Interesting perspective on Bitcoin

This is a copy of email from BitMEX I've received yesterday, I found it interesting enough to repost it here in case some people don't have BitMEX account.

BitMEX Crypto Trader Digest

Jul 06, 2018

From the desk of Arthur Hayes

Co-founder & CEO, BitMEX

From The BitMEX Research Desk

A brief history of Stablecoins (Part 1)

Abstract: In this piece we look over the history of distributed stablecoins, focusing on two case studies, BitShares (BitUSD) and MakerDAO (Dai). We examine the efficacy of various design choices, such as the inclusion of price oracles and pooled collateral. We conclude that while a successful stablecoin is likely to represent the holy grail of financial technology, none of the systems we have examined so far appear robust enough to scale in a meaningful way. The coins we have looked at seem to rely on “why would it trade at any other price?” type logic, to enforce price stability to some extent, although dependence on this reasoning is decreasing as technology improves.

The Volatility Blues

The anguish experienced by traders worldwide during the $20,000 to $6,000 slide further proves that recently experienced losses matter more than gains. The financial media and many traders forget that 18 months ago the price was $1,000 and then in the fall of 2015 the price was $200.

Jonny-come-lately traders / investors were eviscerated by the recent moves. To make matters worse, the volatility collapsed alongside the price. For crypto, this is deadlier than white wine and painkillers.

But what about adoption? One of the major facets of Bitcoin preventing further adoption is its high volatility. In a pure Bitcoin economy, how can people trade Bitcoin against real goods if its value violently fluctuates? The underwater trader laments that the market just doesn’t get the “fundamental” value of this new transaction network. Well, what transaction network's monetary token do you know increased 20x in value in under one year? None. Therefore, the driving force is not about current utility but intense speculation on future utility.

Changing the way in which humans use money is an extremely long and difficult process. This process by its nature must be chaotic. Money and the means by which it is handled is personal and sometimes religious. If you tell a society that tomorrow things will be done differently than how they were done over the past 200 years, there will be an intense reticence to change. A violent upheaval is necessary. Therefore, if Bitcoin is to be used in any productive manner, the period leading up to this new epoch must be extremely volatile.

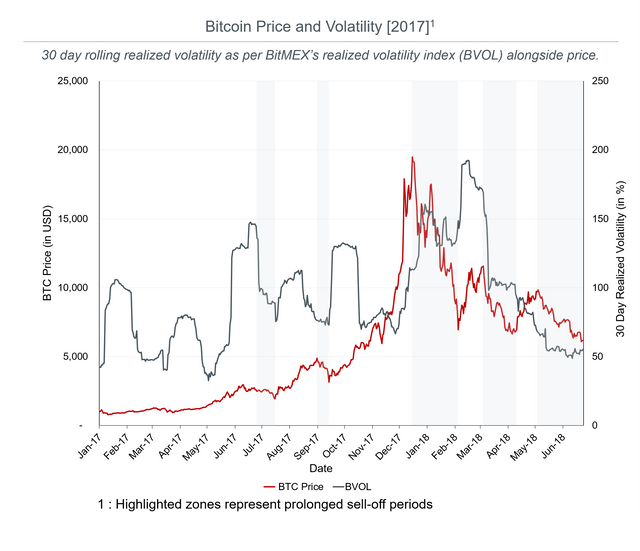

Bitcoin is a call option on a new monetary system. The most important option pricing input is the underlying asset's implied volatility. As the above chart illustrates, the realised 30-day annualised volatility crashed alongside the price. When volatility returns, the price will go higher.

We Have Been Here Before

The nuclear bear market of 2015 started in January when the price broke $300. For the next 10 months, the price traded between $200 and $300. While that is a 50% range, the daily movements were very slight.

Without volatility, many traders, investors, and market commentators wrote off Bitcoin. Why should one care about an asset that has crashed over 80% from its recent all-time high, and has barely moved since?

Traders returned to the market because the volatility re-emerged. If Bitcoin can gyrate 100% in annualised volatility terms in a 30-day period, then quick gains can be made. The FOMO “investors” who believe they can change their lot in life with little effort and in little time took us from $200 to $20,000. There were not many things that fundamentally changed about the adoption of Bitcoin in real commerce from 2015 to 2017.

Return to $20,000

The path to parity will not begin in earnest until volatility rises materially. People need to be excited again. 10% pump & dumps in one day will bring back the good times. The real questions are what catalyst will start the party again, and how long will it take.

During the 2017 bull market, the effect of global macro events on Bitcoin was forgotten. For 2H2018, a global macro event will have to prove that Bitcoin is a safe-haven asset. In 2015 Greece almost told Frau Merkel to do one, but chickened out at the crossroads. Bitcoin responded positively when the market believed Greece could actually liberate itself. If a similar type scare happened later this year, would Bitcoin regain its safe haven status?

