What Is Bitcoin, How To Invest everything about crypto!!

Saying that bitcoins are the future of money may be a bit of an exaggeration. Sure, a decentralized, market-driven approach to currency sounds very good on paper. It even has certain practical applications. But no centralized regulation also makes the currency highly volatile, making it impossible for it to take shape as a stabilized means of investment and savings. However, the lack of mainstream acceptance does in no way discredit the public hype behind bitcoins. As more and more people subscribe to this currency by the thousands, the price of a single bitcoin has skyrocketed from $0.06 in 2009 to a whopping $16,448 in 2017. What’s more, this unique digital currency is only scheduled to grow with time, so here are a few reasons why you should and shouldn't invest at least a few hundred dollars in bitcoin this holiday season.

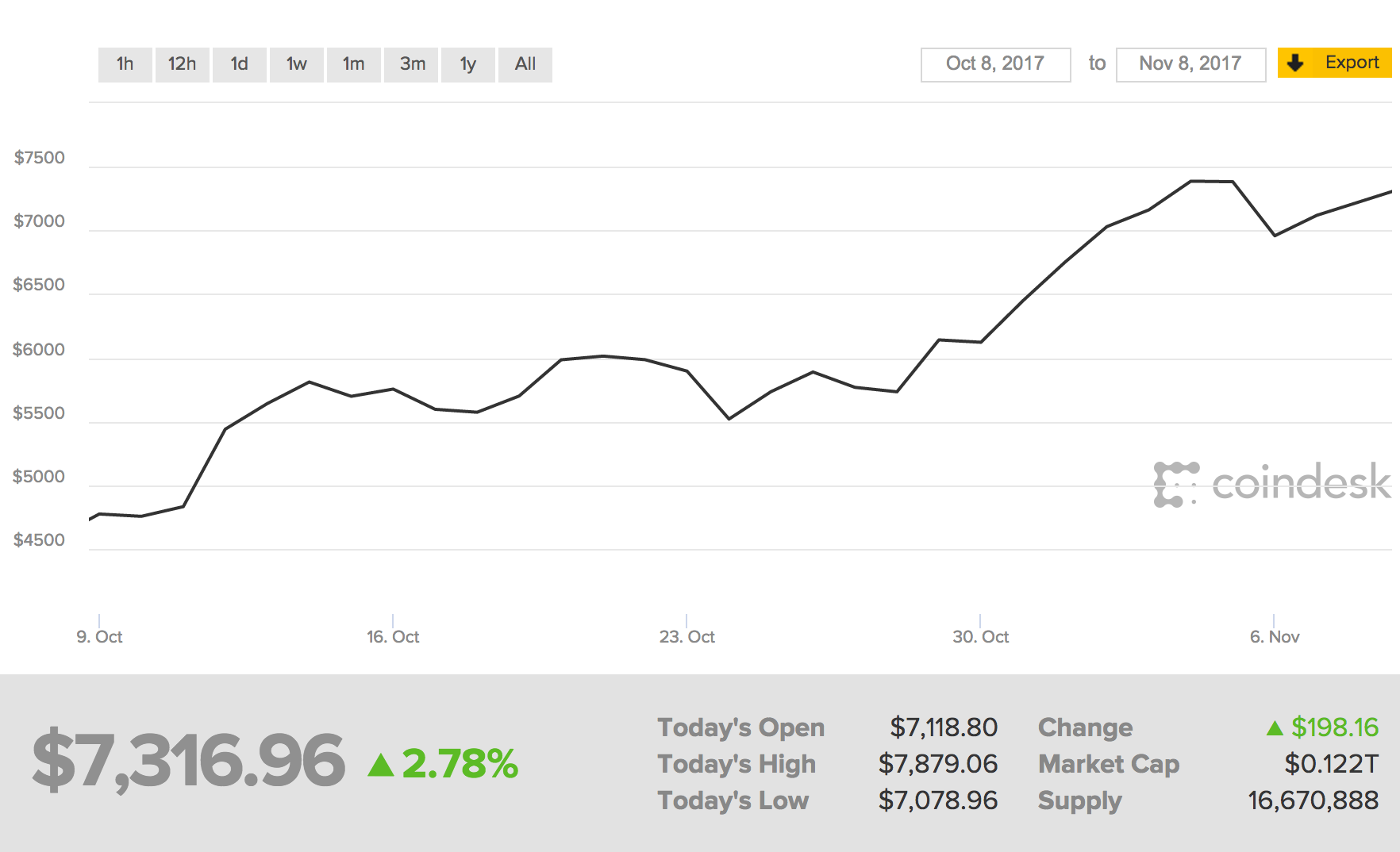

First, let’s talk about why you should not invest in bitcoin. Despite being on a generally upward curve for the past several years, there’s no telling when the cryptocurrency could suffer a sudden downfall in price, causing millions of people across the world to lose by the billions. Historically, bitcoin has always experienced a rapid rise in value before entering a long phase where it falls in value very slowly until it reaches market stability. Right now, the currency has just recovered from a period of freefall and is slowly beginning to make its way upward again, with periodic ups and downs. While it might be a good idea to get it while it costs less, the price could very well drop further before it sees a steady rise once again. The lack of a centralized financial or political authority may have its uses, but it is also what causes bitcoin to be crazily untrustworthy as a means of accumulating wealth.

