Three reasons gold will climb to $1,500 this year

Gold prices could jump to $1,500 an ounce this year, a level they haven’t seen since 2013, according to Frank Holmes, chief executive officer of U.S. Global Investors.

That would mark a roughly 11% rise from the current price, as April gold futures GCJ8, -1.46% traded under $1,345 on Tuesday.

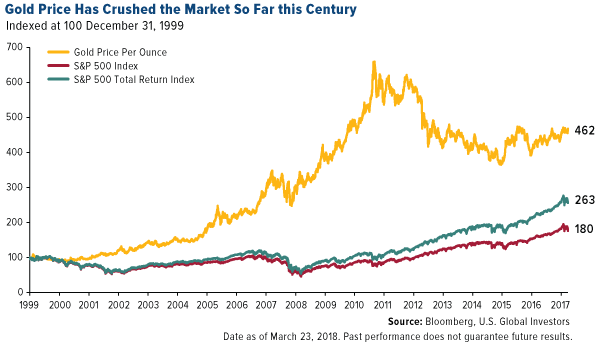

Despite pressure from the rally in global stocks and massive cryptocurrency speculation, gold futures have edged up by nearly 3% year to date, outpacing a 2.4% gain in the S&P 500 index SPX, -0.12% according to Holmes, a well-known gold bull.

He cites three key reasons for his forecast climb for the precious metal, the first of which is tied to inflation expectations.

“Inflation could be growing a lot faster than what the government is telling us,” he told MarketWatch in an interview this week.

The Federal Reserve’s preferred gauge, the consumer-price index, rose 2.1% year on year in December and the NY Fed’s recently launched Underlying Inflation Gauge, rose nearly 3% that month, while the alternate CPI estimate, which uses the official methodology before it was revised in 1990, shows inflation closer to 10%, he said.

“No matter which gauge you look at ... inflation is trending up,” said Holmes. Gold is traditionally seen as a hedge against inflation.

Holmes also pointed out that a weaker dollar policy will “always benefit commodities and emerging markets.”

Year to date, the ICE U.S. Dollar Index DXY, +0.86%

Homes believes that President Donald Trump’s actions as president, overall, have been bullish for gold, particularly as they’ve contributed to a decline in the buck.

“Americans like to hear that the dollar is strong, but a weak dollar makes American exports and tourism rock, not to mention gold prices go up,” he said.

In early 2017, Trump told The Wall Street Journal that the U.S. currency was “too strong,” and in January of this year, Treasury Secretary Steven Mnuchin appeared to back a weaker dollar, pointing out that it would be good for the U.S. as it relates to trade and opportunities.

Still, “one of the obvious headlines that has the potential to be negative for gold is the tariff wars,” said Holmes. “This could result in a strong dollar, which would be bad for gold.” Gold and the dollar often move inversely as a richer dollar dulls the appeal of investors using other currencies.

Meanwhile, rising gross domestic product figures in China and India, continue to help with what Holmes characterizes as the “Love Trade.” That refers to the coveted yellow metal’s popularity as a gift in the form of jewelry, particularly from the beginning of the Indian wedding season in September until Chinese New Year in February.

Gold prices may even eventually climb to new highs at $1,900 an ounce, Holmes said. “If we see inflation ramp up, then ... we could see gold move to new heights.” Gold futures reached a record settlement at $1,891.90 on Aug. 22, 2011.

And “major lawsuits against the big banks could have a profound impact,” he said. If massive dumping of gold and market manipulation, which has happened during Chinese New Year when people are away from the trading desks, are “outlawed,” then gold could rise to $1,900.

Holmes also said there’s a company that he believes “will disrupt the North American gold jewelry industry” and potentially contribute to a rise to new highs for gold.

Menē sells what it refers to as “24 karat investment jewelry,” designed by Pablo Picasso’s granddaughter Diana Widmaier Picasso. It prices jewelry according to the value of the metal without a big margin for design.

“This could change the way westerners view precious metals ownership,” Holmes said.

He doesn’t rule out a possible run lower for gold, however.

“A strong dollar could cause gold prices to dip,” he said. “Interest rates that trigger a global recession, where governments don’t come in too big to fail and print lots of money,” and the finance ministers, “who are consumed with synchronized taxation and regulation and unlimited printing of money could also hinder the price of gold.”

https://www.instagram.com/thedogeofwallstreet/