A Review of a Few Fundamental Metrices that Drive Bitcoin Value and What They Currently Indicate

This article takes a look at some of the fundamental metrices of bitcoin in terms its actual and potential use cases. These metrices also drive user sentiment and ultimately its market price. (Pls read till the last metric which still indicates a lack of growth currently.)

Transaction Fees

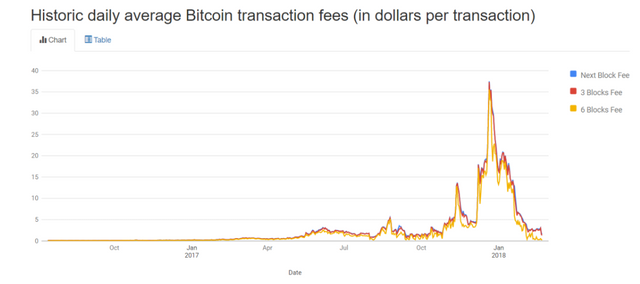

Low transaction fees was one of the early promises of bitcoins. The possibility of lower transaction costs was mentioned twice in the first paragraph of the Bitcoin whitepaper. Recently, transaction fees have become so high that it is no longer feasible to initiate transactions smaller than $20 in most cases. The chart below shows how the transaction fees has evolved over the past year.

Source: bitcoinfees.info. The lines represent the fees for a next block (10 minutes), 3 block (30 minutes), or 6 blocks (60 minutes) wait.

At it’s peak on 12/20/2017, the fees were up to $37, much higher than fees of many fiat based systems. At the time, many merchants began announcing plans to discontinue accepting bitcoin payments. It was a matter of time before this fundamental metric showed up in the sentiment of users, and ultimately its value. Those high fees likely helped precipitate the current correction. The next block fee is now down to about $0.75.

Fundamental Sign: Good.

