Bitcoin Price Predictions 2025: How Crypto Can Take You from Zero to Hero and Transform Nations

From Zero to Hero: The Bitcoin Journey. Can you Image when China joins Bitcoin/Crypto Party? Millionaires will be made.

Imagine turning a modest savings pot into a life‑changing asset—Bitcoin promises exactly that for ordinary people embracing smart strategies. Through historical cycles, halving events, institutional momentum, and adoption trends, top analysts forecast dramatic BTC prices in 2025 and beyond.

🔍 Expert Predictions: Where Bitcoin Is Heading

Leading voices in finance offer strikingly bullish targets:

Tom Lee (Fundstrat): $250,000 by end‑2025

InvestingHaven+13Crypto Data Space+13Reddit+13

Reddit+1Barron's+1

Standard Chartered: $200,000 to $250,000

Investorsobserver+2Crypto Data Space+2Reddit+2

Bitwise (Ryan Rasmussen): $200,000 by year’s end

Axi+3Crypto Data Space+3CoinGape+3

Bernstein: $200K by year‑end, part of a new institutional crypto era

The Times+13in.investing.com+13CoinMarketCap+13

Mark Yusko (Morgan Creek): $150,000 in 2025

Crypto Data Space+2CoinMarketCap+2CoinGape+2

Matthew Sigel (Van Eck): $180,000 by late 2025

CoinMarketCap

Sminston With: $275,000 predicted for November 1, 2025

CoinMarketCap

Chamath Palihapitiya: $500,000 by October 2025

Crypto Data Space+1CoinGape+1

Adam Back (Blockstream): $1 million if the U.S. forms a strategic Bitcoin reserve

The Economic Times+4Coinpedia Fintech News+4Barron's+4

A recent survey of 24 crypto experts estimated an average target of ~$145,167 by end‑2025, with upside to $240K–$250K

businessinsider.com+6The Economic Times+6Finbold+6. Many expect long‑term milestones like $458K by 2030 and $1 million by 2035

CoinGape+3The Economic Times+3CoinMarketCap+3

.

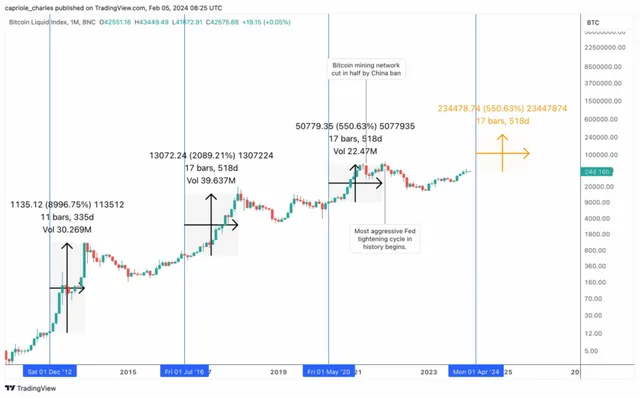

📈 Data Visuals

Image 1 & 2 portray expert‑compiled forecasts over time toward $200K–$500K territory.

🚀 Why Are Experts So Bullish?

Key themes behind strong forecasts:

Bitcoin halving (April 2024): Historically slashes supply growth and triggers post‑halving rallies above 100%, 200%, or even 600%

CoinMarketCap+599bitcoins.com+5CoinMarketCap+5

Crypto Data Space+1Coinpedia Fintech News+1.

ETF inflows & institutional demand: Massive flows from spot Bitcoin ETFs—over $38 billion in inflows from products like iShares Bitcoin Trust—are pushing prices

Crypto Data Space+2Barron's+2BeInCrypto+2.

Regulatory clarity & government engagement: Pro‑crypto policies like the U.S. Genius Act, Clarity Act, and proposals for strategic Bitcoin reserves boost legitimacy

Barron's+1Coinpedia Fintech News+1.

Macro factors: Expected cuts to interest rates, quantitative easing, weakening fiat currencies, and rising inflation make Bitcoin attractive as "digital gold"

CoinMarketCap

Investorsobserver

in.investing.com

Adoption growth: Citi analysts emphasize adoption rate as the primary driver of BTC’s value—how many people and institutions choose to hold it

CoinMarketCap+2ft.com+2swanbitcoin.com+2.

Ordinary People, Extraordinary Journeys

🎯 Didi Taihuttu: The Bitcoin Family

In 2017, Didi Taihuttu and his family sold everything to live purely on Bitcoin, setting an audacious personal financial experiment. They’ve traveled the world bankless and gained attention as “the Bitcoin family,” highlighting adoption as a lifestyle and freedom statement

Wikipedia.

🧠 Dadvan Yousuf: Algorithm to Millions

Swiss teenager Dadvan Yousuf turned early Bitcoin investments (purchased at pennies) into millions, later developing crypto‑prediction software based on macro and technical data

Wikipedia

. Though regulatory cloud formed later, this case underscores extraordinary returns from early adoption and quantitative strategy.

