How Bitcoin became safe haven in South America

How Bitcoin became safe haven in South America

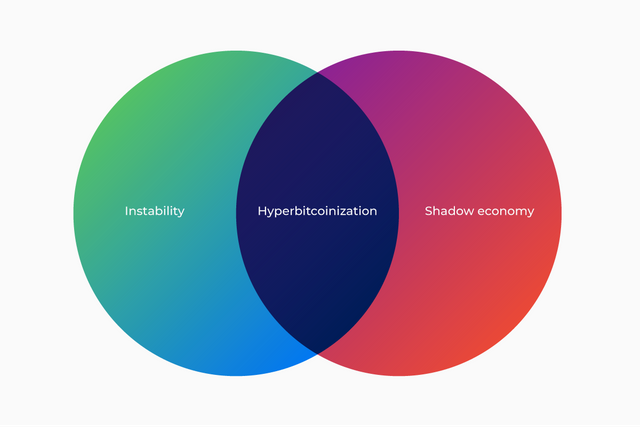

There is a theory called hyperbitcoinization. And it says that the widespread introduction of Bitcoin is possible in developing countries with high inflation — hyperinflation and crisis. As a rule, hyperinflation occurs when a government has a poor monetary policy. This is especially noticeable in countries such as Argentina, India, Turkey.

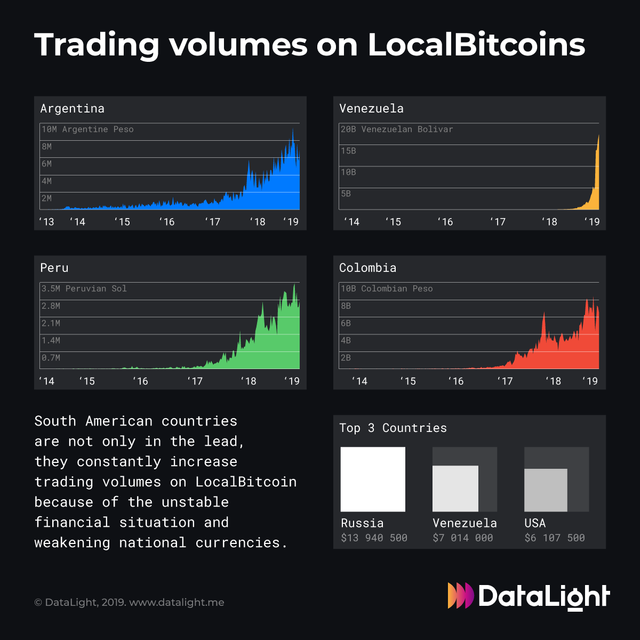

Last year almost every person in the civilized world became aware of Bitcoin. This led to the trend of transferring capital into cryptocurrencies in countries with poor economies. The infographic shows examples of South American countries that increase their cash investments in cryptocurrencies. Data is taken from Local Bitcoins P2P service.

We decided to look at the reasons that prompted the population of these countries to transfer their assets to Bitcoin.

Crises fuel interest for cryptocurrencies?

Argentina: high inflation

Argentina is considered one of the leaders among the countries of South America, along with Brazil, it is included in the G-20 countries. However, over the past 200 years, the economy of this country has experienced 8 defaults. So, in 1989, inflation was crazy 1000%. In 2018, things were no better – the national currency rate (Argentine peso) collapsed by 50% against the US Dollar. Not surprisingly, the population of the country began to look for ways to preserve capital. This can be seen in terms of trading volume, which increased by more than 2 times in 2018 using the LocalBitcoins service.

Venezuela: revolution

Political crises also have a profound effect on national currencies. This we can see on the example of Venezuela. The actions taking place there can be called a revolution with the self-proclaimed president and his supporters and opponents in the form of the current government. As long as a struggle develops between these parties, since the beginning of 2018, inflation has already reached an incredible 82,000%. This figure is the highest among countries on the planet. This is an extremely difficult situation for the population of the country, which already did not have a strong economy. But people found a way out – in just 3 months the trading volume on the P2P service increased to such proportions that it allowed them to take 2nd place in this indicator, second only to Russia.

Peru: political instability

The opposite is happening in Peru. Now it is the most stable country, judging from its economy. Export and GDP is increasing, in various ratings they are greatly supported and called the most stable economy in South America. However, the problem elsewhere. Since the 2000s, all the presidents of this country are under investigation due to suspicions of corruption schemes and abuse of authority. There is a political crisis.

This country is not very suitable for the theory of hyperbitcoinization, but it coincides on two points: it is an actively developing state with a crisis, albeit a political. It is possible that this could indirectly affect the increase in volumes, because, since the presidents (Constitution guarantor) use gray schemes, then the conclusion follows that it is common among the population. So the dark market of Peru is estimated to be 70-80% of GDP, which is almost 100 billion dollars. In this regard, remember the beginning of the formation of Bitcoin, which is associated with the Dark Net and SilkRoad (the first darknet site with Bitcoin trading). It is possible that part of the volume is connected with illegal activity, but this is only an assumption.

