[BTC/Bitcoin] A Summary of Filings for Bitcoin ETF with the SEC and Forecast

Schedule Summary

- 2018, January: ProShares files request (To be decided in Aug. 23)

- 2018, January: GraniteShares files request (To be decided in Sept. 15)

- 2018, January: Direxion files request (To be decided in Sept. 21)

- 2018, June: Van Eck Associates Corp. and SolidX Partners Inc. filed a request to list a Bitcoin-linked ETP to the U.S. Securities and Exchange Commission. (August. 16)

- 2018, July: Bitwise files request. Track the performance of the 10 largest virtual currencies (Date not fixed)

Van Eck ETF will receive ruling first

The earliest SEC ruling will be on Van Eck / SolidX filing. Direxion did file earlier in January 2018, but the ruling seems to have been postponed multiple times. For Van Eck ETF, more than 100 comments were received for the proposal whilst for Direxion funds only 2 were submitted. So, it can be clearly seen that Van Eck is at the center of all the attention.

Even if a positive ruling is made on Van Eck ETF, the actual ETF will be traded around January 2019. So it is not immediate.

The fund will be physically-backed, which means it will hold actual Bitcoin, and will be insured against loss or theft of the cryptocurrency. If approved, the product will be priced at 25 Bitcoins per share, which equals about $188,000 at recent price, to target institutional investors. Regulators are concerned right now about having an ETF that is available to retail investors. So a good place to start is with a product geared purely toward institutional investors. SolidX would handle custody of Bitcoin using a so-called cold storage solution, which means so-called private keys that serve as ownership codes are kept off line.

VanEck oversees more than $45 billion in assets and manages more than 70 exchange-traded products. SolidX is a New York-based financial technology company, developing cryptography software and capital markets products.

Implication for authorization of Bitcoin ETF

As cryptocurrency investor and widely recognized content creator Nicholas Merten said:

“Here’s why a bitcoin ETF matters: With the release of an ETF, this allows investors to add BTC to their retirement portfolio. Global Pensions Market: $41.3 trillion If BTC captures just 1% of global pensions, that would create $413,000,000,000 of exposure for cryptocurrencies.”

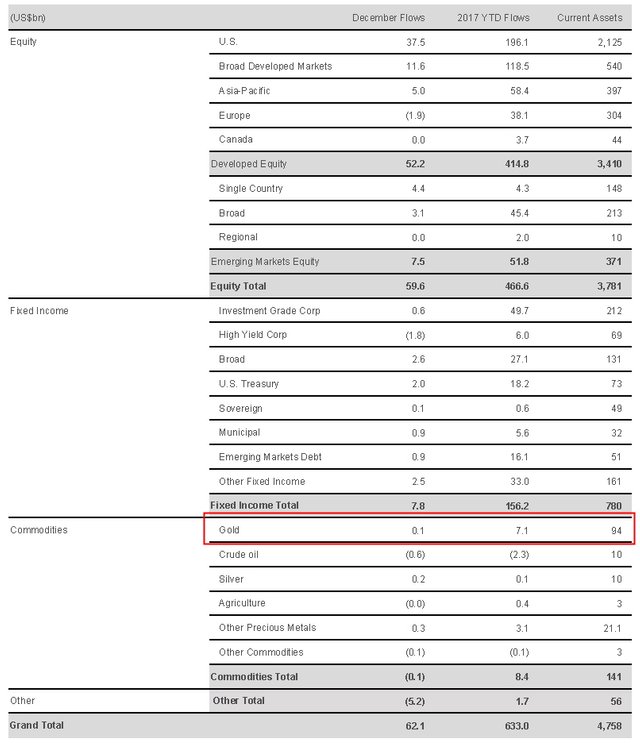

Global ETF market stands at approximately USD 5.0 trillion dollars. It is expected to growth to 6 trillion dollars market by the end of this year. If you consider that gold market is around USD 7.7 trillion, you can estimate what the market for ETF is life. Out of the total ETF market, the size of Gold ETF is around 94bn dollars. Which is 1/80 of the total gold market. So, every dollar which goes into Gold ETF has more than 10x multiplying effects.

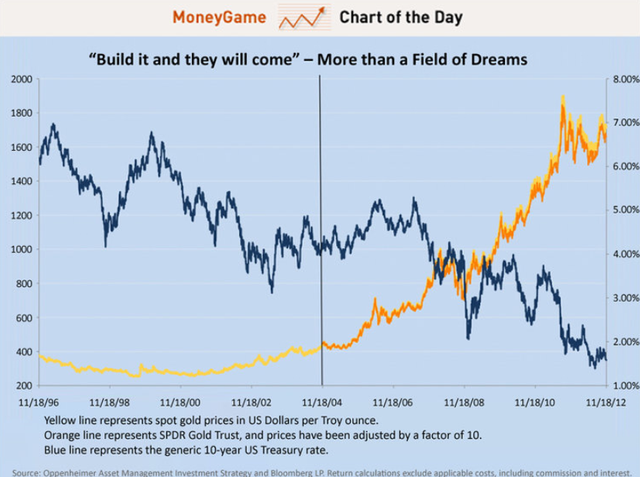

After Gold ETF was allowed to be traded in November 2004, Gold went on a massive 8 year bull run!

Forecast

The ETF that is at the center of attention is the Van Eck ETF. There have been around 100 petitions for the ETF to be allowed on SEC homepage. I feel that there can be several reasons for a positive response from the SEC.

- One unit of the ETF will own 25 of actual (real) bitcoins.

- The ETF will be insured against possibilities of theft and hacking.

- The price of one unit is very high, and as a result it will be mainly invested by institutional investors and will be a barrier for retail investors to actual own the units of ETF. This also goes in tandem with SEC's need to protect retail investors.

- The atmosphere around crypto sphere is gaining positive traction as many institutional investors are taking part in the development of the industry. The industry will be more secure as time passes.

When the Winklevoss brothers were denied ETF listing in 2017, the SEC cited "lack of regulatory framework in overseas markets and that there were not enough institutions overseeing the crypto industry". I believe much of those concerns should have been alleviated.

It would be very positive for the market if the SEC allows for Van Eck ETF to go live in August, and after observing market conditions for a few week, allow other ETFs to be traded in the market. If the august application is denied, the ETF applications waiting their part till the end of the year will likely be denied as well. It is my hope that the US authorities will be at the forefront of market innovations for crypto assets.

Well, i guess we know the outcome of this now.

Check out my new post to get the details.

Nope. We were not waiting for winkle etf. Van Eck is the one we are waiting for.

That's what I'm talking about @hypomone :)

Here's the full text

Lemme check it out !