🏝️ El Zonte, El Salvador (Bitcoin Beach)

El Zonte, a small surf town in El Salvador, became a Bitcoin economy pilot. It inspired national legal‑tender status for Bitcoin in 2021. Property values surged ~135%, and micro‑economies formed around BTC payments—though only a minority regularly transact due to volatility and digital divide

Wikipedia+1The Times+1.

🏙️ Soweto West, Kenya (Africa’s Largest Slum)

A local initiative taught ~200 low‑income residents to use Bitcoin for payments and saving. Garbage collectors and vendors now transact via BTC, enjoy lower fees than mobile money systems, and gain entry to financial inclusion—while education mitigates volatility risks

How Cryptocurrencies Transform Lives

- Financial Inclusion

Crypto extends basic banking to unbanked communities. In Kibera, youth, waste‑collectors, and vendors access global money without formal ID or banks, simply via smartphone wallets and education efforts.

- Wealth Creation

Early adopters—like Dadvan or savvy retail investors—have achieved outsized gains. Even modest capital deployed before the halving cycles can multiply tenfold or more. Forecasts to $200K–$500K represent 2×–10× returns from 2025’s current $90K–$120K base.

- Economic Growth for Nations

Countries like El Salvador and Bhutan illustrate bold integration:

El Salvador legalized BTC, issued residency to large‑BTC investors, and experimented with government balance‑sheet holdings (~5,750 BTC) and geothermal‑powered mining systems

Wikipedia+3Wikipedia+3Coinpedia Fintech News+3

Bhutan uses hydropower to mine Bitcoin, selling roughly $100 million in crypto to pad government payrolls and diversify GDP sources (est. holdings ~30% of GDP) while remaining carbon‑negative

Wikipedia

- Opportunity at Scale

Real Bedford FC, a small English football club, rebranded under Bitcoin sponsorship, mixing crypto‑wages, merchandising, and digital fan‑engagement. With backing from the Winklevoss twins, it hopes to scale up the football pyramid—showcasing how Bitcoin reshapes business models and fan economics

Blueprint: How Anyone Can Become a Crypto Hero

Here’s how ordinary folks can ride this transformative wave responsibly:

Start small and educate: Learn wallet basics, security (seed phrase safety), and scams. Tools like crypto‑recovery services exist but prevention is better than cure

Dollar‑cost average: Regular small investments reduce volatility risk while capitalizing on long‑term growth potential.

Hold long‑term cycles: Analysts suggest 2025 targets up to $250K, with multi‑year peaks far beyond. Exercising patience yields outsized returns.

Diversify in crypto: Beyond Bitcoin, consider broad crypto exposure (e.g. ETH, stablecoins). They strengthen utility and financial resilience.

Stay informed on policy: Regulatory frameworks and ETF inflows are key price catalysts. Monitoring local government and global actions (e.g., Pakistan rolling out integration) keeps you ahead.

Impact at the Country Level: Real Benefits

🇧🇹 Bhutan’s Innovation Strategy

Bhutan turned surplus hydropower into Bitcoin mining income, smoothing salaries for civil servants and reducing brain‑drain. Holding meaningful BTC reserves (some ~30% of GDP) offers hedge against fiat instability and contributes revenue

Wikipedia

.

🇸🇻 El Salvador’s Economic Experiment

Bitcoin legal status brought tourism, international interest, and alternative remittance channels. Property value improvements in El Zonte reflect this surge, though widespread adoption remains low due to volatility and tech accessibility hurdles

Wikipedia

The Times

Wikipedia

.

🇵🇰 Pakistan: Mainstream Crypto Ambitions

As of July 2025, Pakistan’s government is fast‑tracking integration of cryptocurrencies into forex, banking and commodity markets—signaling nationwide modernization toward global finance trends

timesofindia.indiatimes.com

.

Future Outlook: Transformative Potential

If Bitcoin reaches $200K–$250K by 2025, even small retail investments (e.g. ₹10 K saved monthly) could transform household balance sheets. Skeptical? These expert forecasts hinge on adoption, halving logic, ETF flows, and macro‑drivers now playing out globally.

💡 Broader Benefits of Mass Adoption

Lower remittance fees: Bitcoin enables cheaper cross‑border payments, bypassing expensive traditional channels.

Financial sovereignty: Users control assets with self‑custody, reducing dependency on banks.

Currency hedge & inflation protection: In countries experiencing high inflation or currency devaluation, Bitcoin can preserve value.

Entrepreneurial ecosystems: As seen with Real Bedford FC or tourism in El Zonte, BTC unlocks new revenue and international visibility.

Conclusion

Bitcoin’s trajectory is more than price: it's about unleashing opportunity. From Tom Lee’s $250K to Chamath’s $500K, or Adam Back’s $1 million projections, crypto experts envision a world where measured adoption leads to exponential life changes. Bolstered by ETF expansion, halving events, and national adoption, those starting with small stakes today may stand at the threshold of extraordinary gains tomorrow.

Ordinary people—students, gig‑workers, small business owners—can become heroes of their own stories: securing financial inclusion, creating wealth, even lifting communities. Countries can diversify economies, drive innovation, and integrate into the new digital financial order.

So whether you're working, running a business or studying for exams, a steady Bitcoin plan—rooted in knowledge and discipline—could take you from zero to hero.