Atomic Swaps – They're Coming, And They're Huge...But For Whom?

Atomic swaps are a big deal. Even the mere promise of their arrival can have grave implications for the value of your cryptocurrency holdings. You would do well to learn about them.

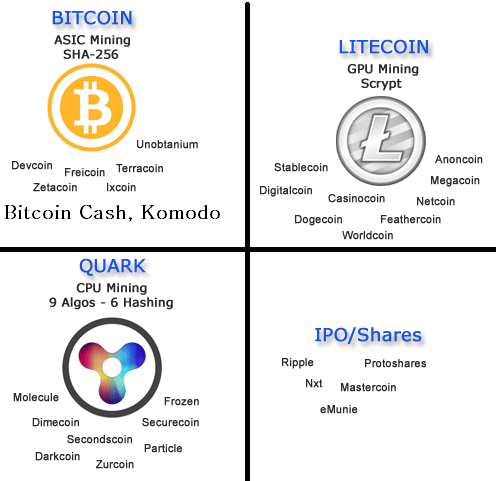

Atomic swaps offer the potential to swap two assets on different blockchains, such as Bitcoin and Litecoin, provided they share the same hashing algorithm, such as SHA-256. You don't really need to know what that is; the key info is that there are a lot of coins that are compatible with each other.

For example, say you have Bitcoin and another party has Bitcoin Cash. You want to trade without counterparty risk. Currently, you would each have to send your coin(s) to an exchange, sell/trade them there, then withdraw them back to your (hopefully secure) cold-storage. Net result: you each make two transactions, two per network total, and you are each exposed to the counter party risk of your chosen exchange.

Atomic swaps hope to allow you to make that transaction directly with the other party via smart contracts called HTLCs - hash-time linked contracts. In other words, a timed escrow which will result in both parties exchanging directly with no trust. The end result will be half the transactions (only one per chain), and therefore half the fees, and no exposure to exchange risk.

They also may be coming fairly soon, as noted by Bitcoin.com only yesterday: (note: Bitcoin.com is fairly pro-BCH)

They may solve grave problems with some coins (looking at you, $19 BTC fees) or even render the competitive advantages of others potentially moot (Bitcoin Cash?) The market does not seem currently to be bothered by BTC's transaction speed and fees, so surely a 50% speed increase and fee reduction can only buy BTC even more time to scale.

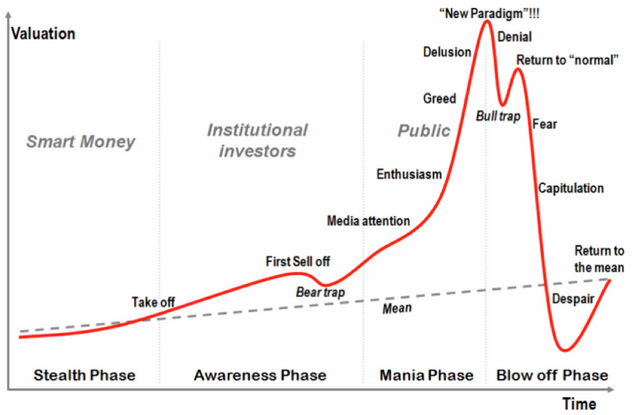

This may not be a good thing for Bitcoin Cash. Though the chart looks bullish, you may have heard it here first - atomic swaps could be negative for Bitcoin Cash, even though Bitcoin Cash is compatible to swap with Bitcoin! Of course, it could also be bullish. It's difficult to tell where we are in this crazy market:

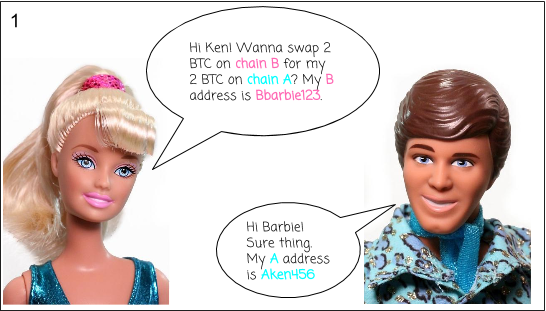

If you would like to see a more detailed run-down of the contract process, along with some of the limitations, all told via Barbie and Ken, please see this link:

http://popeller.io/index.php/2016/09/28/atomic-swaps/

If you have any additions or errata for this post, please let me know! I will see that they are voted to the top of the comments, and will make the appropriate edits (if possible).

