RE: How long will it take for Bitcoin to reach $20,000 again?

I personally don't believe Bitcoin will ever see ATH again.

The fundamentals for some parts of the crypto space are good. The fundamentals for BTC have been terrible for a long time. Reality is catching up on that.

Example of bad Bitcoin fundamentals:

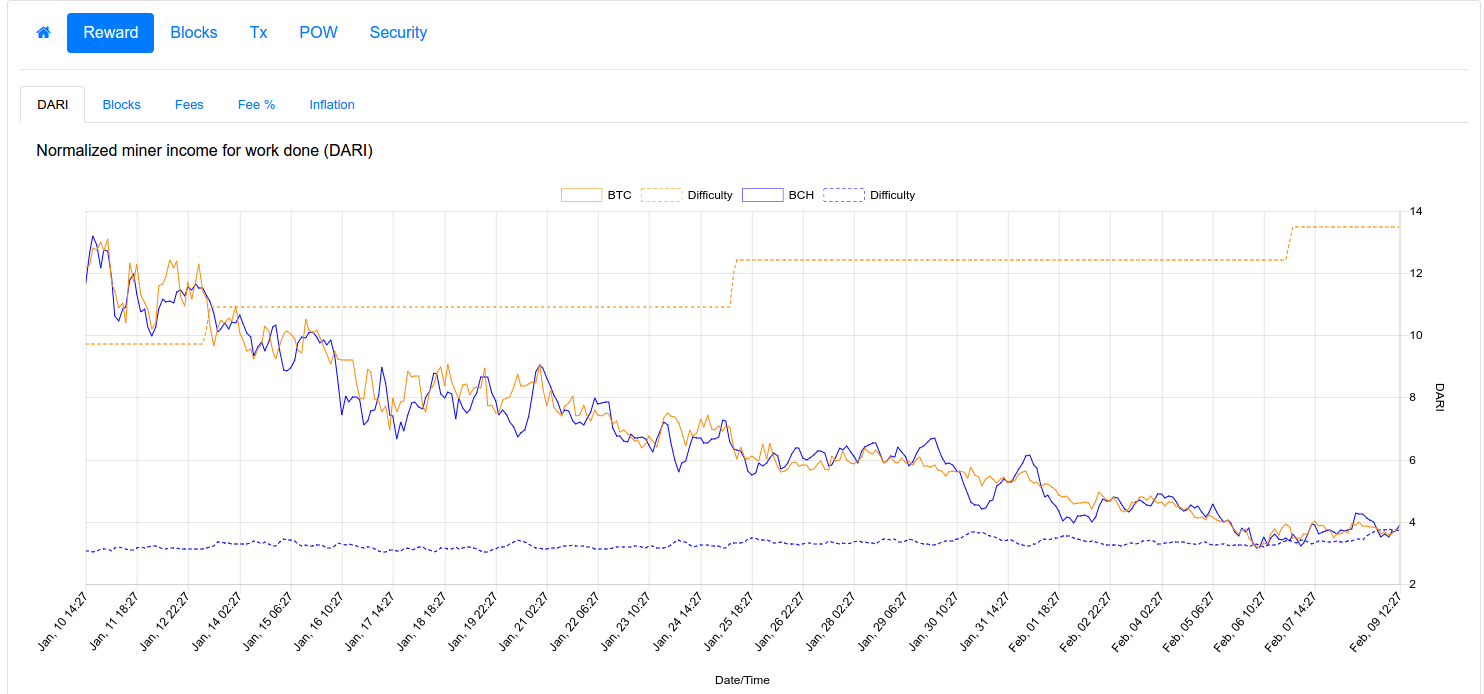

The profitability of mining is in sharp decline. This means miners must sell more of their BTC earnings to cover their costs, which means higher effective inflation.

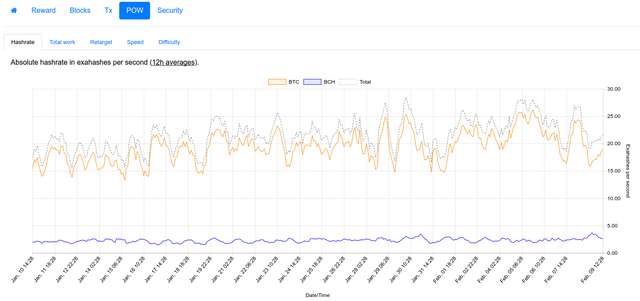

The decreasing profitability of mining is causing an impact on hashrate as well, which has now stopped increasing and may be beginning to decline.