Colombia: high crime level

The Colombian economy recently did not experience strong shocks and it could hardly contribute to the increase in Bitcoin trading volumes. But as you know, this country is the largest supplier of illicit drugs in the world. The total volume of the shadow economy of this country is about 300 billion dollars, where most of it is drug trafficking. With the advent of Bitcoin, making such transactions easier and safer. It is with this that the growing popularity of cryptocurrencies in the country can be attributed, especially by criminal elements.

Hyperbitcoinization theory confirmed

So, the theory of hyperbitcoinization is confirmed in the countries of South America. At the same time, our analysts believe that it is necessary to add to this theory an item called the high level of the shadow economy in the country. It is this feature that unites these countries. South American countries have both of them economic instability and a high level of crime. These factors push the population towards choosing better money than national currencies. And this money becomes cryptocurrency.

Join us and make accurate Precise Trading on our platform!

See the previous Researches

Top-20 Countries runnig Bitcoin nodes

Top 6 coins with most Hype

New BTC Liquidity Records

Bitcoin Volume Research

Bitcoin vs Gold

Top-10 Mined Coins' Inflation Rate in 2018

DataLight Tutorials

What is Hype Index on DataLight

Explaining DataLight indices

What is Buy Market on DataLight

DataLight News

DataLight is now open the ultimate crypto analytics tool is live and its absolutely free

All bitcoin blockchain data now available

Follow us:

Website: https://datalight.me

Twitter: https://twitter.com/datalightme

Telegram channel: https://t.me/datalightme

DataLight Blog: https://datalight.me/blog/

Medium Blog: https://medium.com/@datalightme

Steemit Blog: https://steemit.com/@datalight

LinkedIn: https://www.linkedin.com/company/datalightcandles

Facebook: https://www.facebook.com/datalightme/

.png)

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Of course, BTC it is better to use, because by using it, they can send their values clobally. And also seeing how banks isolate people into small boxes, then it is normal, that it grows strongly there.

It is what I see and think .

ooo

????

pp

At first what led to many adopting bitcoin in Venezuela was not inflation, was that in Venezuela there was a currency control implemented by the socialist government, the first use was as a currency to access dollars or euros.

with time came the economic fall and the Venezuelan exodus, the bitcoin happened to be a medium for the sending of remittances, the catastrophe destruction of the economy caused the currency (Bolivar) to collapse, at this moment bitcoin is a store of value.

ll

In Venezuela, until recently it was a crime to buy dollars in the free market, it was a crime to publish the price of the black dollar. The government was the only one authorized to sell dollars to citizens. In the first years of socialism, the government gave citizens a limited amount of dollars annually for trips abroad, for purchases over the Internet or to send remittances. The oil and the debts that the government acquired paid everything, however, the quota was limited and the people had a good buying power, but we did not have bank accounts in dollars, what we did was to buy bitcoin in Bolivares and they were sent to some platform (Uphold, Payeer, Advcash, Skril, etc.) that gave you debit cards in dollars, with which I had more to travel and bring more dollars in cash when I returned from travel, bitcoin was a currency. Some of those who adopted early became miners and sold their btc in Bolivares in localbitcoin, then came to the collapse of the currency and use it as a store of value.

I think i understand you now, good info mucho gracias straight from the source! :D

But fuck that aint easy living there man. Wish you the best.

Good luck.

This Globally word is my word what I was think and see :) I know there is big inflation what moves fast and this is the basic problem why all want BTC but soon they start see they can send all also globally so they not need use local bank.

\

Good day there.

BTC is a preferred medium of exchange comparing to gold/silver due to its ease of transaction (in speed and cost) as the confidence in the local fiat currencies continues to wane.

I think the graph used in the case of Venezuela is not the best, since it only shows the volume of exchange in terms of bolivars, it does not really say much. I think it is more useful to graph the volume of bitcoin exchanges (the week was 1960 btc). In the case of Venezuela, bitcoin has 3 uses:

The increase in the sending of remittances and

The use of bitcoin as a way to obtain other fiduciary currencies, due to the control of the currencies established in the country for more than 20 years.

Use as a store of value.

https://steemit.com/bitcoin/@ppwrozo/weekly-bitcoin-market-report-in-venezuela-locabitcoin

The bitcoin market in localbitcoin is used as a way to access currencies and, in fact, it is the unit of account to determine the price of the dollar in terms of bolivars.

https://steemit.com/bitcoin/@ppwrozo/what-is-happening-with-bitcoin-in-venezuela

peace