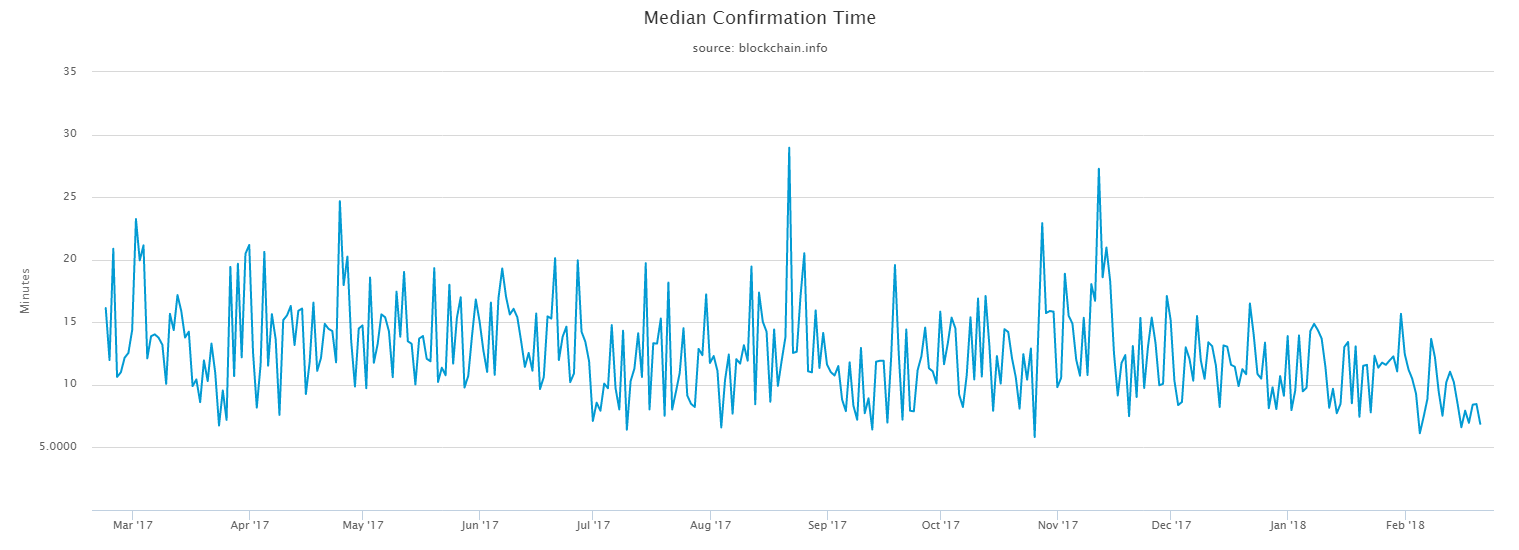

Number of Unconfirmed Transactions and Median Confirmation Time

This is a measure of how long it takes for a transaction to get added to the blockchain, and can be accessed here. At its recent peak around January 2018, the number was around 400,000. This meant transactions were taken longer and longer, sometimes days to process, and users were having to pay more to get miners to include their transactions faster. The metric actually drives up the transaction cost when it goes up so is a more fundamental metric than the transaction fee metric. The number is currently down to about 3,000. This portends well for sentiment to slowly turn around as many users were becoming frustrated at this innovative new platform became more expensive than old methods of sending money and sometimes even slower. This metric was also indicators that would cause a correction even as the market price was doubling over the prior two months. The median confirmation time for transactions is shown below.

Source: bitcoin.info

Fundamental Sign: Good.

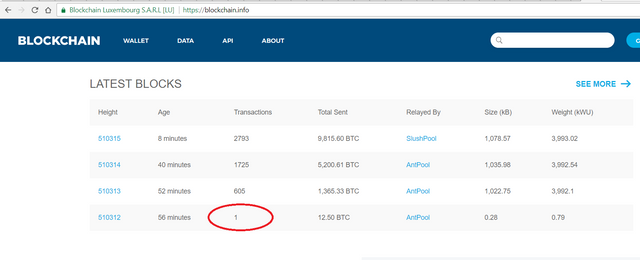

Transactions Per Block

The normal 1 MB block bitcoin could usually contain about 2,000 transactions essentially putting bitcoin throughput rate at about 6 transactions per seconds. But that would be if the blocks are mined are packed, which should be the case when there is a backlog of unconfirmed transactions. Segwit was supposed to increase this to nearly double essentially scaling bitcoins. And the incentive to miners to pack the blocks with transactions is the fee. But we continue to see even smaller blocks. And even an empty block thrown in (here on 2/21/2018):