The current paradigm with full blocks means that in a declining hashrate envirnoment, the network performance (potential throughput) itself decreases. This has the potential to lead to several negative feedback loops. Bitcoin's difficulty adjustment mechanism is not well suited to handle declining hashrate, it happens much slower than when hashrate is increasing.

Of course, the most important fundamentals are users and usability. While there are more Bitcoin buyers than ever before, there are fewer users and transactions. Those buyers are mostly Coinbase users, not Bitcoin users. Usability has only declined in recent months, although there is some relief in the past couple of weeks.

Good points. The one thing that might keep boosting bitcoin's price is the fact that it is essentially the face of cryptos, the one crypto that is becoming a household term. Over the past few months, I've spoken with quite a few people who still have no idea of cryptos; only that there is something "new" called bitcoin.

Therefore, it's highly likely that the (inevitable) growth in the crypto space will be primarily in bitcoin. That may result in another year or more of phenomenal increases in its price, regardless of any outrageously high transaction fees and regardless of delays in transaction-processing time.

After that, it might be superseded by Bitcoin Cash, Dash, Steem, or who knows which coin.

That legacy has certainly brought it far. But there were points in time when 'Atari' was synonymous with video games and AOL was synonymous with the web. I don't think that growth in the broader crypto space will inevitably prevent its collapse for long.

Hi @majes.tytyty and @demotruk, thank you for the rich discussion! I'd love to see Bitcoin climb again, not necessarily for personal investment in Bitcoin, but my investment in other coins that are following Bitcoin's trend and movement. With that said...

Right now, with cryptocurrencies being in a space of "unknown" to the general population and that some have heard the word "Bitcoin" more than "Cryptocurrency", it makes a lot of sense that Bitcoin will go up in value being the most common gateway to the crypto world.

Once that changes, however, and the paradigm shift goes in full effect, with greater amounts of crypto-educated people, Bitcoin won't be necessary especially with better coins offering high speed transactions, safer exchanges, business platforms, and little to no transactions fees.

On top of that, with bitUSD on the Bitshares DEX and USDT by Tether maintaining their ties to the US Dollar for stability in the crypto world, BTC won't be necessary for the crypto world to lean on.

I really appreciate the insight and facts you two are dialed into. Thank you for your information and I look forward to reading more!

Steem On!

I still have an Atari... ha.

Bitcoin's name is where a lot of its value is. It has a strong brand because it was the first crypto, has a cult following, and is frequently discussed by the mainstream media. All those factors make it the first coin people think pf when first considering investing in cryptos.

It certainly doesnt hurt that bitcoin is also a preferred exchange coin for ICOs and smaller exchanges.

Umm I am sorry but you misunderstand the fundamentals of bitcoin. The mining profitability is quite irrelevant for the economics of bitcoin.

Fundamental aspect are more how many people are joining and buying btc.

People buying on exchanges aren't users of Bitcoin, they're users of exchanges. Like users of brokers. Imagine if a company argued "look at our fundamentals, people are buying our stock". It would be a sign to run for the hills. Those buyers are just looking to sell when the price reaches a certain point, they don't form any meaningful part of the Bitcoin network effect until they're actively using or accepting Bitcoin in exchange for goods and services.

Joining BTC and using it is an important fundamental, the most important one. But there are plenty of others which impact the coming supply and demand for Bitcoin.

If you think mining profitability is irrelevant, do you think how many transactions can be processed per day is also irrelevant? Do you think new supply on the markets is irrelevant? Both of these are directly affected by mining profitability.

I believe that any user of bitcoin is a bitcoin users. It does not really matter where you hold the bitcoins. I started out as an exchange user and now hav most of my coins off exchanges.

And transactions will happen no matter how much miners and mining power there is.

Bitcoin has many problems and challenges but some miners losing money and people having coins on exchanges are not the big issues imho. however if you believe in your convictions just sell all your coins and you will communicate you dissatisfaction to the miners.