Bitcoin Transaction Fee Significant Decrease - What it means for SegWit? (August 1, 2017)

Over the past few weeks, the size of the Bitcoin mempool, the holding area for unconfirmed transactions waiting to be picked up by miners, significantly decreased by around 90 percent.

As a result, Bitcoin fees significantly declined and the recommended Bitcoin transaction fee calculated by Bitcoin fee estimators integrated into widely utilized wallet platforms such as Blockchain substantially dropped. Now, fees below $1 have become sufficient to obtain first confirmation within 10 minutes.

In fact, Blockchain’s newly deployed Bitcoin fee estimator, which has received praise from the community for utilizing a satoshis per byte basis to establish recommended fees for users more accurately, has been recommending a $0.19 fee for regular transactions with an estimated confirmation time of one hour.

Why did it become cheaper?

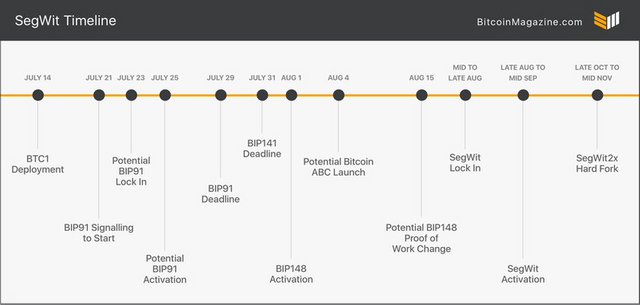

Bitcoin’s very public scaling debate is entering a crucial phase. Two of the most popular scaling proposals available today — BIP148 and SegWit2x — both intend to trigger Segregated Witness (“SegWit”) activation within a month, which means that the protocol upgrade could be live within two.

At the same time, there is a very real risk that Bitcoin “splits.” Both BIP148 and SegWit2x could diverge from the current Bitcoin protocol, which could in turn lead to even more splits.

SegWit

SegWit is a backwards compatible protocol upgrade originally proposed by the Bitcoin Core development team. It has been a centrepiece of the scaling roadmap supported by Bitcoin Core since the protocol upgrade was first proposed in December 2015, and it is implemented on many active Bitcoin nodes on the network today. SegWit is now also part of the “New York Agreement”: an alternative scaling roadmap forged between a significant number of Bitcoin companies, including many miners. And Bitcoin Improvement Proposal 148, or BIP148, a user activated soft fork (UASF) scheduled for August 1st, also intends to activate SegWit.

The SegWit2x development team aims for July 21st to be the day that BTC1 nodes are actually up and running, and, importantly, the day that miner signaling should commence.

This shouldn’t really affect regular users either.

But if you are a miner, you may want to help activate SegWit by signalling readiness for BIP91. (This is done by mining “bit 4” blocks; for example, by mining with BTC1 or with Bitcoin software that includes a BIP91 patch.)

Blockchain Data Crumble

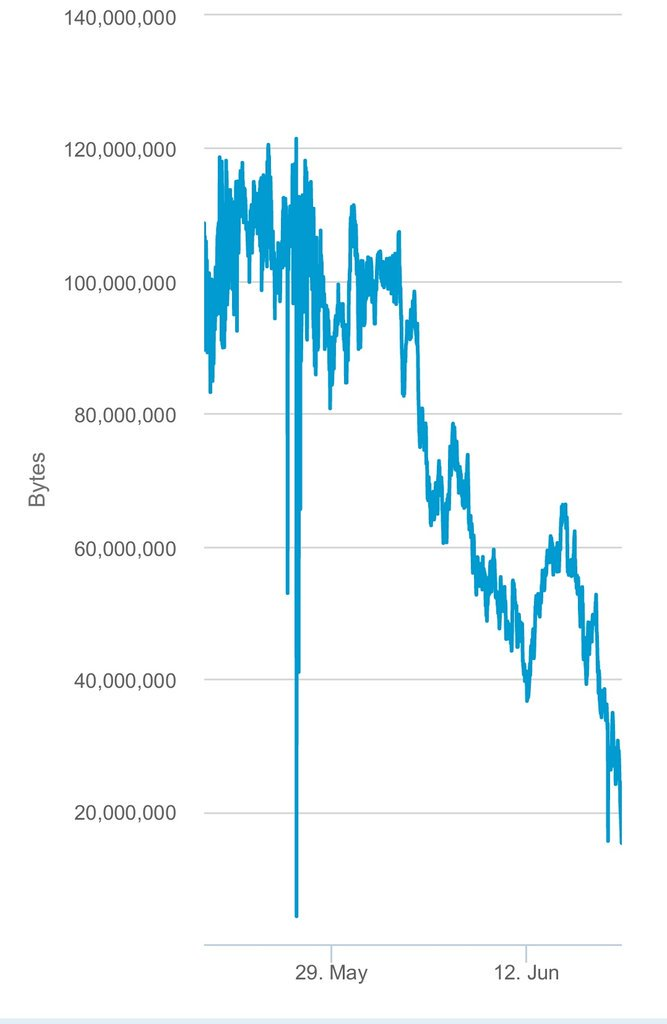

In late May, the size of the Bitcoin mempool reached an all-time high at around 120 GB. The large pool of unconfirmed transactions within the network led to the congestion of the entire Bitcoin Blockchain and the delay of transactions that had attached appropriate and proportional fees.

For over a month from May 1 to June 15, the Bitcoin mempool remained unreasonably large as the mempool failed to clear transactions during the weekend. Previously, the Bitcoin mempool had always cleared the majority of its unconfirmed transactions during the weekend when substantially fewer transactions were being settled on the Bitcoin Blockchain.

However, the failure to clear transactions during relatively inactive periods led the Bitcoin mempool to expand and store even more transactions.

Abruptly, the size of the mempool decreased within a matter of weeks and within 21 days starting early June, the size of the mempool declined from 120 GB to 20 GB.

On May 12, Cointelegraph reported that the activation of a viable scaling solution is urgently needed due to the abnormally large size of the Bitcoin mempool.

Several analysts including Bitcoin researcher Ben Verret suggested that the sudden decline in the size of the Bitcoin mempool is a direct result of the termination of network spam and that because the activation of segregated witness (SegWit) is getting closer, spam transactions have stopped targeting the Bitcoin Blockchain.

This is really great information. Thank you!

Thanks for reading. It is important to know about these blockchain developments before the SegWit implication and a major chain split, which may result in a soft/hard fork.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cointelegraph.com/news/bitcoin-transaction-fees-significantly-decrease-charlie-shrem-pays-025-fee