Source: Link

to the actual block detail here on bitcoin.info

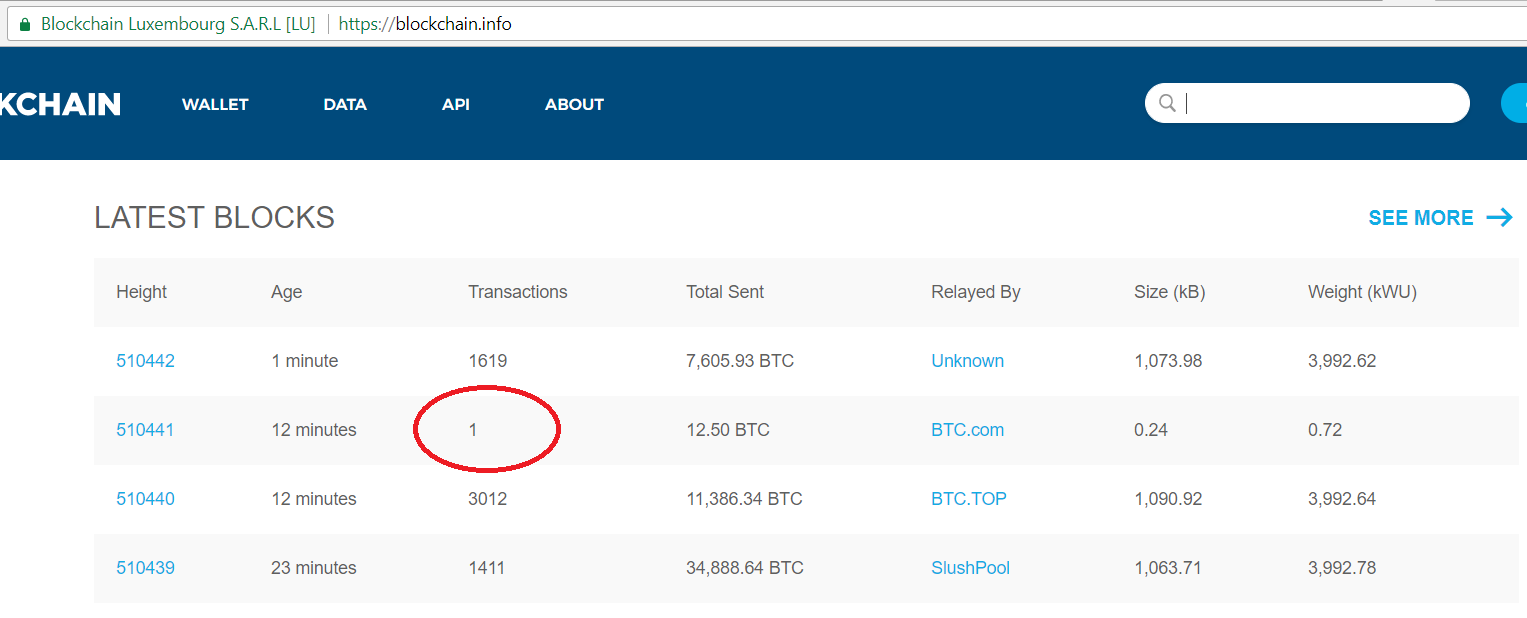

And here again on Feb 22 2018:

Source: Link

to the actual block detail here on bitcoin.info

What you see above is basically a miner making $120,000 for processing absolutely zero transactions. Mining of blocks with fewer and fewer transactions may be a result of the dwindling adoption rate or miners simply cashing in when the algorithm allows (although why even attempt to compute the nonce for an empty block.) However, it does create a slightly more inflationary pressure on the asset when there is that kind of supply for pretty much no value created. (Let’s recall that the days Satoshi was mining empty blocks and accumulating bitcoins virtually free back in 2010 the price was also close to 0, so fewer transactions per minted bitcoins is will tend to be inflationary.)

Fundamental Sign: Number of Transactions per Block Still Low.

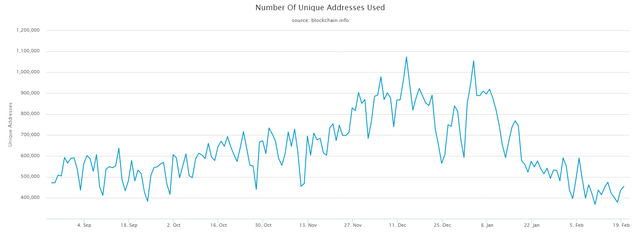

Daily Adoption Rate

The daily new unique addresses (DUA) on the blockchain points to the adoption rate of bitcoins more than any other published metric on the blockchain. (And the blockchain is a mathematical modeler’s dream because it provides more fundamental information on a real time basis than almost any other financial system hitherto available; most of which are quite opaque.)

The popular elasticity curve and equations used by economist to model demand and supply is developed for a system in equilibrium, and is not suited to rapidly growing systems that have not yet reached an equilibrium state, such as the bitcoin network. So other approaches were explored in the paper “Digital blockchain networks appear to be following Metcalfe’s Law”.

In a growing network with constant supply rate, the demand can be shown to be positively correlated to the rate at which new users are being added to the network. The faster new users are joining the network, the faster the value will slowly rise. And the more people join the network, the more they share and introduce the network to their social circles, which then leads to new adoption. And the more people join the network, the more other people they have to use and exchange the network’s resources with, making the network more useful and valuable. This is referred to as the network effect. It turns out in that paper that using approaches based on network effect theory on the daily unique addresses was found to model the price of bitcoins fairly well over the prior 8 years of data available at the time.

The DUA is shown below over the past 6 months. The rate is currently back to levels last seen in August 2017 when the price was around $3,500, and that metric continues to indicate there will be difficulty maintaining a recovery of bitcoin market value long term unless this metric begins to grow again. The Metcalfe model at such low DUA places the value closer to that value than where it has currently “recovered” back up to.

Source: bitcoin.info

Fundamental Sign: This metric has not yet recovered back to growth.

References:

- Satoshi Nakamoto, 2009. Bitcoin: A Peer-to-Peer Electronic Cash System. https://bitcoin.org/bitcoin.pdf.

- Digital blockchain networks appear to be following Metcalfe’s Law. https://www.sciencedirect.com/science/article/pii/S1567422317300480.

Legal Disclaimer: I am not a financial adviser and this is not financial advice. The information provided in this post and any other posts that I make and any accompanying material is for informational and educational purposes only.

