Coinbase - The Central Bank of De-Centralized Currencies | In Depth Review

Several weeks ago, I signed up for Coinbase probably for the same reason that they handle 46% of the BTC/USD, 25% LTC/USD & 20% ETH/USD (which are the only currencies for purchase) on average, every 24 hours – they’re easy to use… on the web at least. Although they seem like a strait forward way to exchange fiat to crypto, I had a few issues with the service in general, as well as the mobile application that I would like to share with everyone whom are considering them as an exchange.

The first thing that strikes you as a bit odd can only be described as the ‘big bank feel’ crossed with a California DMV. Here’s how they slowly unlock higher weekly purchasing power, while increasing their abilities to track you:

- Credit/Debit card unlocks – $150/week (regardless of card limit)

- Home Address – $250/week.

- Front & Back Picture of Govt issued ID card – $1500/week

- Login to their site with your bank account login – $5000/week.

- $10,000 liquidity limit (crypto > fiat) each week.

Also, you’ll have two balances, instant purchase and wired purchases (with bank account). Instant is exactly what it sounds like, but more expensive if using your credit card, while the non-instant takes more than one week to fill an order and is slightly less expensive. For the wired purchase, you are locked in at the rate at the time of order, but they don’t mention that in the service agreement, LOL

Now, I don’t want this article to be about Anarcho-Capitalism or ‘fighting the system’, but I have only one point I would like to throw out there. Coinbase & GDAX are part of the central bank. As such, they may disclose information about the user’s investment activity to the IRS and other government services if that day comes.

Fees

Due to the crypto world’s current volatility, they can get away with high fee’s for now, but I would imagine that high frequency traders (which I will define here as 600-1200 BTC equivalent each month) have already grown tired of this an are seeking other exchanges. Personally, I purchase a lot of Ethereum(ETH) from these guys but am searching for more economical sources. Their fee’s are broken down in the US as follows:

- Purchase or Sale w/US Bank Account – 1.49%

- Purchase or Sale w/Coinbase USD Wallet – 1.49%

- Purchase w/Cedit & Debit(instant) – 3.99%

- Sale via Paypal – 3.99%

- USD Deposit via ACH Transfer – Free

- USD Deposit vis Wire Transfer $10($25 outgoing)

- Network Fee’s – 0.0015%

Although not advertised on the fee’s page, network fee’s are applicable for all transfers to wallets in or outside of Coinbase. Since I don’t personally trust my coins in a web based hot wallet, I suffer from these fee’s. Also, I only bank with one institution inside of the US, so I was not about to connect multiple bank accounts, though I would suspect that you would need multiple IDs if you were going to try to pull that off – which I believe is illegal, though I’m not sure.

Fees outside of the US – This is where it gets a bit interesting. At the time I wrote this article, our mates from Australia and bros from Canada can only allowed to buy with their credit card, which charges 3.99%. Europe, UK and Singapore on the other hand, are allowed similar rules and fee’s as the US, but with fewer options for payment and liquidity.

Exchange Logic

This is something that you need to watch out for, especially if you are like me, and are using multiple application and websites to monitor your investments. Coinbase pre-fee prices are almost always several percent higher than listed on places like coinmarketcap.com & Blockfolio, which is bad when compounding with your 1.5 – 4% purchase fees, then network fee’s you will have to pay just to get the currencies out. By the time is it all said and done, you may end up paying 8-10% more than the rest of the market.

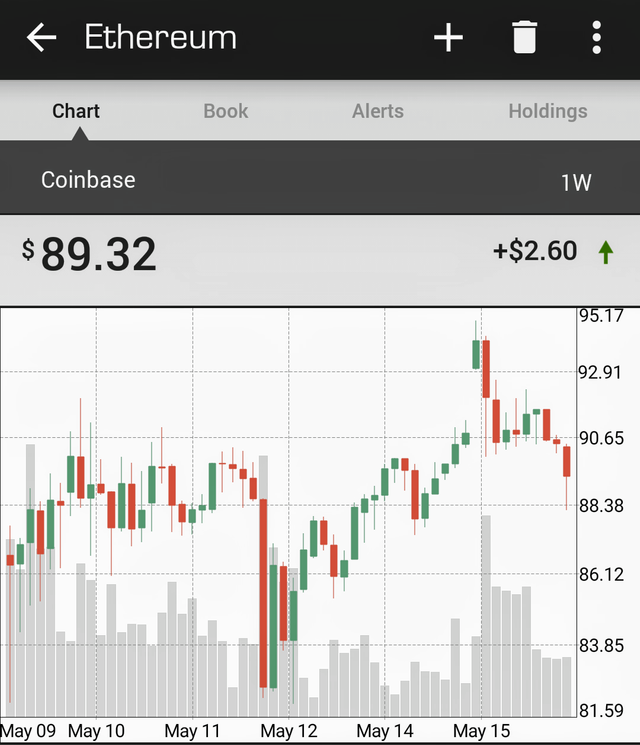

Additionally, the prices raise instantly with the market, but are very slow to fall. Users might have noticed this on 11MAY17, when Ethereum(ETH) fell from just under $90 to sub $83 in 2 hours. Although coinmarketcap.com and Blockfolio both reported this drop, Coinbase only did so retrospectively, and only in their chart, but never in price.

Mobile Application

This is probably the worst mobile applications that I’ve ever used in my life. Although most developers aim to create a mobile application which is a close analogue to their site, Coinbase decided to go a different route and make something that’s about 75%, rather than the easily achievable 97.5% that most use as a standard. The application does not issue errors when you do something wrong, which is very easy to do because of all the big bank rules, and it doesn’t appear to be very secure in that screen shots are enabled and several additional behavioral logging ‘spyware’ apps came with the software, which I discovered on my android with sockstat.