We also have a Radio Station! (click me)

...and a 5000+ active user Discord Chat Server! (click me)

Sources: Bitcoin.com, Crypto-Compare, Google

Copyright: quarkcoins.com, popeller.io

Good graph of a crypto market cycle. Dope idea to be able to cut transactions in half!! But I guess wouldnt matter directly for steem/sbd because no transaction fees?

Yep, Steem has no scaling issues. It's mostly BTC/Eth that are scaling dinosaurs at the moment.

nice, love steem, hope you have been doing well!!

Can't complain after recent events!

hope the new year's going well for you lex!!

Anything that allows you to avoid a centralized exchange is good in my book!

@samuel-swinton I agree seems like the central point is always the weakness.

I agree. It isn't just a bottleneck for transactions but also a very public hacking target.

Not only that, it's also a source of unnecessary additional fees. Exchanges are mostly non-producing middle-men, only necessary for trust reasons. (They can also be liquidity providers, but generally speaking.)

"only necessary for trust reasons" exactly, and the blockchain allows for trustless transactions. I feel that they will only exist in the infancy of decentralization.

For sure. They are only around as a legacy tech from our previous days of "dumb" financial markets.

Yep anytime you put a big stack of BTC in one spot it is a bounty to test the security of the system. the bigger the honey pot the more attacks... it either proves secure and the bounty stays or the hackers win and the btc goes to the winner of the bounty. @dan is super smart to add time as the safe guard with steem power and the dpos idea. I have seen a few people recover their accounts here on steem and cancel the power down. This made me feel much more safe with securing the coin an why I bought 1200 steem September 2017. Now i have over 1400 sp and it keeps growing.

"Yep anytime you put a big stack of BTC in one spot it is a bounty to test the security of the system. "

Not only security, but you also are tempting the humans involved in the system! Everyone has their price.

I completely agree with the safety feelings that power-downs provide, even though they are often inconvenient for other, unrelated reasons.

The powerdown also helps me from doing stupid things and acting too fast. I like this aspect of it. I also know that if I need some funds that I can power it down and use it. Steem is the first time I have ever had a "savings" account where I enjoy saving and it is fun to vote with my "savings" and add to others steemy bank.

You are absolutely correct. Selling too early is just as bad as selling too late. Thanks to the PD cycle, I've saved a lot of Steem I might have sold cheaper.

yeah so glad I did not trade any back then... I am using my SBD I earn to play with and make profits outside of steem and with the 50/50 setting I am sure to keep building my SP.... looking so forward to the new year! Keep stackin them coins my friend... :)

Good read thank you Jason for being the first to introduce me to atomic swaps!

I'm surprised you didn't already know about them! You're a pretty well informed guy.

Atomic Swaps are definitely slowing down my enthusiasm for Bitcoin Cash!

@lexiconical Man this could not come at a better time I just bought $72 of btc off of my mom and they wanted $15 to send it... so i just gave her the money and am holding it in the same account until the atomic swaps are a thing and we can move it out cheaper.

That could definitely be awhile...good luck with it!

Okay @lexiconical . I've been on a mission to hear opinions on this new supposedly block chain killer hashgraph! Nobody wants to talk about it, but it seems like it may be bad for block chain investors whats your thoughts? Thanks in advance bro!

It sounds pretty interesting from what little I know about it. I'd need to do more due diligence to comment further.

useful topic :) All We Know That Bitcoin have Big Problem of Unconfirmed Transaction , If we Try To Swap BTC to LTC it's Will Take They Same Time of Sending BTC to Somewere or it's Will be instant !

Thank You For Sharing :) Following you (y)

Even if it does take the same time as it does now, you'll still only need one transaction instead of two! This would instantly drop network traffic by 50%, with a hopefully corresponding drop in both fees and transaction times.

These swaps will surely make exchanging a lot smoother and cheaper. I only recently heard about this a few months ago. That's pretty cool man. Good post!

They could solve a lot of fee and transaction congestion problems for Bitcoin (and friends).

This is one of the reasons I invested in litecoin a bit more :)

It would be great If the transactions are fast/instant and the transaction fee is low.

Swapping is a great idea, it will make thing more easier and fast.Thanks for the great informative post.

I can tell you really took a close look...

...

Looking forward to not paying ridiculous coinbase fees!

Well, it's not really Coinbase's fault - it's network congestion in the Bitcoin mempool.

This will be a game changer. I'm curious how we will make this transactions, I'm uessing I might need to get an online wallet?

I think you only need an address and the ability to send coins. The rest is handled through time-locked contracts.

I have never heard of this, it sound like it will be such a game changer..

Let's hope so, BTC needs a game changer.