Principle of Investment (Part 2: Indicators)

The following is a list of our favorite indicators we use on a daily bases to find the best time to enter and exit a trade. Note the following is a short summary of our favorite indicators and it does not go independent on how to use them.

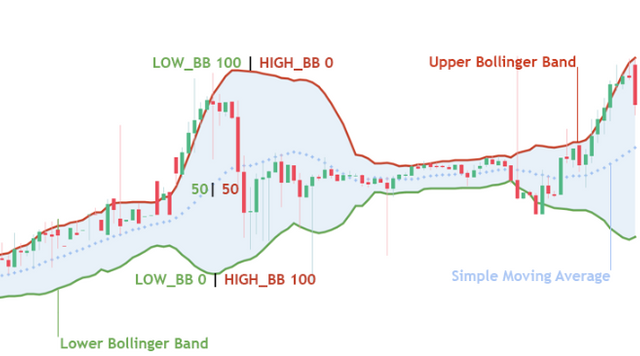

Bollinger Band

This was developed by the famous technical trader John Bollinger. Bollinger Band are plotted two standard deviations away from a simple moving average. It's great for showing when a stock is in a squeeze and about to have a break out (up or down). The closer the prices move to the upper band, the closer the market is to being over bought and vise versa. To learn more about the Bollinger Band there are 22 rules that John Bollinger have set for using this trading system.

Relative Strength Index - RSI

The Relative Strength Index(RSI) is an indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions.

The mathematical calculation:

RSI = 100 - 100 / (1 + RS)

RS = Average increase periods during the specified time frame / Average loss periods during the specified time frame

RSI values range from 0 to 100. The value under 30 means it's over sold and above 70 meaning it's over bought.

RSI is a great indicator to figure out when it's a good time to enter or exist a trade, but it should not be the only indicator you look at to make your buy and sell decision.

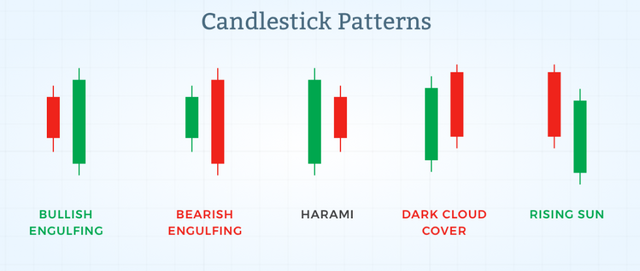

Candlestick

Believe it or not Candle stick actually provides a lot of information and master reading it paired with other indicators makes it a very powerful tool. A candlestick is a type of price chart that displays the high, low, open and closing prices of a security for a specific period. Depending on the pattern formed by the candle stick it could give you a lot of insight on when to buy or sell.

Tell us what your favorite trading indicators are in the comments below! Happy Trading!!!

Note: All the Indicator or tools above are not meant to be used alone to make financial choices. You should use a few non-correlated indicators that provide more direct market signals to help you make better choices.

DISCLAIMER: We do NOT offer financial advice. We are just offering our opinions. Erizun is not responsible for any investment decisions that you choose to make.