Bitcoin goes mainstream: S-curve of technological adoption

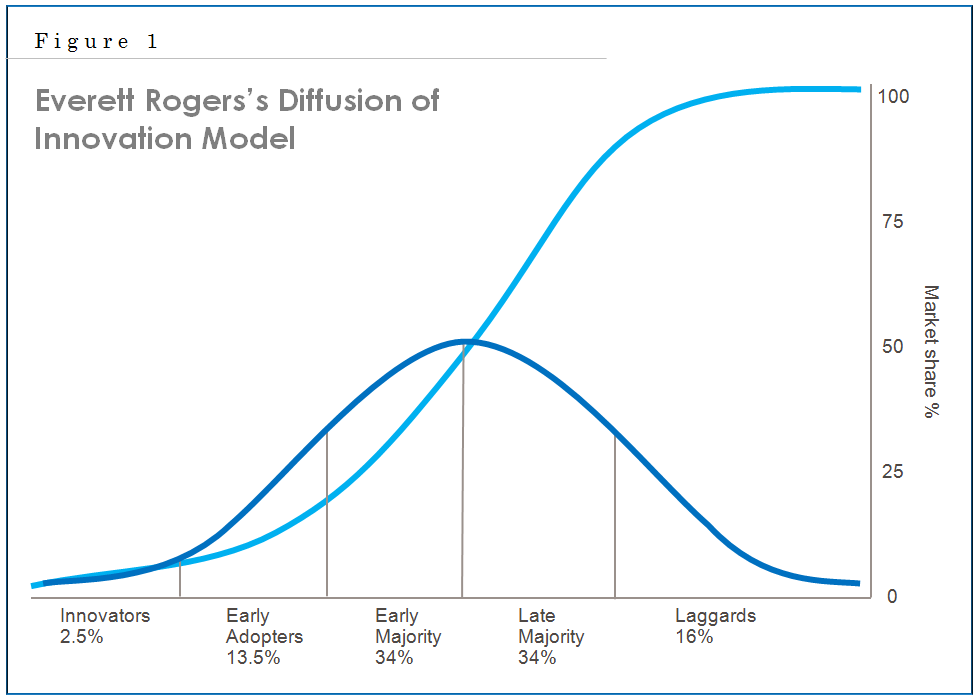

The most compelling demonstration of the widespread adoption pattern of bitcoin is the "S-curve of technological adoption" from the "diffusion innovation model" by Everett Rogers (Figure 1). The image of bitcoin, or cryptocurrency in general, becoming mainstream becomes clear when compared to the adoption curves of other technologies such as electricity, car, radio, telephone, TV, video games, credit cards, internet, cell phone, etc. This curve is shaped like an “s” on a spectrum of innovators, early adopters, early majority, late majority, and laggards.

The moment I was convinced that it is feasible that bitcoin, and its underlying technology, may be fully adopted and used around the world was when I united my understanding of the cryptographic developments it embodies, it as a form of money, and the S-curve of technological adoption it appears to be following as it grows.

- Bitcoin is based upon sophisticated, decentralized technology called blockchain that solves very important cryptographic problems, such as duplication

- Bitcoin can be quickly transferred peer-to-peer across borders with relatively low fees; it can be a store of value, medium of exchange, and standard of value

- Humans in the last hundred years have learned to adopt technology at faster and faster rates as demonstrated by the S-curve of technological adoption; bitcoin adoption is following this S-curve

How does anything transition from a state of zero adoption to complete adoption?

How long did it take humans to adopt the use of fire? Iron? Writing? How about electricity, the car, television, the internet, cell phones? The time it takes for humans to adopt a new technology is speeding up, immensely.

Michael B. Casey wrote an article posted on Medium that elegantly explains the technological adoption of bitcoin and its correlating value. Casey clearly presents this premise: “The growth of adoption of bitcoin and therefore bitcoin price is following an S-Curve of Technological Adoption, which is itself characterized by fractally repeating, exponentially increasing Gartner Hype Cycles.” His explanation of these ideas is so illuminating and inspiring that the credibility of bitcoin adoption is immediately elevated. Note: This post is not investment advice; bitcoin price could go to zero anytime (so could the dollar).

