Bitcoin Tumbles Below $50,000 as Fear Sweeps Through Crypto

Bitcoin’s losses accelerated, with prices tumbling below $50,000, as investors started to bail on the market’s frothiest assets.

The cryptocurrency tanked as much 18% on Tuesday and traded around $48,750 as of 10:41 a.m. in New York. While the selloff only puts Bitcoin prices at the lowest in about two weeks, investors are starting to wonder whether it marks the start of a bigger retreat from crypto or simply represents volatility in an unpredictable market.

“Today’s correction for crypto assets is part of a wider sell-off in markets globally, being driven by profit-taking,” said Simon Peters, a crypto-asset analyst at the trading platform eToro. “Investors are closing positions, which will have generated significant gains for many of them.”

Bitcoin has been battered by negative comments this week, with long-time skeptic and now Treasury Secretary Janet Yellen saying at a New York Times conference on Monday that the token is an “extremely inefficient way of conducting transactions.”

Microsoft Corp. co-founder Bill Gates also weighed in. In an interview with Bloomberg Television’s Emily Chang, the billionaire said he’s not a fan of Bitcoin and warned against retail investors being swept up in speculative manias.

“It’s a pure speculative asset,” said Nader Naeimi, head of dynamic markets at AMP Capital Investors in Sydney.

Other markets that have seen massive gains this year sold off sharply on Tuesday. Tesla Inc. sank as much as 13%, Cathie Wood’s flagship $28 billion ARK Innovation ETF dropped as much as 12% at one point. The Bloomberg Galaxy Crypto Index, which spans Bitcoin, Ether and three other digital tokens, declined as much as 21%.

Bitcoin did rise from the lowest levels of the day after crypto exchange Bitfinex settled a probe with New York Attorney General Letitia James over allegations that it hid the loss of commingled client and corporate funds and lied about reserves. Some market participants saying that the agreement, which included $18.5 million in penalties, lifts a cloud over the cryptocurrency market.

“On the grand scale of things, it’s less than a speeding ticket,” said Antoni Trenchev, managing partner and co-founder of Nexo in London, a crypto lenders. “I’m just excited that they will be revealing more numbers so that we can accurately assess and hopefully that will create some comfort for the market participants.”

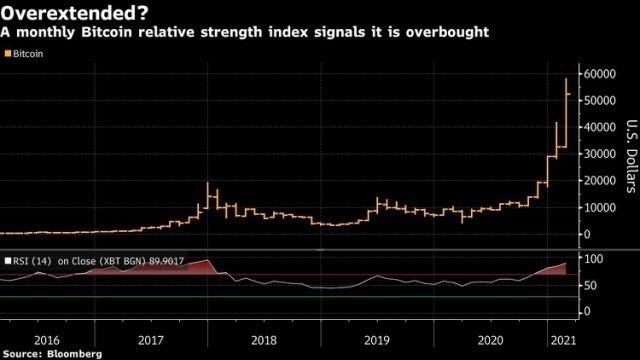

Bitcoin prices have soared more than 50% this year as more investors buy in to the argument that digital currencies can act as a hedge against inflation. A pullback in Bitcoin shouldn’t be surprising “given the current over-leveraged long positions on mainstream coins,” said Annabelle Huang, a partner at Amber Group, a crypto financial-services firm.