“It’s a revolutionary new technology that is already changing the way that money is perceived and used. For all of the reasons stated above, it’s important that you understand that this is a seismic shift that is poised to completely change everything… not just payments and remittances, but the entire concept of “money” as we know it. So while many people, myself included, are making considerable gains on their cryptocurrency portfolio’s — that’s not the point.” - Jonathan Levi, Bitcoin Arcade

The first thing you need to understand, there’s no living on bitcoin. You can’t literally have all or most of your wealth converted to bitcoins and use it to live off the rest of your days until retirement. Many of my colleagues who have tried living off bitcoin for even a week have come back to tell me that it’s extremely risky and mostly unrewarding. The best way to use bitcoin, therefore, is to invest and trade, The constant rise and fall in price makes bitcoin the perfect mode of investment, albeit a very risky one. People who have purchased and sold bitcoins at strategic times have reported as high as an eight hundred percent return on investment. Bitcoin is also based upon the highly secure blockchain network, where, in the absence of shady middlemen, every transaction is recorded on a public ledger, making it a perfect way to carry out money transfers and exchanges across borders. Several online sellers have now started accepting bitcoins in exchange for products purchased, making it an exceptionally secure means of carrying out online transactions.

The primary selling point of bitcoin has always been the amount of security it offers, although most people who purchase into this currency do so mainly to receive unusually high returns on their investments. Trading in bitcoins has become a lucrative business in itself, over the years. As a result, a number of organizations, big and small, have chosen to plant stakes in this industry and offer services surrounding the exchange and trade of bitcoins. Platforms like Coinbase and Kraken have always served as the most trusted means to buy, sell and trade in bitcoin online. However, with the advent of new technology, faster and more convenient platforms that offer a decentralized, peer-to-peer network to carry out bitcoin exchanges, have quietly grown in popularity. Cointal is one such platform. It offers free insurance, quicker transactions, minimal fees and even more flexibility per transaction to make trading in cryptocurrencies a breeze. There’s also CryptoHawk, which claims to be the world’s first all-in-one solution for all your cryptocurrency needs, be it exchange, trading or payment. Aimed towards professionals in the financial mainstream, the platform can be used not only to buy and sell cryptocurrencies but also as a novel payment solution for merchants looking to accept different cryptocurrencies as a payment method. Their token sale goes live on January 1, 2018. You can view their full whitepaper here.

“The success of the cryptocurrency market depends unilaterally on the number of startups that are willing to push the boundaries of orthodox thinking and use blockchain technology to answer the questions that matter. Bitcoin, when it was founded, was no more than a random startup. Today, it is the most expensive and popular digital currency to ever dominate the market. And us? We’re just getting started. A decentralized blockchain ecosystem that spans nations and establishes connections between brands, companies and consumers, Benebit is looking to take the online shopping industry by storm. We accept multiple currencies and boast some of the lowest transaction rates in the industry.” - John Laverty, Benebit

Peer-to-peer exchanges aren’t, however, the only ones to take advantage of the cryptocurrency boom. The sudden popularity of digital currencies has welcomed investment from different sectors all over the world. Coinloan, a cryptocurrency startup that actually allows you to secure loans against bitcoin or other crypto assets at very low interest rates, is one particular startup gaining a lot of traction. It boasts a global market reach and offers quick loans against cryptocurrency assets like bitcoin, ethereum and more. Their ICO is currently live and has already raised $3M in actual currency. There’s also Blade, a fintech startup whose primary goal is to get more and more merchants to accept bitcoins as payment. It has created its own real-time debit card that allows users to convert bitcoins into fiat currencies any time they visit a nearby cash dispenser. Elliptic is yet another startup which provides clients in the law enforcement and financial sector with actionable intelligence on illicit activities going on in bitcoin’s blockchain system. Startups like these, and more, add to the potential of cryptocurrency assets are a big reason why bitcoins are such a lucrative investment to begin with.

I can’t stress this enough, but bitcoin is a highly experimental digital asset. It’s kind of like investing money in a kickstarter. You have no idea what the end result is going to look like. You may very well get your money’s worth, or you may end up losing big. If you are going to invest money in bitcoins, or really any other form of cryptocurrency, please remember to do your research and study the graphs so that you may know where the price is headed. Shedding a few dollars worth of money in cryptocurrency assets may be a good way to make some quick money this holiday season. It might also be just the thing you need to clear off those huge holiday debts. However, be cautious.

Editor's note: Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated. Anyone considering it should be prepared to lose their entire investment.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.forbes.com/sites/haroldstark/2017/12/02/heres-why-you-should-invest-in-bitcoins-this-holiday-season/