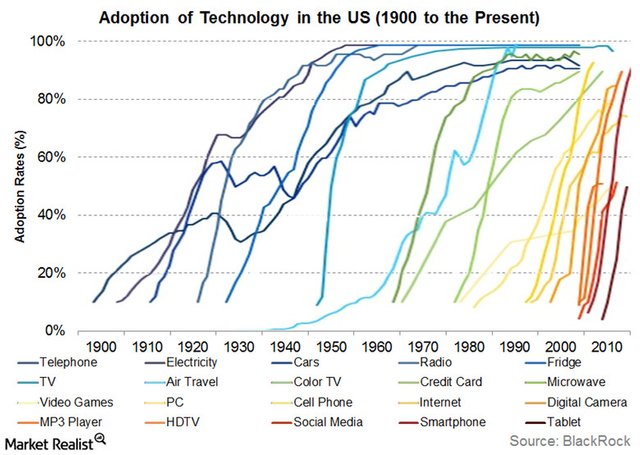

The curve of adoption represents time (x-axis) and the market saturation/adoption (y-axis). The curve can be steeper than shown in the diagram above. See the diagram below that shows the variations that occurred in adoption rates for various technologies, all forming the s-shaped curve. As for bitcoin, we are most likely on the cusp of the “innovators” and “early adopters” stages. The current status of bitcoin adoption is in its infancy.

As adoption increases you can imagine the line rising at a steep incline—forming the “s” in the process. Take a look at the lines representing the adoption of the “smartphone,” “social media,” and the “tablet.” Those lines are nearly vertical. In this modern day, humans are more inclined to be rapid adopters of technology. Plus, more and more people are gaining access to technologies as they become more affordable. For example, more people own smartphones everyday, such as in places like Kenya, Nigeria, and India, as demonstrated by the rise in provider subscriptions in those places.

What’s up with the bubbles?

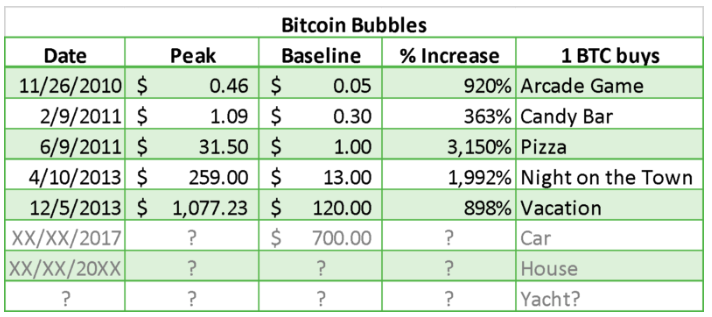

The multiple bubbles that have formed in the price of bitcoin are caused by hype cycles that work like a heartbeat, up-and-down. The hype cycles are marked by a price explosion, crash, consolidation, and then the next shoot up in price. This cycle repeats, but the overall pattern is an uptrend spanning many bubbles—slowly the price rises overtime.

Will the pattern continue? Casey theorizes that the pattern will continue. He created a table showing the price of bitcoin and the percentage increase following each bubble. He speculates that there have been five bubbles so far. After each bubble the price increase is higher than the previous one.

Casey theorizes that there will be at least two to three more bubbles. When these bubbles will occur is open to anyone’s guess. It may be accurate to assert that the S-curve will emerge in the adoption of bitcoin and/or other cryptocurrencies.

“The last bull run that happens will be the exponential increase that characterizes the S-curve; wherein the majority of the population of the planet will all adopt bitcoin in a relatively short period of time. This is known as the knee of the S-curve where it goes vertical and is likely still years away. When bitcoin takes over, it will happen quickly.”

I recommend that you read the complete article written by Michael B. Casey.

Source: https://medium.com/@mcasey0827/speculative-bitcoin-adoption-price-theory-2eed48ecf7da

This post is not investment advice; bitcoin price could go to zero anytime (so could the dollar).

I saw the explanation on a YT vid.

Although it is diffucult to belief it is possible. A s curve adoption will be faster nowadays since information are bein spread in less time than decades ago.

Upvoted.

Thanks for your comment. Yes, adoption of technology is speeding up! Cool article on Harvard Review on the topic: https://hbr.org/2013/11/the-pace-of-technology-adoption-is-speeding-up

by Rita McGrath