really appreciate. I am following you please visit my page.

This is one of the most comprehensive articles I've read on BTC as an asset class. Indeed it looks good on charts for BTC. I'm hoping the bear cycle ends soon. Thanks for the article.

Thank you! It looks like the fundamentals are that good that a new bull run have to come sooner than later.

The stock markets suffered with 2008 crisis, but usually we learn with our mistakes; I don´t know why almost nothing was done to repair what caused that crisis. As soon as the stocks start to come down in price and the FUD get to people, we have two possible scenarios, either BTC price and all cryptocurrencies go down with the crash, or (as I believe) we will see a lot of investor running away from the stocks and arrive to the crypto world, that has shown big potential for profits in last months.

Btw, really good post, you deserved my upvote and resteem.

This are indeed the 2 most likely scenario's. I agree, I also expect BTC to go up when a stock market crash happens because investors will look for save heavens and BTC is one of them. I think the current holders of BTC now are the strong hands (because they hold through the 70% crash) and won't sell because of panic in other markets. Maybe some have to sell their BTC because they lose their job or whatever, but I don't think this effect will be big.

you took as an example great personalities in the business world

Hey @michiel , pos bagus! GOOD

Saya menikmati konten anda Terus bekerja dengan baik! Selalu menyenangkan melihat konten bagus di Steemit! :)

https://steemit.com/travel/@boyhaqi97/yuk-join-open-trip-pulau-breuh-pulo-aceh

You got a 12.17% upvote from @buildawhale courtesy of @michiel!

If you believe this post is spam or abuse, please report it to our Discord #abuse channel.

If you want to support our Curation Digest or our Spam & Abuse prevention efforts, please vote @themarkymark as witness.

upvoted, resteemed and follow! great post! I myself was thinking bitcoin just entered a 1-2 year bear market, but we'll see. Still not sure how bitcoin will cope with sustainability and energy consumption issues. And according to my views, bitcoin mining will become unprofitable in the next 3-5 months.

Very nice post...Support you!

Excellent article very didactic without a doubt is a source of ideas for discourse. Codial greetings