How to Set a Limit Order

Now that you’ve done extensive research and know what to buy, it’s now time to learn how to buy. By placing simple market orders, taking the best offer at the moment, you’re automatically paying a 10-20% premium, and here is why.

The crypto market is extremely volatile. Within the next week or two, it’s almost guaranteed that the price will fluctuate at least by 10%, either up or down, or even both. If you see a big green candle that has suddenly shot up, that is the worst time to buy. It’s more than likely going to come right back down again. Don’t FOMO (or panic with the ‘Fear Of Missing Out’) when you see that a coin has shot up 30% in the last day, as the chance to take a profit from that is likely over. Instead, it is much more likely to lose 20% of that over the next 48 hours, unless the growth is fueled by some huge news or a milestone.

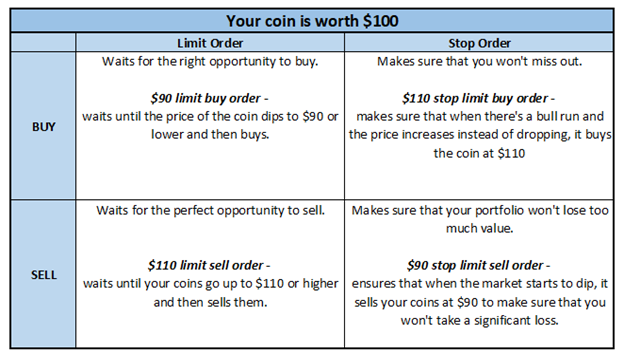

The way to get the best deal is by setting limit orders. A limit order is essentially saying “I am willing to buy this many tokens, at the price I have selected.” The order book will then automatically make that buy for you, if there is a matching offer. These orders don’t expire, so you can conceivably leave an open limit order for months, or even years, waiting to take advantage of the next dip, whenever it may be.

This strategy works when the market is calm and is not losing or gaining tens of billions of dollars every day. This will not work during bull runs when the price never comes down for several months, and by the time it does, you’ve missed out on huge returns. In the case of a bear market, you can also place staggered limit orders, buying a little bit at each interval as the price drops lower and lower.

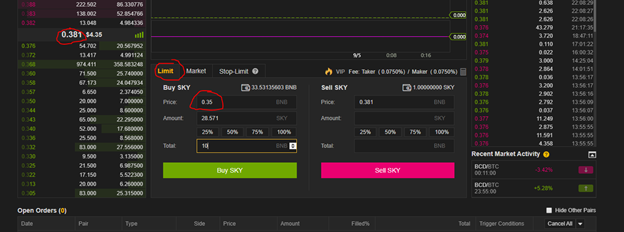

To place a limit buy order, let’s use Binance as an example:

First thing to note on the chart is the current price on the left, which changes in real-time. Next, select the Limit tab. Lastly, entered a price lower than the current price. If I enter a higher price, it will trigger automatically, and foolishly pay much more money, so be careful with this function.

Set your price lower in small increments, or even set multiple limit buy orders. Spreading the amount you want to invest on multiple orders that each have a lower limit gives you the ability to take advantage of a continuing downfall of the market and purchase quantities of your desired crypto at lower, and lower prices. This practice is often called dollar-cost averaging.

A 2%-5% swing is normal to happen, so if you’re looking for a substantial chunk of savings, set your limit really low and forget about it for a couple weeks.

In the bottom left corner, you can see it says, “Open Orders”, which will be changed to display your limit orders that have not been filled yet.

A limit sell order is the opposite. You set a higher price than what the current price is, and it will wait to match you with a buy order once the market price rises.

The Stop Limit tab is very similar, depending on how you use it. As mentioned above, if you put in a limit buy order higher than the current price, it will be triggered automatically. But a stop limit buy order will not trigger automatically. It will wait until the market climbs to that price, before triggering a buy. This is useful in a situation where you want to see some recovery in the market before buying into something.

The stop limit sell order can be used as a safety net to limit your losses. When you have set up a stop limit sell order at a level where you are comfortable selling your coins, then when there is a major dip in the market, the order will sell your coins at the level you have set, making sure that your crypto portfolio doesn't plummet with the market.

A combination of limit orders and stop limit orders can keep your investments within a safe zone, when you don’t have the time to wait for something to recover or normalize.

By combining all of these different orders, you can create a quite sophisticated trading system. Your limit buy orders make sure to take advantage of falling prices, while your stop limit buy orders are there to make sure that you won't miss out on the next bull run. The limit sell orders ensure that you will sell your coins at the most profitable moment and the stop limit sell orders are securing you against significant dips.

Of course, setting up such a system takes a lot of work, practice, patience, and even some losses. It's all a part of the learning process. If it would be that easy, everyone in the crypto community would be driving around in a ‘lambo’ (Lamborghini) and not just dreaming about it.

Like it is with everything, as you get more practice, you will become better. You will learn to recognize better buying and selling opportunities, and accumulate your fortune much faster with these methods as opposed to just simple market buys and sells.

Start with really small amounts just to get used to the tools; and don't trade when you are tired, as it is very easy to make mistakes when you are half asleep. In crypto, there are no take-backs, do-overs, or refunds. Everyone has to live with the decisions they make, so be alert, smart, and remember that trading is just the simple act of buying when it is red and selling when it is green, which is of course easier said than done.

Originally published at cryptofinance24.com.

You write well, @cryptofinance24!