Bitcoin is the Ideal Portfolio Asset

Bitcoin truly is a new asset class that investors should take seriously, not just because of the extraordinary returns thus far, but because of its correlation to everything else.

t’s All About the Correlation

The holy grail of portfolio management is to find an asset with a positive expected return that isn’t correlated to anything else. You want something that goes up on average, but even better if it doesn’t follow the herd down in a crash. Bitcoin is exactly this asset.

Bitcoin’s returns have been spectacular, but what’s even more interesting for portfolio managers is that those returns have about zero correlation to anything else.

Constructing a Portfolio

One of the great insights of modern portfolio theory is that you can actually lower overall portfolio risk by including a bunch of risky securities, as long as their returns aren’t strongly correlated.

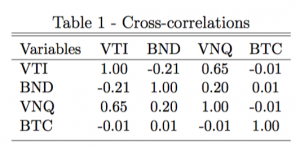

It turns out that Bitcoin’s correlation to stocks, bonds, and real estate is, well, basically zero:

Note: VTI is Vanguard’s Total Stock Market ETF, BND is their Total Bond Market ETF, and VNQ is their equivalent real estate investment trust (REIT) Index Fund.

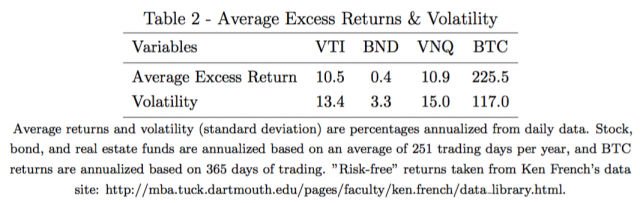

Here’s the average returns in excess of the “risk-free” T-bill rate and standard deviation of those returns from 1/3/2013 – 6/30/2016 (basically when BTC’s daily volume started to be consistently over $1M):

Adding Bitcoin to Your Portfolio

We know that Bitcoin returns have essentially no correlation to stocks, bonds, or real estate, and we know that they’ve been enormous compared to other asset classes; but is that reason enough to add it to your portfolio?

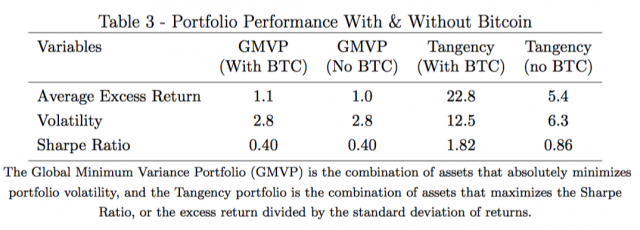

We’ll answer that by looking at two classic portfolios: the Global Minimum Variance Portfolio (GMVP), and the Tangency portfolio.

The GMVP is the combination of assets that gives us the absolute smallest amount of return standard deviation possible, while the Tangency portfolio is the asset mix that maximizes the Sharpe Ratio, or excess return per unit risk. If interested you can check out the matrix algebra that solves these portfolios, but here’s what we get:

The GMVP loads up on very little Bitcoin; in fact, rounding to the nearest percent makes it look like zero. This makes sense because BTC is, by far, the most volatile asset under consideration and we’re trying to construct an absolute minimum variance portfolio.

What’s interesting is to note the stark difference in the Tangency portfolio with and without BTC. The Sharpe Ratio, or excess return per unit risk, jumps from 0.86 to 1.82. Mind you, this is all what we call “ex post” analysis, or after-the-fact, but it’s at least illustrative in discussing the merits of diversification.

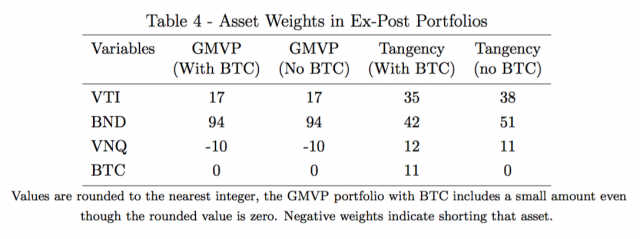

For the curious, here are the weights for each asset in the portfolios:

Putting It All Together

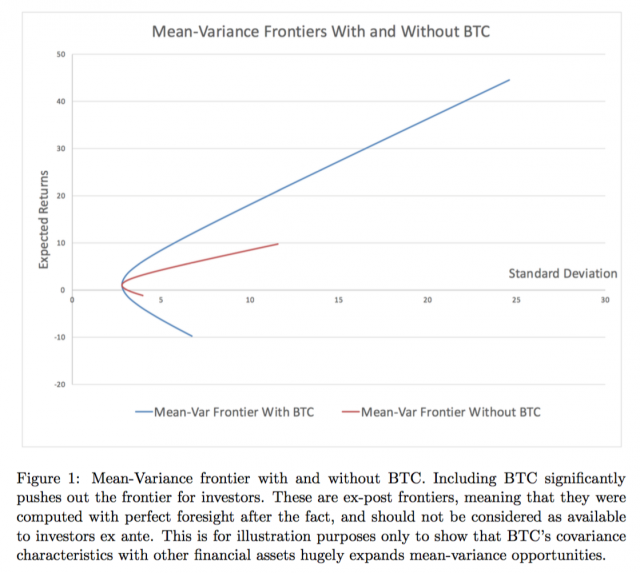

Let’s look at the efficient frontiers to see how BTC changes the game for investors:

The Ideal Portfolio Asset

nvestment Blockchain Positive OutlookThe return and correlation properties of BTC significantly push out the efficient frontier for investors, meaning that the risk-return opportunities are far greater with this new asset class.

Here’s an academic paper that took a look at this in 2013, which confirms the findings here.

Moral of the story: Bitcoin truly is a new asset class that investors should take seriously, not just because of the extraordinary returns thus far, but because of its correlation, or more precisely, lack of correlation to everything else.

Hi! I am a content-detection robot. This post is to help manual curators; I have NOT flagged you.

Here is similar content:

http://cryptostyle.com/news/news-bitcoin-is-the-ideal-portfolio-asset

NOTE: I cannot tell if you are the author, so ensure you have proper verification in your post (or in a reply to me), for humans to check!