Bitcoin Network Update - 19 December: Crisis is Here, Situation Is Going To Get Worse

One day after the great retarget, we have to understand what is the situation with bitcoin. BTC price is decreasing while Bitcoin cash is rising to new All-Time-Hight: why?

Today's update is very important because situation is going to really worse for bitcoin network usability.

Let's continue with our periodic update about bitcoin network situation.

I believe that it is very important not only for people who try to use bitcoin for value transferring, but it is also very important for investors because this negative situation of bitcoin network is giving a great market advantage to Bitcoin Cash and Litecoin, that are the most obvious (and more efficient) alternatives to Bitcoin as crypto-money.

Ps: If you have forgotten last episodes, this is (in part) why in these days BTC is so slow. Read this article about the great bitcoin retarget that happened two weeks ago and yesterday again

!https://steemit.com/bitcoin/@marculisse/important-do-you-want-to-transfer-bitcoin-do-it-immediatley-retarget-incoming.

From yesterday, because of the effects of retarget, bitcoin produces -17% blocks/hour without considering hashrate variations (hashrate, to simply say, measures mining power) . This means -17% confirmed transations and higher fees.

Ps: Data reported here cover period from 00:01 to 23:59 UTC+1 (Central Europe Time) of 19 december

Seems that Bitcoin network is producing new blocks at a very slow rate, also because of a slight decrease in hashrate. We are having a Bitcoin Blocks production rate of approx. 5.75 blocks/hour in last 24 hours.

Source https://fork.lol/blocks/time

Bitcoin unconfirmed transation number is growing, and after a great increase it is now over 180K (with average transation fee that, in 19 december, was surely over 30$. Data will arrive within 10 hours from now...).

In fact the number of transations on BTC network was high, about 370K transations in 24 hours.

So bitcoin is continuing and even worsening the long period of mempool stoopping up, whit an increase of unconfirmed transaction. The "mempool" is the "pool" that contains all Bitcoin unconfirmed transations.

So, as a lot of transations are still unconfirmed. Here you can find all mempool data https://jochen-hoenicke.de/queue/#24h Probably, unless this grat hashrate influx continues, situation will continue to get worse.

Because of these elements, already now, bitcoin fees are really increasing and average transaction fee is probably over 30$. It is too expensive to use Bitcoin for normal payments. Consider also that bitcoin price rally is increasing the cost of bitcoin average transaction fee, that is calculated in Bitcoin. See at https://bitinfocharts.com/comparison/bitcoin-transactionfees.html#3m

MARKET REVIEW

Competitors of BTC are taking advantage from this situation.

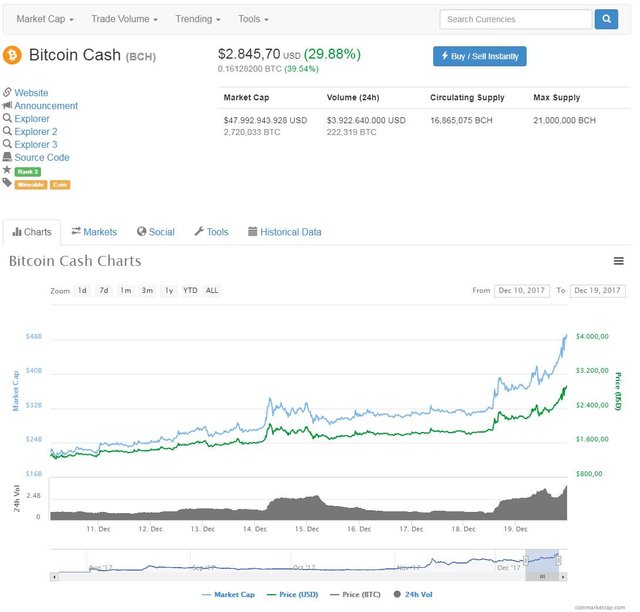

This slowdown period, as forecasted in precedent posts, is creating a good chance for a bitcoin cash price recovery, that has spiked over 2900$ and now it is near to 2883 dollars. We seeing a good price increase and this trend will probably continue.

Litecoin price is near to yesterday's All-time-hight, and at this moment it is $350. Daily transactions done with litecoin are near to 136K, a significative decrease in comparison with the last days.

Bitcoin price at the moment decreasing, and after a very volatile day at the moment it is under 18000$

See at https://coinmarketcap.com

We also have to coinsider that this still high price is making bitcoin network less usable (see for more informations about this https://steemit.com/bitcoin/@marculisse/in-bitcoin-rally-making-bitcoin-unusable-the-problems-of-speculative-market)

Stay turned and pay really great attention to this chaotic moment.

If you need of help or clarifications, dont hesitate to comment and ask.

Have a nice day guys!

The last time Bitcoin fell and Bcash went up sharply, it reversed and Bitcoin went on a big up surge. What's the odds on that happening again? I'm not selling my Bitcoin, the problems can be fixed and I don't trust some of the people behind Bcash.

Consider that:

Now, Bitcoin simply is slowing down because it is overheated. No miners scaping to Bitcoin Cash. The problem is that there are too users for the network. At the moment, simply bitcoin cannot handle this transaction volume.

So in my opinion the solution cannot be 100% good for BTC. Bitcoin cash is mooning and this situation won't completley reverse back in a couple of days...

I think you drastically underestimate the resilience of Bitcoin. It could crash but then there's likely to be people buying at what they think is a bargain price. Bitcoin Cash doesn't have the same quantity of enthusiastic investors, its unlikely to ever pose a real threat to Bitcoin. If there was a real threat, I'm sure Bitcoin would sort its problems out fast.

TWO things to consider here:

1, Segwit is ready to be implemented. The process to enable segwit was two parts: first, Bitcoin updated the software. but second, segwit upgrade was never executed. IF bitcoin core group can come to 100% consensus and enable segwit, realistically bitcoin value will surge. If they do not, then you are likely very correct in your assumption that the mempool will get bigger and slower and the world will not wait for BTC--it will go to litecoin or Bitcoin cash.

2, Coinbase added Bitcoin Cash today. I am a firm believer in the Coinbase Bump: all coins offered on coinbase increase in value because of the exposure (there are only 4 coins to choose from on coinbase). Coinbase has not enabled selling of Bitcoin Cash yet. Many users on coinbase were using the platform in August and will discover that they actually have some bitcoin cash in their wallets from when the hardfork took place. When coinbase enables selling in the coming hours/days, many coinbase users will sell the Bitcoin cash since it is around an ATH and they will view it as "free money". this could create a dip and be a nice time to buy.