The 24-hour stress test for Bitcoin cash has come to an end. This is the second stress test of Bitcoin cash network which has achieved a complete success. Although this is only a stress test, a lot of data is enough to illustrate the strength of Bitcoin cash in the field of cryptocurrency.

It is undeniable that there is a force based on the BCH community-driven stress test, and believers have more reason to believe that BCH can perfectly support the 8M block and even have the ability to support larger blocks!

What is a stress test?

Traditionally: Stress testing refers to placing the entire financial institution or portfolio of assets in a specific (subjectively imagined) extreme market situation. If assuming a sharp rise in interest rates by 100 basis points, a currency suddenly depreciates 30 %, the stock market plunged 20% and other abnormal market changes, and then tested the performance of the financial institution or portfolio under the pressure of sudden changes in these key market variables to see if it can withstand the sudden changes in this market.

In software testing: Stress Test, also known as strength test, load test. The stress test simulates the hardware and software environment of the actual application and the system load of the user's use process. The test software is run for a long time or a large load to test the performance, reliability and stability of the system.

In a sense, to break through the limits of bitcoin network payments, BCH was born as a bitcoin stress test experiment from 1M to 8M.

The first stress test of BCH:

On January 14-15, 2018, BCH ushered in the first stress test to test the block limit of 8MB. In response to the huge increase in transaction volume after BitPay and GDAX BCH payment, the scenario where the BCH network was heavily used and spam attack was simulated by BCHStressTest team.

Since this test of BCH was not explained in advance, it was used by people to maliciously destroy the reputation of Bitcoin cash and promote the congestion of the Bitcoin cash network. In fact, BCH fully demonstrates that it has a more absolute advantage than Bitcoin through this test. The reason why the unconfirmed transaction seems to increase is mainly because the test transaction uses the lowest fee. And through that test, we saw that the handling fee can still be at a lower level when the bitcoin cash transaction volume is very large. The first test showed that the BCH network can perfectly support 8MB full block operation.

The second stress test of BCH:

On September 1, 2018, BCH ushered in a second stress test. With the experience of the first test, the official publicity in early June that the second stress test will be hold in September. Testing is done in a trust-free way to avoid having one person control all the money. The test team created a website where people can upload signatures and raw transaction in advance. When the stress test is agreed, all transactions will be broadcast in a certain order.

What about the result of the second test?

It is reported that as of 13:00 on September 1, BCH supporters have uploaded 2.1 millions of transactions. According to the statistics of the past 24 hours, BCH Miners handled more than 2 million transactions. On the BCH network stress test day, the miners dig out lot of 4-8MB blocks, and some blocks have reached 9M, 10M, 13.5M, and 14M, with the largest block capacity reaching 15.2MB. The blocks excavated by Viabtc, BTC.top, Coingeek, BMG Pool, Waterhole, Bitcoin.com, etc. are much larger than 8MB.

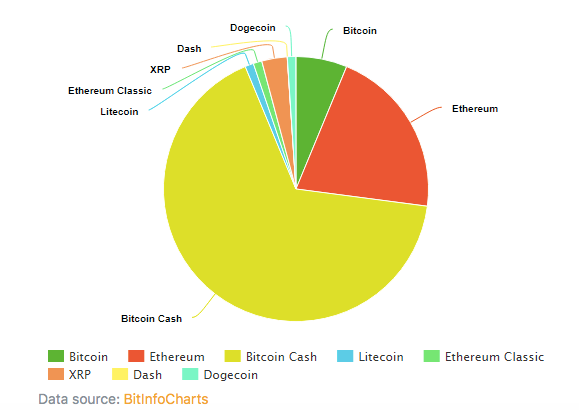

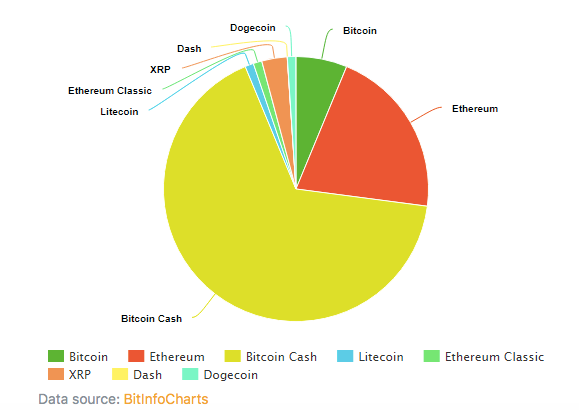

According to the analysis, the ability of the BCH network to test 23 transactions per second is far above the BTC's 3 transactions per second, and the TPS is much higher than other public chains. On the other hand, BCH's handling fee was $0.001 per transaction on September 1st, which was lower than before. It must be said that this stress test of the BCH network has injected strong confidence into the BCH believers, and also shows that the large block can improve the performance of the public chain.

