Who really owns bitcoin now?

On the final day in his insurance job last week after 14 years in the sector, Donnie wore a T-shirt emblazoned with a rocket logo, the symbol for bitcoin, and the slogan “to the moon”.

The phrase, one that characterises the fervour espoused by bitcoin enthusiasts who say its price knows no bounds, was fitting.

Over five years, the 39-year-old has made enough money from trading digital currencies to pay off his mortgage, buy a Mercedes, and now swap office life for managing his remaining crypto investments full-time.

“It was very euphoric . . . It’s been life-changing for me at this point,” says the California-based father of two, who has a cult-like Twitter following under the pen name bitcoin Dad.

Donnie is just one member of a clubby community of early investors in bitcoin who have been able to reap the benefits of its dramatic bull run, cashing out some holdings as its value more than doubled in the space of a month to peak at around $20,000 in mid-December.

He will not reveal his exact returns because his new-found wealth has already left him the victim of hacking and extortion — part and parcel of the freewheeling digital currency marketplace.

Six months after its peak, bitcoin remains the most popular cryptocurrency, though its price has sunk to about $7,500 at the time of publication. It follows that for each of the bitcoin millionaires, there have been numerous casualties; the “get rich quick” punters who entered the market a little too late.

“These are people that see something moving up and start buying — they jump on the bandwagon,” says Campbell Harvey, a finance professor at Duke University and an investment strategy adviser for Man Group.

“Initially in the crypto space, you had people who really understood the technology. Then there was a typical bandwagon investor situation and you know how it ends — and it did.”

But how many have gained — and lost — from the bitcoin bubble? Exclusive data from blockchain research company Chainalysis seen by the FT provides some tantalising answers.

Please use the sharing tools found via the email icon at the top of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email [email protected] to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found at https://www.ft.com/tour.

https://www.ft.com/content/29259448-69b3-11e8-b6eb-4acfcfb08c11

Coin exchange

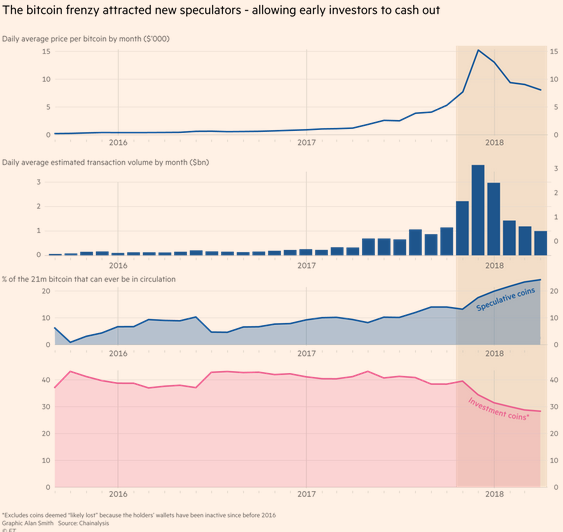

The Chainanlysis data quantifies this distinct shift in the make-up of bitcoin owners from longer-term investors — those who held the asset for more than a year — to short-term investors who have traded more recently, by analysing how regularly coins have changed hands.

Last November — before December’s pricing peak — the amount of bitcoin held for investment was roughly three times that held by traders.

However, by April 2018, the data show the amount held by investors — about 6m bitcoin — was much closer to the amount held by short-term speculators, with 5.1m bitcoin.

Indeed, Chainalysis estimates that longer-term holders sold at least $30bn worth of bitcoin to new speculators over the December to April period, with half of this movement taking place in December alone.

“This was an exceptional transfer of wealth,” says Philip Gradwell, Chainalysis’ chief economist, who dubs the past six months as bitcoin’s “liquidity event”.

Mr Gradwell argues that this sudden injection of liquidity — the amount of bitcoin available for trading rose by close to 60 per cent over that period — has been a “fundamental driver” behind the recent price decline. At the same time, bitcoin trading volumes have now fallen in tandem with the prices, from close to $4bn daily in December to $1bn today.

So will the price of bitcoin ever surpass December’s peak? Part of the answer lies in who holds bitcoin now that the hype has died down.

Born in 2009 in the wake of the financial crisis, bitcoin is rooted in a libertarian quest for a means of exchange that is unshackled from the central banking system. Proponents — among them, computer experts and political activists — heralded the arrival of an alternative monetary system that could replace fiat currency.

But despite the recent crypto boom, there are few signs that this is happening. According to research published this month by Morgan Stanley, only four of the top 500 US e-commerce merchants accepted cryptocurrencies in the first quarter of 2018, compared with three at the beginning of 2017.

Chainalysis notes that the “vast majority” of transactions it analysed showed bitcoin being received from exchanges and rarely sent to merchant services to pay for goods or services.

Only a finite number of coin — 21m — can be created. Of this, about 4m are yet to be mined. Just as physical coins can be lost down the back of a sofa, so can bitcoins if users lose or forget the passwords needed to access their online wallets. The Chainalysis data separates out coins it deems to be lost or unused for years — which total 3.7m bitcoin, worth about $28bn.

The proportion of bitcoin it estimates to be held by groups such as exchanges or merchant services held steady between December and April at about 2.2m bitcoin.

Critics argue that bitcoin’s volatility and a lack of fundamental underpinnings disqualifies it as a reliable store of value, and that this is unlikely to change. This leaves droves of new opportunists dabbling in what has been dubbed a “Wild West” marketplace, with regulators still weighing up how best to tackle the space.

“Speculation remains the primary use case for these digital assets; merchant or institutional adoption does not appear to be a primary driver of price,” says Preston Byrne, an English structured finance lawyer and cryptocurrency observer.

Given this breakdown in bitcoin owners, most market watchers do not rule out another rapid price run-up. However, they say this would likely be the random movement of pure speculation or market manipulation rather than anything else.

“It’s very important to stress, this is not in any sense a rational market,” says David Gerard, the author of Attack of the 50 Foot Blockchain.

“It’s very thinly traded, very badly structured . . . and it’s stupendously manipulated,” he adds. “Anyone who goes in not realising just how manipulated the crypto markets are will get skinned.”

Some argue there is an art to trading bitcoin regardless — but it is a stressful business that takes nerves and can be addictive. Donnie, a.k.a bitcoin Dad, puts his successes down to careful research, “patience” and avoiding the trap of obsessive, leveraged day trading.

But others are unconvinced that bitcoin millionaires actually show investment nous, drawing parallels with gambling.

“It’s the luck of the draw, where everyone who won the draw seems to feel like they deserved it for being smarter,” Vitalik Buterin, the Russian-Canadian programmer who invented the smart-contract blockchain Ethereum, told the Financial Times recently.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.ft.com/content/29259448-69b3-11e8-b6eb-4acfcfb08c11