A New Trend in Bitcoin

Well, it's official.

The naysayers are now recognizing that Bitcoin is an asset. For the longest time they couldn't stop comparing it to Tulip Mania. To be fair, I guess Bitcoin could be compared to Tulips. After all, both can be charted...but that's about where the similarities begin and end.

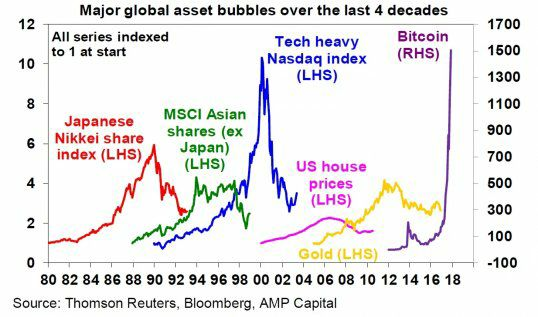

A good friend and I recently had yet another Bitcoin (crypto) difference of opinion. Whereas he used to call Bitcoin the biggest joke/scam on the planet, I've noticed his negative remarks over the ever-growing Internet phenom have begun to change. The discussion began over the following chart and his comments below:

"This graph should terrify anyone thinking of speculating in cryptocurrencies. Trust a mathematician that exponential growth can NOT continue indefinitely. If you don't know the answer to this question -- How do I short cryptocurrencies? -- then you shouldn't be speculating in them at all..."

And so I couldn't help but reply:

Doth mine eyes deceive me?! You're now comparing Bitcoin to other well recognized assets! You're making progress, my fantastically facially-haired friend. And I thought that you thought (that I thought, that YOU thought) that Bitcoin was just a Tulip. I'm glad we're passed that phase.

I continued:

In your chart, you're comparing Bitcoin to other assets that were over-bought but ultimately corrected. Keep in mind, however, that these assets still exist today. They didn’t "crash and burn."

Bitcoin's history is that of an extremely volatile asset. It plummeted from $1200 down to $200 in 2014, and then recovered. It does this all the time. It’s at $8,200 today and could easily be at $5,000 tomorrow. This wouldn’t surprise or concern me in the least. Perhaps if it gets back under $4,000, I’ll consider buying some fragments. (You do realize that Bitcoin is divisible, right? You can buy a fraction of a Bitcoin.)

What I find interesting is that you (and many other naysayers) are now comparing Bitcoin to real and even hard assets...this is quite a departure from your earlier arguments and Tulip Mania concerns.

At this point, our conversation turned to other "concerns" about Bitcoin, such as how completely devastated the Bitcoin community COULD be if the price crashed. My friend argued that since Bitcoin is a digital (or virtual) asset, Bitcoin holders would be wiped out before they even heard the news of the downturn. And so I replied:

Let me point out that the "instant virtual asset crash" you mentioned is symptomatic of the stock market in general, not with the cryptocurrency market. The stock markets are only open from 9:30-4:00 (depending on where you live). You cannot trade during night hours. Thus, when stocks take a huge hit, it coincides with large "gaps" in price that occur when the markets are closed to the average investor.

(See the gap in the chart below.)

The cryptocurrency market, however, is open 24-7. Everyone can take part in these markets 24-7 to buy and sell. And you can rest assured that those holding Bitcoin are watching the price movements like hawks, unlike your average mutual fund and retirement account investors. In fact, the traditional investors are the people at the greatest risk. Their money is tied up in a manipulated financial system run by bankers and politicians who always come out on top despite the financial carnage in their wake. A brief glance at recent history proves this undeniably. Blame Republicans all you want (I blame them all!), but the fact still remains that the average investor is stuck with his retirement plan and plummeting housing value and has basically no means to exit these markets as a financial collapse becomes imminent.

Of course, the whole reason Bitcoin even exists is because of the financial collapse of 2008. Bitcoin was launched in 2009 by those who were looking for an alternative to the inefficient and corrupt banking system that has our arms pinned behind our backs. Its whole purpose is to provide a means for people to exchange goods and services between one another and eliminate the expensive and corrupt third party, i.e. the banks and government. I understand you probably don’t like this because it enables people to avoid paying taxes. But as I’ve mentioned before, the government has already admitted to losing some $10 trillion (who knows what the government ISN’T reporting)…but government officials are doing nothing to return this money or even account for it. Yet you would have me pay even MORE in tax dollars to provide more government services? Thus, I paid once, and the money was stolen (or is “lost”). And now you want me to pay again? Are you insane?! I don't understand how you can tolerate this, but that's your business.

Bitcoin is growing in global popularity because people are waking up to the scam they’ve been forced into since they were born. And at the end of the day there will be billions of people chasing 21 million Bitcoins. Now THAT'S a mathematical equation I’d be interested in seeing play out.

You started off this thread by pointing out something that should terrify us: the exponential rise in the price of Bitcoin. Well, here’s something infinitely more terrifying. In 2008 we survived an unprecedented financial "downturn," but the tidal wave coming is going to dwarf 2008. And THIS is why many people are looking to Bitcoin.

Below is the DOW index. Notice the 2008 "crash." If this was indeed a "crash," which we all agree it was, can you imagine the size of the next crash?

And so we parted ways, neither one of us able to convince the other. 'Twas a fun conversation...probably because I own Bitcoin and he's secretly wishing he had some of his own...but is too proud to admit it.