Cryptalk - Episode 1: Bitcoin. The Godfather of cryptocurrency.

On the 18th of August 2008, the domain name Bitcoin.org was registered, by one Satoshi Nakamoto, and the rest is history. Bitcoin is a public, de-centralised currency with no third party authority; entirely created as a solution to the 2008 banking crisis, when the banks chose to mend a broken system over building anew.

Click the link at the top of your browser, it will expand and say 'https://steemit.com/...' 'HTTP' This is the command your computer makes when it want's to send a request to bring you a website (in this case, steemit). 'Bitcoin' (capital B) is the command that the Bitcoin Project makes when you want to send a payment of X value of bitcoins (small b).

Bitcoin can be bought through an exchange- Poloniex, Gatehub, btcE- like any other currency. You could be paid in Bitcoin by an employer if the option is made available. Or, it can be MADE.

Like the banks and accountants who keep a ledger of all of everyones payment history, a ledger for every bitcoin payment ever processed is also written and kept, with the assigned sending/receiving wallet numbers. Only this is made public, as intended by Satoshi Nakamoto to keep the status of a decentralised currency. A ledger must always be kept for a currency to work. Thus, we have the blockchain. The blockchain is the ledger where we see all bitcoin transaction, no matter how large or small. If the ledger (blockchain) is decentralised, then who writes it? We do. We have the mining process. Bitcoins are made ('mined') by using any bitcoin mining software programmes. Everyone in the world who uses the software is racing to write the next ledger (block). The person whose computer writes this ledger the fastest wins and is given a 50 bitcoin reward, thus the ledger is maintained and the public are incentivised to keep the ledger going. Once that block is done, we move on to the next block, then the next and the chain continues (the block chain).

The 50 bitcoins are then used by the recipients, and they find their way into circulation. In actual fact, the block chain is written, then your computer is given a mathematical problem which must be solved. The person who writes the ledger AND completes the puzzle the fastest wins.

Back in the day, any home computer was enough to mine. However, with the increase in popularity and value, competition has gotten so fierce that only the most expensive hi-tech equipment will even come close to successfully mining a block (Youtube professional bitcoin mining, or something like that, have a look around). The bitcoin system itself automatically adjusts the difficulty of these problems in order to keep a quota of one blockchain being mined every 10 minutes- essentially 6 blocks per hour. If the blocks are being mined quicker, the math will be come more challenging- and vice versa. Clever isn't it? That's the genius of bitcoin.

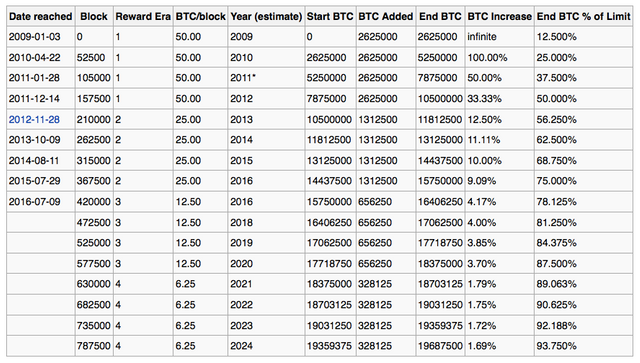

For every 210,000 blocks, the amount of bitcoin given as a reward reduces by 50%. At the time of writing, bitcoin has already surpassed its 420,000th block, and miners now receive 12.5 bitcoin per block mined. Of course, now that bitcoin is pushing $3,000 per coin, nobody's really complaining. There are only 21 Million bitcoins available for mining- it is estimated that these will be in complete circulation by the year 2140. What will happen to the mining process? How will people be incentivised to keep the ledger going? After all, we need a ledger for this to work... simply put, there will be a 0.000001 fee for sending bitcoin. The total amount of bitcoin currently in circulation can be monitored at https://blockchain.info/charts/total-bitcoins [at time of writing this sits at 16.4 million].

How bitcoin will perform in 100 years from now, I can't even being to discuss here. What we can agree on is that in the midst of a corrupt banking system, built for the few at the expense of the many, Bitcoin is a beacon of hope. A light at the end of the tunnel where complete decentralisation, privacy and fair distribution are at its core. With no third party, sending bitcoin is no different than handing your neighbour a £1 coin or dollar bill- theres no third party and the only people who know the ins/outs of the transaction are the sender and recipient. This aspect of privacy is what has brought bitcoin into light, raising demand with an ever-decreasing supply. It is no surprise that price as escalated so quickly.

Bitcoins code has been bugged, tested and open-efforts at hacking the system have been attempted across the nation- even encouraged. Written in C++, the code s exceptional. Written by the online entity 'Satoshi Nakamoto', wether it is one person, a collection of people, a secret do-good branch of government (if even a life-form), the security and functionality of the system is beautifully flawless.

The aim? Total decentralisation. Privacy. Even distribution. Eradicating financial inequality. The possibilities are endless.

I have mentioned this in a previous post, but for a complete, well-rounded knowledge of the ins, outs and history of bitcoin, please look for this book. Bitcoin: The Future of Money. It is an exceptional piece that will open your eyes to the possibilities of cryptography. You will understand how cryptocurrencies are doing to banks what email did to the mail service and internet has done to newspapers.

This post was intended as a simple breakdown of Bitcoin and how it works. You know how to get it, you know how it is maintained. All you have to do is spend it. Amazon take bitcoin, most airlines take bitcoin, and the can be used to buy vouchers to certain stores- a list of which can be found here: http://www.coindesk.com/information/what-can-you-buy-with-bitcoins/

Thank you for following the first episode of CrypTalk, dedicated to the father of crypto currencies. Hopefully this has given you a basic understanding of the bitcoin protocol. Again, please buy the book 'Bitcoin: The Future of Money'. The basis of all my bitcoin knowledge started with that book. Join me in a couple of days where I explore Ripple (XRP), the crypto currently taking over the financial payment system, partnered with the likes of Santander and the Bank of Abu Dhabi!

Speak soon.

Kyle

A very well written article mate, keep up the good work!

Consider bitcoin price which could significant increases in few years, then it suitable as savings for future purposes.

Yeah, who decided to hold bitcoin should have faith in it as the market fluctuations could affect your decision, the best way is saving without looking at the price, and never sell it to get profits but wait until certain time

Congratulations @kylemcquade! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @kylemcquade! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP