Lightning Strikes! Why Bitcoin is STILL a Bubble

Bitcoin and the cryptocurrency space as a whole has had a rough March. Bitcoin has fallen from above $11k to around $8k while altcoins have bled even worse as Bitcoin dominance rises.

As always, we're all looking for reasons why the market has fallen but I wanted to issue a key reminder that I (emphasis on I) still view Bitcoin and all other cryptocurrencies as a bubble. Very few of them fulfill the lofty goals people have set for them, with Bitcoin in particular hardly being used as a payment mechanism because of:

- Security concerns with holding private keys

- Immutability is a double-edged sword: Returns are a pain and mistakes can't be rectified

- The UI is awful if you can't use payment request QR codes

- The fees are volatile

- While payments may settle quicker than traditional systems when the network isn't under heavy load, the fact there are no "takebacks" or ways to "correct" a mistake after settlement means that it is inconvenient for merchants to accept zero confirmation transactions

- Price is volatile

- etc.

As a result, most merchants just use processors like Bitpay which instantly convert Bitcoin into USD, which in that case, is it really accepting Bitcoin anymore? It's just another method for accepting USD.

Several of these arguments hold up for all other cryptocurrencies as well, even if some solve the issues of speed of settlement and fees. Even for cryptoassets that aim to be platforms, like Ethereum, generally offer almost no decentralized applications that have any real use. It's also worth noting that decentralization is really not well-fit for mass adoption - Normal people NEED customer support and ways to fix mistakes, which truly decentralized projects can't offer reasonably.

The point isn't that blockchain technology isn't meaningful or useful, just that these cryptoassets aren't worth even remotely close to what they are being priced as today - so price doesn't need a whole lot of reason to fall for those who feel convinced for certain that the space is undervalued.

As for some catalysts that COULD be contributing to prices coming down, we discuss:

- Mt. Gox trustee fears

- Google Ad Ban

- US Congressional Hearing on ICOs

On the positive side, we discuss the first live beta implentation of Lightning by Lightning Labs. I'm super excited to see how it behaves in practice. Based on the amount of nodes we had using Lightning prior to this, it should be interesting to see what developers do now with the Lightning Lab implementation.

It's unfortunate that this news is overshadowed by price action (and yes, I am aware that I am contributing to that), but I encourage everyone to keep a close eye on what occurs on the main net and what developers have to say.

What are your thoughts on the market? I'd love to hear them - Thank you for watching / reading!

agree for the altcoins

Market cap means shit...

"Bitcoin is not used for payments" - maybe by you. I use it. And I bet even you use it for long term store of value.

Yep. People being happy to buy for cheap are right. Bitcoin is cheap and it was cheap at 19k too...

I think crypto is in a speculative bubble so the boom bust behaviour we are observing is not surprising. However the technology paradigm shift is not going away and as enhancements to the ecosystem such as the lightning network start proving themselves we will see increased adoption and consequent price uplift.

I don't believe so, I don't really think the technology being adopted means price goes up at all. If Bitcoin didn't have so many decimal points then yes, for it to be used more widely the price would need to go up, but it has many decimal places and so it's price certainly doesn't need to go up to be usable.

I agree with @cryptovestor that Bitcoin overall will not sustain these crazy prices long-term as people wake up and realize that these cryptocurrencies are not worth the prices and market capitalization that they currently have.

We could end up looking back in a year or so and asking ourselves what the hell were we thinking lol.

First of all, the market rose in the first place because of the ads and everyone knowing about bitcoin, cause a tremendous peak in price. But the moment everyone started to see a crash, everyone also paniced.

Second, the price is too high right now, and we can see that because people only invest in crypto because of the rewards and don't think of the risks.

Third, I think that the blockchain system can and will be used in the future.

Unfortunatly, the prices are caused by people, and if the prices lower, people can't handle a crash, because they only see their value decreasing, and if people withdraw their money, causes the dip.

We can also see that the market has now much lower 24h volume (beeing it today $16 623 182 325).

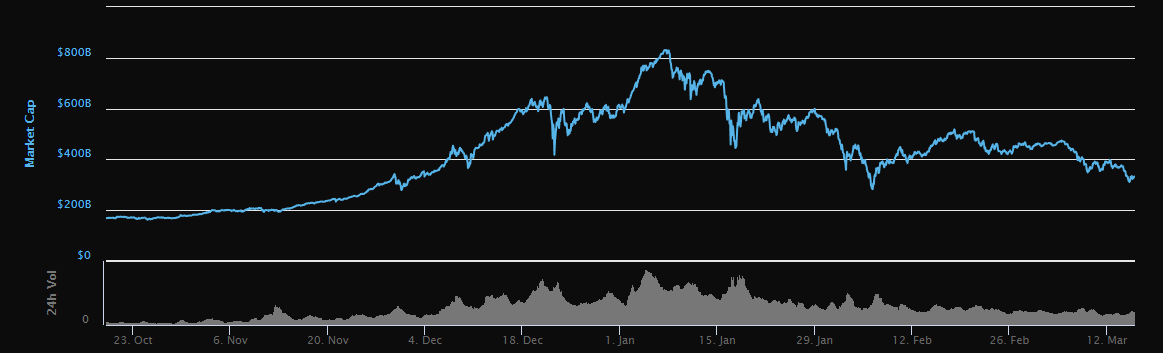

We can see a HUGE dip in the global charts, it almost hitted 850 billion dollars, and now it sits at 330 billion because of all the crashes.

