Bitcoin Dominance Hits 3 Month Highs

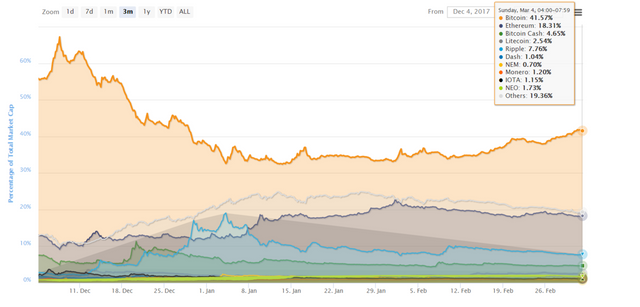

The market cap of Bitcoin measured against the total cryptocurrency market cap hit 3 month highs this weekend.

Bitcoin dominance is currently sitting at around 42%, which is a year-to-date high.

It's also the highest it has been in the last 3 months:

(Source: https://coinmarketcap.com/charts/#dominance-percentage)

What is going on?

Likely there is some reversion to the mean trading going on.

What I mean by that is that over the last 6 months or so, altcoins have enjoined a strong bull market.

The strongest compared to bitcoin in some time, if not ever.

In the past, bitcoin had almost always enjoyed over a 50% share of the entire cryptocurrency market, at times even reaching over 80%.

Within the last few months it hit an all time low of around 31%.

We are likely seeing some snap-back from that decline.

Other possibilities?

Part of the reason it's share is going back up could also be due to the fact that fees are coming down and transaction times are also going down.

Which were two of the big reasons that bitcoin adoption hid a rather large speed bump late last year.

Segwit adoption is helping with this as well as order batching being implemented by some of the largest exchanges.

Bitcoin also has a major catalyst that is set to come out at some point this year that could be the real game changer for it and possibly the altcoin market as well.

The Lightning Network is likely going to be implemented this year and it will likely make transactions much cheaper and happen much faster than they are currently.

Which would likely spell major trouble for many of the altcoins out there that are being touted as payment coins as they would no longer do anything better than bitcoin.

(Source: https://news.bitcoin.com/lightning-network-alpha-release/)

My thoughts:

Overall, I think we are mostly seeing a reversion to the mean trade for bitcoin. A situation where bitcoin perhaps got a little too low in terms of its market cap dominance and is now taking some of that back.

I would say that it also looks something akin to sector rotation in the stock market. Good news is expected for bitcoin over the coming months, so investors are locking in gains in altcoins and moving back to bitcoin.

My thoughts are that bitcoin will likely hover around that 50% dominance mark until either the Lightning Network gets fully implemented (at which point I think it goes up) or some other coin/coins start to really catch on in terms of utility (at which point I think the dominance percentage goes down).

Stay informed my friends.

Follow me: @jrcornel

That's a good way of explaining the pattern. When bitcoin overheats, speculative money starts flowing into alts, and vise-versa.

Exactly. When new money starts coming in, they also tend to try to buy "the next bitcoin" thinking they may have already missed the boat.

Thanks for sharing!

The dominance factor is an interesting one for sure. I like your comparison to stock market sector rotation. That makes sense to me. Bitcoin is being seen as a safer bet that’s more likely to get gains in the near term. Once some good profits have been made and the ratio is 60% or higher, then we may see some investment start to flow back into the alts. I would like to see Bitcoin over $30k with the alts lagging, then I’d like to see the alts catch fire at the Bitcoin $30k mark. May be wishful thinking, but the opportunity is there. Thanks for the post!

It's great that the fundamentals of bitcoin are improving (lightning network and lower transaction fees). Bitcoin at $11K is pricey and even if it hits $40k you are only making about a 4x return. Altcoins have better returns and it is good to diversify. I agree bitcoin may return to its mean of 50%, but other altcoins could still outperform. Hold a basket of cryptos to minimize risk and maximize return!

Some of the altcoins are dying.

As they should. Let's start flushing crap down the sewer sooner versus later.

Yeah it doesn't seem like we should need over 1,000 coins. I'd guess we probably only need about 100 maybe even less. I also think consolidation will be very good.

Not sure we even need 100. In the end I'd be surprised if the form of the industry wasn't three big blockchains have 90% market share

And a bunch of little niche players end up with 10% share between 40 niche players

I think steemit will be getting smart media tokens. I think those might be similar to alt coins. We'll probably have at least a dozen of those on here eventually but yeah the top 3 or 10 tokens should have a huge portion of the market share.

I love how you say 40k is "only" a 4x return. We can't expect to see the sort of returns last year keep going forever. 4x return in a year would be phenomenal. People need to re-calibrate their expectations.

Agreed. I'll take 4X any day. All day long.

Return on US stocks since the crash of 2008 is less than 3X. After 10 years.

People need to recalibrate how amazing a 4X return is.

Solid analysis. There will always be swings from bitcoin to altcoin and vice versa. Diversification is key as you said!

Diversification is key since no one really knows who long term winners will be

hey there

click on my link to earn 2000 per month free

https://steemit.com/money/@wolf92/easy-job-from-home-earn-at-least-2000-dollers-per-month

vote and tell me if you like it

Good news :D

yeah man btc increasing but other currencies like steem ltc not incresing

Nice commentary. Not sure it goes up to 50% before Lightning Network gets implemented.

I agree it is rotation from alt coins in BTC.

So now is a good time to stock up on alt-coins, to take advantage when the counter-rotation swings the other way.

I am also thinking that over the past month Bitcoin seems to have found some stability and hasn't had too much volatility. Many Altcoins are still bouncing all over the place and possibly investors are getting tired of the never ending rollercoaster. I know that Bitcoin seems to be a safer place to keep money right now and Altcoins are a place for quick in and out investments or very long term holds. I know I'm waiting for a little more stabilit before I get into more Altcoins. I would have chosen Ethereum or Litecoin but with the higher speeds and lower fees Bitcoin is becoming more enticing.

To be honest I am scratching my head trying to figure out what purpose Litecoin will have if Bitcoin becomes both faster and cheaper than it?

Agreed. 6 months ago I would be getting all in on litecoin and it was looking like Bitcoin was just going to be the token Grand Daddy of Crypto but they have totally pulled up their socks and made a strong statement to the entire market.

Yeah Bitcoin is pretty much as fast as Litecoin now. Many exchanges only need 2 confirmations for Bitcoin compared to 6 confirmations with Litecoin. Litecoin is still cheaper though (mainly because it is worth less).

Sounds like you would need to stay as a long term trader. If you are looking for stable investment maybe, investing in Cryptos is not for your risk tolerance...imo

yes the last 3 months bitcoin soared, but the results will return if some trading people hold it.

thank you very interesting post about bitcoin discussion, whether bitcoin will be top most people waiting for the highest bitcoin peak I agree with your estimation, but we are ready to wait