Bitcoin Hits Highest 2023 Value, Nearing $40,000 Mark 🚀💰

Bitcoin Hits Highest 2023 Value, Nearing $40,000 Mark 🚀💰

BTC made a new record in 2023, hitting $39,753 on Saturday. This surge was driven by positive expectations for a BTC-spot ETF market. Keeping an eye on regulations, the US Committee on Financial Services has scheduled a hearing for December 8.

Key Insights:

BTC achieved a new 2023 high of $39,753 on Saturday, fueled by optimism toward a BTC-spot ETF market.

Regulatory activity remains a focal point, with the US Committee on Financial Services calling a December 8 hearing.

A crypto regulatory framework driving innovation while protecting investors would be a boon for the crypto market.

Bitcoin Approaches $40,000, Marking a Positive Trend 📈🌐

On Saturday, bitcoin (BTC) saw a 2.01% increase, following a 2.60% rise on Friday, closing the day at $39,499. Notably, BTC maintained its position above $39,000 for the first time since May 4, 2022.

The market is optimistic about the SEC approving several BTC-spot ETFs in January, sustaining the demand from buyers.

BTC Liquidations Stay Elevated 📉💔

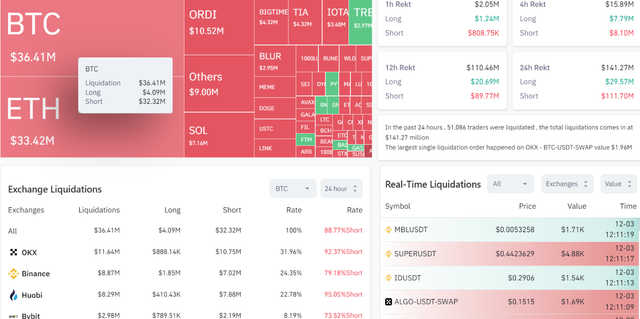

BTC liquidations remained high on Sunday, especially impacting short positions. Coinglass reported total BTC liquidations at $36.41 million, with $32.32 million from short positions. OKX, Binance, and Huobi experienced the highest percentages of BTC liquidations.

Investor expectations of the SEC approving a batch of BTC-spot ETF applications continue to drive buyer demand.

Digital Assets Hearing Announcement 📣💻

Patrick McHenry, Chair of the US House Committee on Financial Services, announced a digital assets hearing on December 8, 2023. The subcommittee hearing, titled "Connecting Communities: Building Innovation Ecosystems Across America," will address comments related to crypto regulations and the SEC's enforcement approach.

Senators Push for Regulatory Framework 🏛️🤝

Senators Cynthia Lummis and Kirsten Gillibrand introduced the Lummis-Gillibrand Responsible Financial Innovation Act in June 2022. Responding to the SEC's actions, Senator Lummis emphasized the need for a clear regulatory framework, stating, "The SEC cannot continue ruling by enforcement." A regulatory framework promoting financial innovation while restricting the SEC's powers would benefit the crypto market.

Technical Analysis: Bitcoin and Ethereum 📊🔍

Bitcoin Analysis

BTC remains above the 50-day and 200-day EMAs, indicating a bullish trend. Breaking above the $39,600 resistance level could pave the way for a run at the psychological $40,000 resistance. Monitoring BTC-spot ETF news and SEC activities is crucial for crypto investors.

Ethereum Analysis

ETH maintains a bullish trend, sitting above the 50-day and 200-day EMAs. A return to $2,200 could lead to a move to the $2,300 resistance level. However, falling below the $2,143 support level may bring sub-$2,100 into play. The 14-period Daily RSI suggests an ETH return to $2,200 before entering overbought territory.