But either way, I agree with the post, tell me your opinion on my comment, thanks!

I agree many people just got in it because it was the thing to do with out knowing what there were getting into. That is what created the rise so fast that no one knew what hit them. Now I think people are saying what did I do and want out because they were not really into it in the first place. That is why the market is plunging like it is. Great posting and comments keep it up and steem on.👍👏👏👏👏👏

thank you for your support!!! I really appreciate it!

Something that has become very frustrating for me on crypto space is the number of people who call themselves bitcoin maximalists or hyper bitcoinist and such and believe bitcoin is gold v2.0 and if you don't like the volatility the market is probably not your place... Interestingly, the more I get to know these kind of ppl the more I realize they don't have an skin in the game. Meaning, they talk about bitcoin and HODL like gold v2.0 while they have very tiny portions invested into it...

I am not against bitcoin and cryptos in fact, I truly love the technology but I cannot see the usecase and I think bitcoin and cryptos more than empowering the poor would actually weaken them at least couple of generations until cryptos develop to a level where manipulation and volatility would not take place anymore.

Just think about the poor people of Zimbabwe who bought bitcoin over 15k with huge premiums... Just imagine how poorer they have become ... It's interesting how no one talks about it anymore...

People should chill and be neutral about things.

One characteristic of a bitcoin maximalist is to have near 100% of his assets in bitcoin or be holding something else for a short term increase of his amount of bitcoin.

Bitcoin maximalist also understand money, while most people see bitcoin as a technology that can be obsoleted by antother one. It's simply not the case, Bitcoin is more than a technology it's an idea who's time has come.

V.

I do actually not agree with your comment. Because everyone gets pushed down when the market crashes, and everyone handles it a different way, but everyone feels fear to lose everything, no one wants to lose money. Of course, you have to be self-aware that you might lose everything, but the fact that you said "if you don't like the volatility the market is probably not your place... " is wrong, because if the markets go down, no one likes it, and if the markets go up, people who don't understand how this works just get greedy and tend to lose their money. "People should chill and be neutral about things." I agree, but it's inevitable to be neutral when we are talking money.

This news below is literally hours ago. This doesn't make Gold a non reliable asset, doesn't affect the value of person holding it, or make gold lose its use case.

I feel that this argument is on the same lines of "why do we need space exploration when there are people starving" argument. Not the same context but I can't help but see the similarity of these arguments.

A, everyone owe it to themselves to learn about market cycles before investing in anything. Including gold. Regardless of the asset you cannot expect any asset to only grow forever.

B, this needs to be compared to how hyperinflated their currency is in the first place. Zimbabwe's peak month of inflation is estimated at 79.6 billion percent in mid-November 2008. I know that's not the case right now but it is what resulted into this:

It goes without saying that you shouldn't invest all you have into crypto, regardless of whether you're poor or rich. There's a wrong time to invest in every asset. It's not like people who invested in crypto in the US or UK or somewhere else are better off. People have sold their houses or took a second mortgage just to invest in bitcoin at 20k and got rekt. For instance people have been calling Bitcoin dip to current levels since Dec 2017. If you fail to do the research, or ignore all the knowledgeable people in this space and put in everything you have who can you really blame but yourself? And I say that with the deepest sympathy to everyone who is invested in it and lost.

And if you're saying that now, the future is going to be even more bleak. Some analysts contend that there will be a centralization of the PoW coins toward one coin. Meaning people who have invested in smaller altcoins are going to be completely rekt at some point. What can you do right now to tell them to stay off of those coins? You don't even know if it's really going to happen. What if they turn out to be right and you turn out to be wrong and they become poor because of it?

I strongly disagree with your comments on the senate hearing. Overall the politicians were very interest and wanted to get educated. Calling them idiots is completely irrational. Of course it was not their field of experience, but it shouldn’t be. They are the experts in getting the right information and that was exactly what they did. They are working closely with the experts on the field and are trying to establish the right set of rules to help the industry as a whole and not harm it.

The only exception of course was Mr. Sherman, who didn’t understand anything what so ever.

You should watch the video of the hearing!

Thanks for another good video @cryptovestor. Appreciate the logic behind your belief it is a bubble. Got a question though, why is steem going down more quickly than btc when steem has actual intrinsic value?

While I generally agree with your thoughts and find myself in a similar position regarding being fully invested, I think it is important to note that current prices reflect the expectation of future value. Whereas a stock could be modeled to be the present value of cash flows, you can assume that some of these assets reflect a discounted future expected value given the realization of the adoption and use case of their corresponding technology. These valuations are currently reflected in the tug of war that is currently demand vs supply. It reminds me of the early valuations from Amazon when it took them years to turn a profit; despite that, they had multi-billion dollar valuations along with stock price volatility that sent the price soaring and crashing within a 18 month period. Technology continues to advance exponentially and the crypto space and its blockchain technology may be the next broad based application that grows in huge steps.

I agree, you don't want to be the last fool to invest into bitcoin when it's going to be accepted everywhere.

Bitcoin will be a multiple trillion market cap by then.

I do feel more positive for the future than last summer. Reasons:

So my view is positive and I believe that after the G20 summit, price will recover, since regulation wont kick in immediately and it wont be that bad as most believe. Regulation could be the door opener for the next bull market.