It should not be considered financial or investment advice at all. You should consult with a financial or investment professional to determine what may be best for your individual needs.

This is only opinion. It is not advice nor recommendation to either buy or sell anything! It's only meant for use as informative, educational, or entertainment purposes.

It takes time to build stability, I find it amusing when people complain about the volitility in this market. Like really what do they expect from a brand new revolutionary tech and market

Great article. Let's hope Segwit finds its footing and we see some lower fees and faster transactions.

Very nice overview of interesting factors. I disagree however that the current low transaction fees and the smaller pool of unconfirmed tranasactions are a good sign. The fees shooting up in december created a big red flashing warning light that needs to be addressed. I don't think segwit will solve these problems, because if more people want to get into bitcoin and the network cannot accomodate that, it will fail again at some point. It's a fundamental flaw of how the btc system is maintained.

I checked out the lightning network proposals too and I dislike it completely, because it looks exactly the same as the current banking system. It concentrates power, and with that it creates options for abuse. If the lightning network is indeed implemented it will turn btc into a hybrid. I see no advantage of doing that.

In my view all these things are setting btc up for failure in the not so distant future. That makes me too uncertain about the future price of btc to invest in it.

I mostly agree with you. Overall all those signs taken together are not good currently. The unconfirmed transactions is going down partly because the rate of user growth was declining. Check my other articles where I indicated that there are indeed fundamental issues that persists. I did not intend this article to express an overall rosy outlook yet just was defining and explaining each metric on its own. The last paragraph is more indicative of the overall outlook as seen in the article.

I think segwit will improve things as far as the use goes and the price of Bitcoin will continue to grow. But I certainly do agree that it is a limited fix and we will run into this issue again in the future unless a better solution is found. However, I do not see this as the "failure" of Bitcoin but rather a substantial limiting of it's maximum potential. Crypto is so strange as it is so extreme. If Bitcoin stabilizes at around $50K in four years is that a failure? I guess it is if your goal is 500K in that time frame. However it is a far cry from 5K which I would be shocked to see four years from now.

That being said, I see the market share of Bitcoin going down surely and steadily. Name recognition only will take you so far. As the market matures, so will the people investing in it. The key is to diversify in good projects. I think the Bitcoin maximalists are going to be very disappointed.

Thanks for your very thoughtful reply! I think segwit is a bandaid. It covers the wound, but doesn't stop the bleeding, although it slowed it down a bit. Quite a few devs saw that too, and that's why bitcoin has forked a few times.

I think we'll see btc go down this year, not up. More people will get frustrated by the self imposed limitations. Other coins will pick up from that. I agree with your observations.

You bring up a big issue for me, which is the forks. The forks make "Bitcoin" inflationary as opposed to deflationary. While I think the mainstream media usually gets things wrong, this is something they have pointed our that I agree with.

Also for many people crypto' s are a leap of faith. It does not instill confidence when there is basically a civil war going on in the crypto world. When Roger Ver and a few Asian exchanges and miners tried to make Bitcoin Cash the "real Bitcoin" I knew it was the beginning of the end. If Bitcoin Cash does achieve a higher market cap than BTC then it will not be the real Bitcoin, it will simply make all crypto's "alt coins" including BTC. While that may be a good thing in the long run, it will lead to a big delay in mainstream adoption of crypto's.

My fear is the last thing we need is for governments and the big banks to be given more time to coordinate their attack against crypto's.

I'm not too worried about forks or the huge amount of ICOs we're seeing. To me it's part of the development and adoption process. Although many people seem to be motivated by greed (getting rich fast without doing much for it), in the end things will start to stabilize. That might take some years, who knows.

I think it shows the options cryptos give us, that just needs to sort itself out. Good ideas and good dev teams will survive and bad ones will fall the the sides. Only after that will the real adoption process begin.

Banks and governments already realized that they cannot stop the process. When it was just a few coins, like btc and ltc, they could have tried, but with so many alternatives popping up everywhere it simply means that if they attack one, people can move to another and then another coin.

Governments and banks may want to start their own cryptos, but since they're centralized institutions, they can never really bring the strength of something decentralized like proof of work blockchain...

We live in interesting times, let's see where this (organic) process goes...

