The start of trading in bitcoin for the first time on the Chicago Stock Exchange

The first trading of financial products based on the electronic currency of bitcoin began in one of the major exchanges in Chicago, USA, in what was considered a step towards codification of the digital currency.

The Chicago Board of Options Executing (CBO) began trading in the currency of bitcoin in futures contracts at 23:00 on Sunday night (Monday GMT).

The value of the bitcoin at the start of trading $ 15 thousand, but futures contracts in electronic currency fluctuated during the first twenty minutes of trading, and rose to $ 16,600, before retreating later.

"There were about 150 deals made during the first few minutes," said Bob Fitzimons of Waidbush Securities. "Things are quiet."

Expectations for the first listing of the currency of traditional stock exchanges led to a currency appreciation of more than $ 10,000, reaching $ 17,000 last Thursday, before falling further.

Futures are a type of derivative contract that allows trading on the basis of the movements of the currency of a home bitcoin, without the condition of ownership of the currency itself.

The CBO stock market was on Twitter on Sunday, warning that its website "is operating slower than usual and may not be temporarily available" after trading, but all trading systems have worked normally.

The listing of forward contracts in the currency of the company entered into the stock exchange after the approval of the US Commodity Futures Trading Commission.

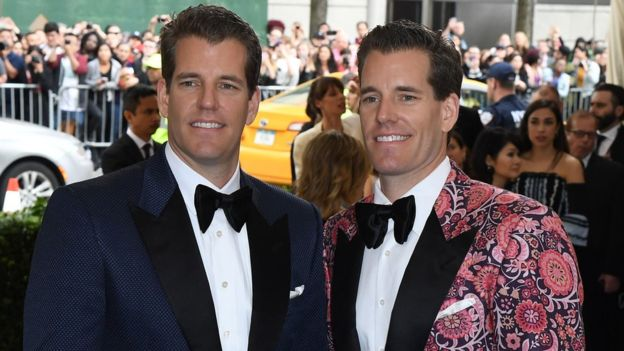

Cameron and Tyler Winklefus are among the first investors in the currency of the bitcoin

But the committee warned investors, "of a high degree of vulnerability and potential danger, in the circulation of those contracts."

Critics have criticized allowing the circulation of financial assets in the currency of the bitcoin traditional stock exchanges, including Jim Cramer, economic commentator of CNBC.

Kramer believes that this opens the door for "short sellers" betting on the move of financial asset downward.

The bitcoin is not regulated by any central bank of any country, and has no internationally recognized exchange rate.

CBE said it would suspend trading for two minutes if the price of a homeowner went up or fell by 10 percent to prevent sharp fluctuations.

"We are committed to continuing to work closely with the Commodity Futures Commission to monitor trading and promote transparent and fair market growth in the bitcoin currency."

The Association of Futures Industry, which includes some of the largest brokerage firms in the derivatives sector, criticized the decision by the US Commodity and Futures Commission, saying it did not pay enough attention to the risks involved in the move.

If you liked this post - please Resteem it and share good content with others!