Looking at the price of BCH, the price of BCH has been in the range of $500-550 throughout August, but with the arrival of the stress test day in September,the price of BCH broke through $600 in one fell swoop and surged to $660.but it has fallen back to $441 at the time of writing.

So, what is the operation behind BCH's second stress test and the soaring price of coins?

The BCH official wants to take this opportunity to conduct the BCH stress test as an annual event. It is conceivable that every year to the test day, it will be a big benefit for the constantly improving BCH network and stimulating the price of the currency.

In fact, this is only the tip of the iceberg, and since the BCH stress test day began on 20:00 on September 1, 2018, major exchange platforms have joined the BCH to issue relevant announcements.

What will this lead to?

Obviously, it will bring a wave of BCH lock position, which means that during the BCH lockout period, the exchange will suspend the withdrawal until the network is stable and then resume. The number of exchanges that have been counted has reached dozens, including Huobi Exchanges and Binance Exchange. Therefore, it must be said that behind the second stress test of BCH, it perfectly created a lock-up activity, which effectively promoted the rise of the currency price.

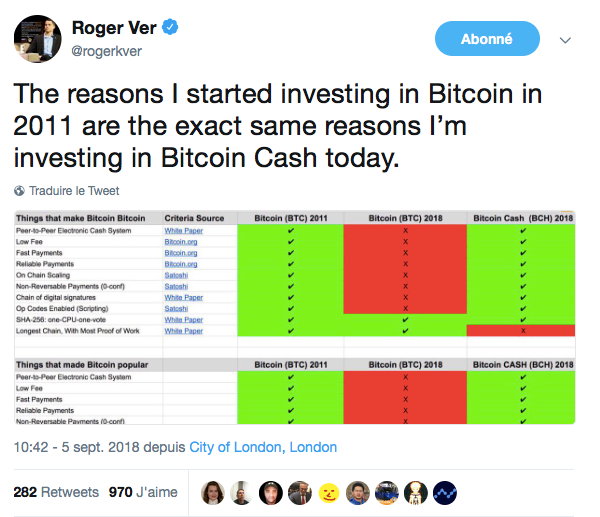

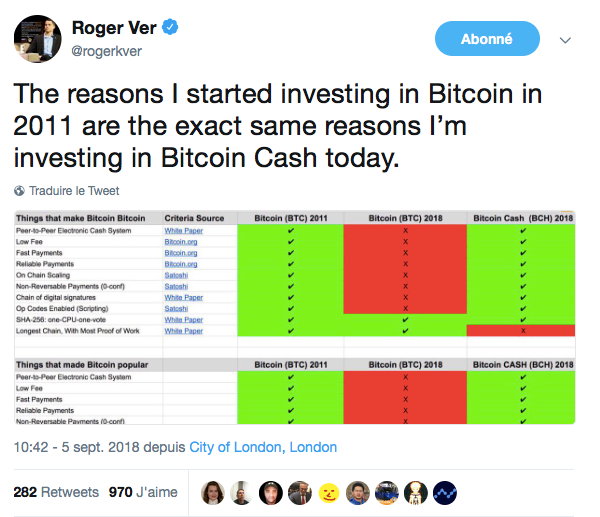

Moreover the last conference held on Coinbanks with Jimmy Song and Roger Ver has shown an extreme intensity within Bitcoin community due to the legitimate “Satoshi vision” to scale on-chain promoted and demonstrated by BCH community during the second stress test.

Which one will survive?

Check also our previous blogs:

Are Stablecoins a Cryptocurrency Volatility Solution?

For Crypto Rookies – What is cryptocurrency exchange?

The 3 Challenges Bitcoin Mining Are Facing With In 2018

ICO Supervison Is Still In The Era Of Grassroots

Blockchain community are dealing with big security challenges

Follow us

Twitter Facebook Linkedlin Instagram Telegram

I gave you a vote!

If you follow me, I will also follow you in return!

Bitcoin Cash can definately be the number one cryptocurrency as Lightning Network may kill BTC but we will see in the future BTC will definately rise and BCH but we need to look into the future not short term.

I don't see your logic. Bitcoin can't be killed by lightning network, which runs on top of the main net. Even if you support BCH over BTC, numerous cryptos (XMR, XRP, LTC) do the same things, and more, than BCH.

The competition to become the benchmark of crypto market is already owned by BTC and it will be very complicated to reverse it back. BCH could be recognized as the original Bitcoin code by organisations and institutions. Nevertheless BTC will stay for many the original Bitcoin vision which is to be a protocol layer for exchanging trustless value and not only digital currency.

The time will show us which one is legitimate