Interesting times indeed. I have no fear that blockchain will go on. It will thrive. I too have no problem with the ICO's or forks in general. I have a big problem with Bitcoin forks. To the mainstream Bitcoin IS crypto. We need the mainstream to have confidence in Bitcoin. It is "supposed" to be the rock of crypto. The "safe bet". The coin they can only make 21 million of.

There is no patent on blockchain per se. So what really gives Bitcoin value is the belief in it. It has great value because we believe it does. Those outside the crypto world need to see that confidence and conviction of those inside it.

The civil war in Bitcoin leads to skepticism not just about Bitcoin but crypto currencies in general.

The one thing we need ASAP is for there to be exchanges where you can buy many alt coins with fiat. I hope Bittrex will replace Tether with USD and make it available for all trading pairs. The sooner Alts can operate independently of BTC the better.

Good chatting with you.

Yup, I see your point. Great chat indeed, following you now :-)

Same. It's been quite informative following this thread.

Being that coin is still in its infancy, it going to take time to balance out. The

system whole system will gravitate to a way that is more stable. It will balance itself out .

it's a great news for bitcoin lover actually for small transaction user. thanks for share with us.

Our ongoing research reveals four factors that produce an effect the price of Bitcoin. These append media hype and uptake by peers, embassy uncertainty and risk (such as the election Donald Trump or the vote for Brexit), moves by governments and regulators, and the governance of Bitcoin itself.

Agreed. However, some of those like media hype tends to have a shorter wavelength so that when you go for long term effects and average out those shorter wave lengths, some of those might have a sustained but more constant effect. Still I'd be very interested to see what those look like.

it is likely the last factor that has driven the latest slip in the price, as a proposed Bitcoin split (or fork) fruitless to profit acknowledge from developers towards the subside of last week. The split would have doubled the number of coins in circulation (as previous splits have) and increased transaction quickness

Very nice analysis. Thanks for doing the research and sharing it with us. Are you planning to give updates? Maybe also do this for ethereum?

Great post,the fees are now low,i moved sum btc yesterday for 20 cents!!!much better than 20 dollars!!!

Yes that metric does directly feed into the sentiment on bitcoins. And yes 20c is way cheaper than using bank wire or Western Union or most alternatives in fiat. People know what technology works for them by the results they see and that's why bitcoins had value in the first place, even while some in the mainstream missed it and declared its value baseless. But yes it still also does have some issues its working through.

So true

Awesome, Nice work

Yes especially with encouragement and expressed interest such as this. The referenced paper did have

some analysis of data from Ethereum and Dash but that was really old data and definitely needs to be updated.

Cool and you’re welcome :)

I’m really looking forward to the day that one of the other big crypto coins can separate its path from bitcoin. Would be good for the maturity in the market

IMHO, bitcoin will still be the main cryptocurrency of the future but the transactions will be done using other low-fees cryptos such as ETH, XRP or XLM. Meaning, in a distant future, transactions between BTC wallets will be handled by robots, acting as a "bank", while small HODL-ers will be doing transaction using other currencies. This insinuates that decentralization of BTC will mostly be federated among the whales.

Very interesting take. This is indeed one possible path this could all go. Although I'd want to still know what basis would keep BTC the main cryptocurrency if doesn't have the utility (or maybe that part was just not expressed). Is it that people would just kind of agree to keep it the main cryptographically enabled digital currency just for the sake it was the first?

In tech that almost never happens. Didnt fot netcape, aol, myspace, etc. Utility always seems to win in the end in tech.

I am not as knowledgable as you, my friend, but with every country starts regulating bitcoin (and probably ban some other, unsafe, cryptocurrencies), bitcoin and some other cryptos will reach a status as hard currencies. Thus, willing or not, the other cryptos will be pegged to bitcoin (like many countries are now pegged to USD).

I foresee some sort of a "United Nations of Bitcoin" or "International Monetary Fund of Bitcoin" or "World Bank of Bitcoin" --international bodies to regulate bitcoin ownership and distribution, which is politically enforced for national security issues. So, yeah, that could be the only utility that bitcoin have in the future. This is way beyond Satoshi's original idea of the blockchain --a decentralized bank and empowered citizen-- but governments still have the rule, otherwise there will be chaos.

god bless you..

How could I not upvote that when you come expressing blessings?

hi friends steemians, I am newcomer from Nanggroe aceh darussalam NAD is the most western tip of indonesia, best regards and compact greeting always .. thank you

Welcome to Steem.

Thanks