Wirex.com debit card review

Wirex, formerly known as E-coin, combines digital money with traditional banking services. The bitcoin debit card issued worldwide allows the transfer of money at any time, anywhere. The Wirex card works like a normal debit card, but offers much more thanks to the flexibility and opportunities offered by bitcoin blockchain technology. A card for the traveler, for the bitcoin freelancer and for anyone who wants to be at the top of their finances in the digital world.

The Wirex team is working on a brand change. Previously, the platform worked under the E-coin.io site. The company based in London has been established at the end of 2014. The rebranding of the company started in February 2016. The old website is still running, but direct traffic to wirexapp.com.

The founders of Wirex have a diverse professional background. Pavel Matveev He has been working as an IT developer for the last ten years. He had high level projects in several investment banks around the world. Dmitry Lazarichev has multiple interests in financial and business projects. Starting in Russia, he worked for Solid providing consulting services, then moved to the United Kingdom to start his own business importing wood biomass. Georgy Sokolov He is a sales person with international experience in the USA. and Europe. Before financing the electronic currency he has been working for the largest cargo airline in Russia.

After founding the company in 2014, it only took the four-month-olds to build and launch the work platform of the E currency for scratches. Two years later, the business is now going through a rebranding and continues its success under the name, Wirex.

Services provided

Wirex issues two types of debit cards with bitcoin backup. An opportunity to choose is a MasterCard with pin and chip, the other is a virtual VISA card. Behind the cards, users can choose to choose the base currency of USD, EUR and GBP. The cards are accepted everywhere in the world where MasterCard and VISA cards are accepted - ?? This basically covers 99% of the acceptance market for debit cards, including millions of ATMs and retailers both online and offline.

The company delivers plastic cards to 130 countries around the world. With standard delivery it takes 3 weeks for the card to arrive in the EU and up to 8 weeks in the rest of the world. Standard shipping is free. Users can choose the fast delivery option for an additional $ 33 fee to receive the fastest bitcoin debit cards. In this case, the shipment only takes a few days in the EU and 7-10 days in other countries outside of Europe. Although Wirex serves users in more than 100 countries, services are not available to US citizens, neither in India nor in many Arab countries because of legislative issues.

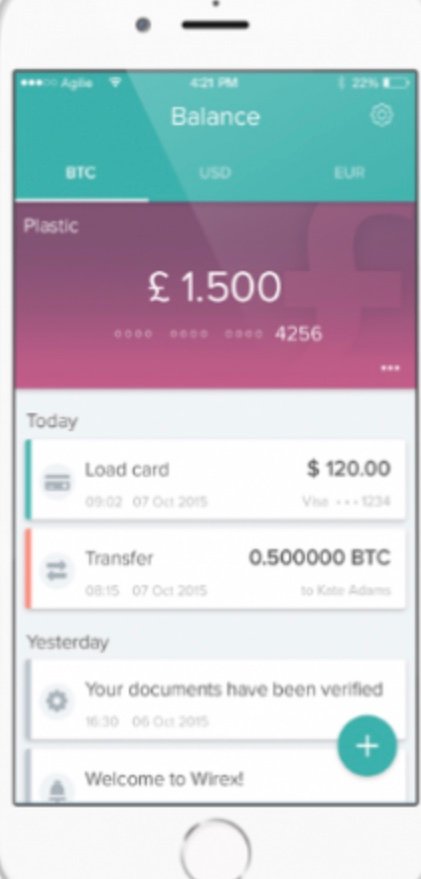

The conversion between bitcoin and the base currency only has a simple touch on the application that is available on both Google Play for Android users and Apps Store for iOS users. Two-factor authentication is used to maintain high security: next to the user's password, a unique special code generated by an authentication application, installed on the smartphone, secures the funds in the Wirex accounts.

With Wirex, users can buy bitcoins directly with bank transfers. For an additional fee, Wirex also allows users to charge balances with alternative payment service providers and also with PayPal. Due to the instant notifications available in the application, users can track the money while they are on the move, without needing to pay attention to the bank's opening hours or wait for the transfers to occur. The Bitcoin transfer with blockchain technology allows instant money transfer service.

Prices and Prices

The Wireco bitcoin debit card costs 17 USD, the virtual card costs 3 USD at the time of issue and there is an additional charge of USD 1 per month. When charging the card, Wirex charges 3 USD or 2.75 EUR or 2 GBP for direct bank transfers on each occasion. In addition to the traditional payment method, users can also transfer funds to the account with alternative payment service providers for a fee of 2-3% (minimum rates apply).

The load limits of the account depend on the source of the funds. Verified users can increase Wirex max. 5 times a day, with a min. 10 USD ?? Max. USD 2500 per single transaction of the bitcoin account. However, other transfer methods have lower limits: through traditional bank accounts and alternative payment service providers, only 2 transactions per day are allowed, with a max. 5000 USD per day for bank transfers and only 500 USD for alternatives.

Users can buy an unlimited amount online and offline through point of sale terminals. Two withdrawals from ATMs are allowed daily with a maximum amount of 2000 USD. Although, there is no limit on the withdrawal of funds during the life of the card.

To verify the user account, Wirex requires different documents such as Proof of Identity and as proof of residence. The IDs must contain the full name, date of birth, a photo of the user and an expiration date. To prove residency only documents that are more recent than 3 months are accepted. Any account or bank / tax declaration can be presented that shows the current address of the user. Documents must be in English, or a translation must be attached. Identity verification is done by the bank, so it takes a longer time: it is done within 7-10 business days.

To maintain anonymity or until the verification process is approved, services can be used without verification. However, in this case many functions of Wirex accounts are limited. Unverified users can only make two ATM withdrawals per day, for a maximum amount of USD 1,000. The total number of ATM withdrawals is also limited to USD 2,500 over the life of the debit cards. However, online expenses and the use of points of sale are not restricted even for unverified users.

When traveling and using the Wirex card, a transaction fee in foreign currency of 3% will be charged if the base currency is not the same as the currency of the transaction.

The bitcoin prices used for the conversions are not available on the Wirex website. In E-coin, the average price of bitcoin seems reasonable, although offers are not shown.

General conclusion

Wirex, formerly E-coin provides Bitcoin debit cards with VISA and MasterCard. The associated smartphone application makes the user experience a great pleasure, keeping price programming at a decent level.

Pros:

Android and iOS applications

All major currencies supported: USD, EUR, GBP

Worldwide Free Shipping

Cons:

Long check time: 7-10 working days

Missing information on wirexapp.com: the prices of bitcoin and the owners of the company are not available on wirexapp.com, only on e-coin.io

US citizens excluded.

wirexapp.com