Bitcoin TA - summary of analysts - 07. July 18

Regular daily update on BTC ta analysts opinions.

**My summary - short-term (next 24h) sentiment: neutral ** (last: neutral)

Bearish scenario*:

- Rebound is a dead cat bounce turning below 7'000

- Price falls below 6'000 again and quickly gravitates towards 5'500.

- Short term recovery from 5'500 staying under 6'000.

- After breaking 5'500 again a significant drop towards new lows in the range of 4'975 and 4'300.

Bull scenario*:

- We get huge follow up.

- We go up to 7'500 and higher.

*scenarios based on daily-candles - so around 4-14 days timeframe. See also definition section

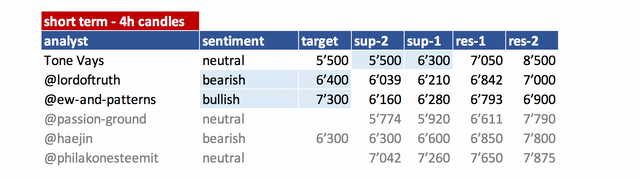

Summary of targets/support/resistance of TAs

Short-term overview

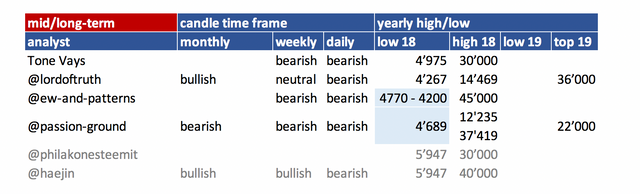

mid- and long-term overview

- please refer to definition section for time-horizon.

- you can easily spot which analyst did an update

(block writing - grey ones don't have an update today).

Their changes are in light blue.

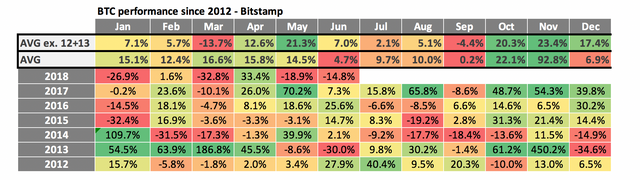

Helpful statistics:

monthly performances

- Added 2012 + 2013 on request.

- As 2012 and 2013 the % move are gigantic I added two averages. One without 2012 + 2013.

- June performance was very weak. With -14.8% clearly below the average of the last years. With 2013 this is the only negative month at all.

- July is a mixed bag - 2 year positive performance and 2 year of negative performance. 2012 and 2013 were positive though.

- The average is positive with 2.1% but that is mainly due to the bull rund 2017. The average incl. 2012and 2013 is even more positive. That is mainly due to the 40%+ spike in 2012 so I wouldn't rely on that.

So just looking at this table we probably facing another negative month.

News about the blog

- changed the order and put the summary table up front. So you can easily spot which analyst did an update (block writing - grey ones don't have an update today) and see their main changes they made (light blue are numbers that changed).

- updated definition section for time frame of candle forecast.

- added/update monthly performance section

- updated "Educational links" section

- added a bullish and bearish scenario to my overview section

I hope you find those changes helpful.

Analysts key statements:

Tone:

Mid-term outlook: -> He expect this to be later than expected.

He expects us to put in a swing low at around 5'000 in first two weeks of June. From there we probably bounce strong towards 7'500 and more. For now he keeps this target.

Still he is expecting that we put in a final low only at around October.

Short-term outlook: -> unchanged

- Weekly: Not much changed. This is a rebound to the downside of the triangle which is quite expected. He looks forward to weekly close as he want to see how much we fall at the 30 MA. He is looking for a death cross of the 7 and 30 MA weekly and may see us pulling into it which would be a short opportunity.

- Daily: He sees us in a no trade zone. Falling below 6'300 is also a short play. Touching 7'050 he sees also a short opportunity with double down at 6'300.

@lordoftruth:

Bitcoin price failure to beat the strong resistance located at 6'842, due to an increased selling pressure around 6'600, the reason why we believe that bitcoin price could move below 6'400, while breaking 6'210 will lead to the continuation of Harmonic Swings towards 6'039 followed by 5'870, where further losses will try to target November low at 5'500 before reaching the final target at 4'300.

We still waiting for bearish continuation unless breaching 6'842 and settling above it. Shorts need stop around 7'200 for an unexpected break higher.

Todays trend is neutral. Trading between 6'210 and 6'842.

@ew-and-patterns:

He can't see this move down to be an impulse (5 waves down) rather it looks like a WXY for red wave A. That implies that we are in an impulse wave up (yellow wave 1 or yellow wave A).

This scenario would mean no new low below 5770 in the short-term. That means we are going up now for at least a big ABC pattern (target zone 7'300-8'000).

This is his new primary count.

@passion-ground:

Only time will tell if a meaningful and lasting bottom is in. The monthly chart still holds out for further weakness into 2019, however, that does not diminish the nice move up we’ve had off the most recent bear market low. (See video for details)…

For bull run we need to see a much more powerful wave up to 8'366 level.

Daily doesn't look good. Positive sign we have some bullish divergence on the RSI.

The most bullish count is that the intermediate (4) is in and we are moving up.

@philakonesteemit:

A bounce at the 7'000 level was much expected due to hitting a major trend line support established since Nov 11, 2017.

Bullish View, if we break the 7'650 range, there's a chance to hit 7'850 to 8'000 range (0.5 to 0.618 fib retracement)

Bearish View, if we break 7'161 range, we'll most likely test 7'040, which I see as failing to hold and then testing 6'500.

@haejin:

@haejin is moving his analysis to bitcoin live. Those of you who want to follow him directly should look into subscription. I will try to get in contact to see if I can use an abstract to post here also in the future.

Bitcoin (BTC) Short Term Update: The blue circle shows a potential price pathway of BTC. The purple waves have been updated and it shows a scenario where purple 1,2,3 could be complete and 4 is getting its final touches. Purple 5 is still targeting the 6'300 zone or so.

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 06. July | here |

| @lordoftruth | 07. July | here |

| @ew-and-patterns | 06. July | here |

| @passion-ground | 03. July | here |

| @haejin | 13. June | here |

| @philakonesteemit | 31. May | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely). The sentiment is based on 4hr, daily, weekly, monthly candle charts.

- The forecast time horizon of candles can be compared with approx. 4hr = 1-2 days; daily = 4-14 days; weekly = 4 - 14 weeks; monthly = 4 - 14 month.

- target = the next (short term) price target an analysts mentions. This might be next day or in a few days. It might be that an analyst is bullish but sees a short term pull-back so giving nevertheless a lower (short term) target.

- support/res(istance) = Most significant support or resistances mentioned by the analysts. If those are breached a significant move to the upside or downside is expected.

Educational links:

- From @ToneVays: Learning trading

- From @philakonecrypto: Like in every post you find links to his amazing educational videos. For example here. In addition he has an online course which you can find here

- From @lordoftruth: Fibonacci Retracement

- From @haejin: Elliott Wave Counting Tutorial

*If you like me to add other analysts or add information please let me know in the comments.

Candles after breakout looking very bullish. Thinking it will go another leg like it did on June 30 some time in the next 3 hours.

Congratulations @famunger! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - Quarter Finals - Day 2

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

$7,500 sounds good in the next month!

Hi @famunger, I wanted to announce that the matches of the semifinals of the World Cup are already available. https://steemit.com/worldcupwithsteembounty/@jmhb85/match-61-or-semifinal-predict-the-result-and-win-with-steem-bounty-10-sbd

intresante espero pronto agarremos esos toros jejeeeeee creo que si va a subir