Don’t trust the camera - The QR code scanner in the Coinbase app, copied the wrong wallet address while I was trying to send to my Ledger Nano S wallet and tried to send 2 BTC to a (luckily for me) non-existent wallet. I found that the QR scan had missed the first 8 digits of the address, and the last 4. This was odd because I had successfully sent funds from wallet to wallet using this exact methodology. Aside from the obvious, the main problem I had with this is that Coinbase is quick to confirm transactions, even if they didn’t go through, in which case there will be no error message.

Don’t trust the wallet – As I mentioned in my post on the Nano Ledger S, each crypto investor must perform the same tasks as a financial instiation. This includes maintaining a high level of cognizance for the way that threats may take your funds. Although I tend to stick to cold storage devices for coins that I am not actively trading, ther following are points that make me nervous about keeping any type of balance in the Coinbase mobile wallet:

- Wallet remembers your user ID and password.

- Screen capture is enabled, which means that it is enabled for anyone with dormant malware in your device.

- The application uses the google keyboard, for which I believe there are dozens of YouTube videos which will teach you how to build a key logger in 10 minutes or less.

- Suspect that no precautions have been taken to mitigate or stop interposes communications(IPC) from collection data.

- If the application is run through any type of Dynamic(DAST) or Static(SAST application security testing by a 3rd party, it is not posted anywhere. Having working in this industry at executive levels, I know from experience that this is the type of thing you brag about.

Last complaints - Purchase order receipts do not include the price you purchased your coins at, so be sure to use an app to track this, like Blockfolio, etc. Additionally, the user does not appear to have access to their private keys… I’m not kidding at all.

Closing thoughts

Coinbase is very simple to register and use, but they charge an arm and a leg as a result. I’ve experienced a lot of issues with Kraken in both the service and transparency departments (a topic for another article) but there are few options when purchasing cryptocurrencies via Fiat in the US. Although I would recommend Coinbase to any users looking to purchase less than $5,000 BTC, LTC & ETH each week, I would not recommend doing so if you plan high frequency purchase/liquidity, nor would I recommend storing your coins with them or using them your sole exchange.

Donations

100% of Steem generated by my account will be donated responsibly to a cause which is commuted toward empowerment of impoverished areas, tangible improvements to Human Development and the betterment of all mankind. For each donation, I will generate a full write up of the reasons why I selected a particular organization, stated mission, and what our STEEM has purchased. These write ups will be complete with receipts and pictures when possible.

In my commitment to support the currencies and the blockchain space, all funds will be used to purchase material goods directly, or converted into other currencies (such as ETH) which ensure contract completion and mitigate exposure to fraud.

Very informative post that obviously took a lot of time to put together. I gave you an upvote and I'll retweet as well -- this post deserves more attention.

Thanks Jamesbrown, I hope that you got something out of it. If you have any other questions prior to setting up, let me know.

@lennartbedrage Excellent article! Do you know how useful this is for someone who is contemplating getting a coinbase wallet. This first hand information is par excellance! Thanks

BTW, you must've gotten a kick out of @cheetah's comment about TDV and your article eh! :-)

Hey @absna, I'm glad that you enjoyed the article and hope that it helped you in some way! As per your request, I've begun my analysis on paper wallets and will release soon!

Thanks @lennartbedrage

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://dollarvigilante.com/topic/coinbase-big-banks-big-fees-slow-processing

Yep, Marco Solo is my TDV allias, LOL, but I added quite a bit more to this post.

Anyways, how did a scraper/poster get into the TDV members only Forum?

Very useful article, thank you. Helps me a lot as I am a novice in trading. Cheers!

@lennartbedrage thank you for the informative article. I recently dived in to buying crypto and am extremely worried about crooks hearing all the Mt Gox and other horror stories. Everyone was saying Coinbase was the best so I signed up. I noticed all the things you pointed out. They rip everyone off by overcharging for the coins that adding all those fees to buy and sell. It seems like everyone else is doing the same that I just gave up. Decided not to buy any. Now from what I understand, they own a site called GDAX and you can set the prices you want to pay and by doing so, the transaction is FREE. You only pay the 1.5% to 4% if you take the going price rather than set a price. I haven't tried it do you know if that works? Maybe its just a scam and they will never fill your order if you set the price.

I opened an account trough them and haven't had any problems. My plan for was to buy about 100k$ in crypto then sell it for USD to buy property. I was able to increase the 10k liquitidy limit to 100k without any issue. If I thought I didn't have to give my home address for that than I would agree that they are a pain to deal with and are acting like banks. I haven't bought any crypto with the instant function so I have one balance.

Granted I have yet to cash out so I am unable to speak on that but so far so good.

To lower some of the fees I would learn some basic trading skills and learn how to post a maker order so you pay zero fees.

I would say stick to one exchange for doing your taxes and for things like Blockfolio, take the value they give as am estimate. Any prices needed for calculations, use the same exchange consistently.

I haven't found the need to use the app. Trading via GDAX's mobile compatible site works well enough. Maybe its the instant purchase part for Coinbase your referring to. I'd say stick to doing important transactions on a desktop.

As for the wallet, be fine with loosing it all and if your aren't, you have too many coins in there. Using 2FA is also a must and use Google Authenticator and not Authy which just sends codes to a phone number and not necessarily your device phone or tablet.

I don't think users have access to their private keys because only one person can have custody of those keys, either you or the exchange. While they hold them for you they give you access to their trading platform for a fee. One could go meet someone in person to trade but it would present many problems and risks. Coinbase feels that their service far more valuable than trading with someone in person.