With the Fed, ECB, and BOJ effectively flatlining or outright reducing their balance sheets, cracks in the financial markets will show later this year. Money printing has never led to prosperity in the long run, and when you shut off the tap the ghosts and ghouls of the financial markets will play.

The MSM Still Loves Bitcoin

Thankfully the mainstream financial press loves talking about crypto. The personalities of the leading figures are larger than life. Even at Bitcoin $6,000 and Ether $400 a whole cadre of individuals are generationally wealthy, and are making interesting life choices the media can’t stop covering. In 2015 no one was watching, in 2018 everyone is.

In order to prove their prescience, MSM outlets will fall over themselves attempting to call the bottom in Bitcoin. The foolish many who believe these pundits actually can divine the future will attempt to knife catch. Many will fail, but if enough try, some will succeed. These successful retail punters will be paraded on the airwaves as trading gods. This will further increase the FOMO, volatility, and price appreciation.

Nothing goes up or down in a straight line. I still haven’t seen enough pain and anguish to believe we are done bloodletting. In true Bitcoin fashion, the price will go to the level no one thinks is possible and rebound faster than traders can work up the nerve to BTFD.

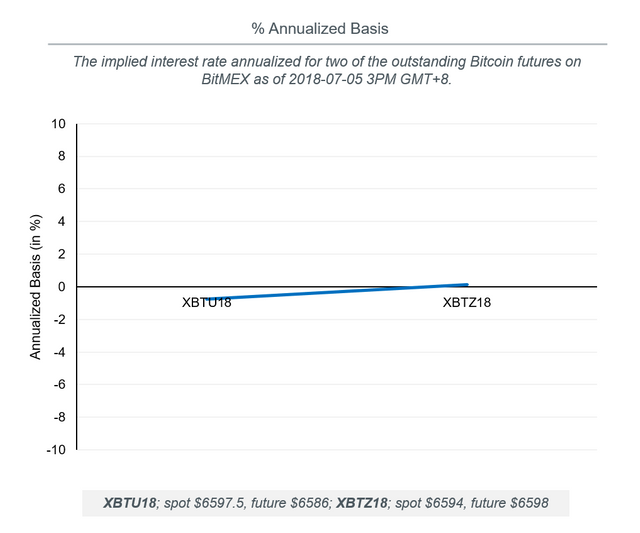

Calling the Curve

The BitMEX Bitcoin / USD 28 December 2018 futures contract, XBTZ18, recently began trading. The following trade ideas assume that spot in the short term will continue to fall and bottom in 3Q2018, and then aggressively rebound into 4Q2018. This scenario also assumes that trader sentiment will not fall out and enter a protracted bear market.

However, if you have very high conviction in that scenario, the riskiest and potentially most profitable strategy would be to:

- Go short XBTU18 from now until you believe Bitcoin has bottomed.

- Cover the short XBTU18, and then go long XBTZ18.

The reason to go short the 3m initially is that it should be more responsive to spot movements due to its lower time value. It is also more liquid so panicked speculators and hedgers will use that futures contract. Its annualised basis should trade at a steeper discount than XBTZ18.

You go long XBTZ18 on the rebound because it has more time value. If the market does perform as you expect, speculators will bid up the backend of the curve. A lot of things can happen by the end of December. Given that Bitcoin is a call option, the future implied volatility has a greater probability of causing the price to rise rather than fall. The more time value housed in the instrument you are trading, the better change the long convexity can work in your favour.

If you believe this a credible sequence of events, but want to reduce risk, a spread trade is advisable. The reduced risk comes at a the cost of reduced profit potential.

- Go short XBTU18 vs. long XBTZ18 from now until you believe Bitcoin has bottomed.

- Replace the above short XBTU18 with a short on XBTUSD

Because you expect the sell pressure to happen at the short-end of the curve, the term structure will steepen causing the profit made on the short XBTU18 position to offset losses on the long XBTZ18 position. The term structure chart shown above shows the current curvature of the BitMEX Bitcoin / USD futures markets. It is relatively flat, which indicates now is the time to enter into this spread trade.

This is a price neutral trade; however, be aware that each position is margined separately. Unrealised profit from the short XBTU18 position cannot be used to offset unrealised losses from the long XBTZ18 position.

The second trade is a funding plus long 6m basis trade. As the market rebounds, the swap will be pushed into a premium which means shorts will receive funding. The long end of the curve will also get bid up in annualised basis terms due to the greater time value. You earn money from the swap funding, and futures basis appreciation. Again this trade is price neutral, and you must be cognizant of each positions’ margin.

The reason why I prefer the use of spread trades to express directional moves is that if my prediction is wrong, it does not destroy my capital base. The more conviction around the prediction, the more leverage I employ on each leg to juice up my return on equity.

Risk Disclaimer

BitMEX is not a licensed financial advisor. The information presented in this newsletter is an opinion, and is not purported to be fact. Bitcoin is a volatile instrument and can move quickly in any direction. BitMEX is not responsible for any trading loss incurred by following this advice.