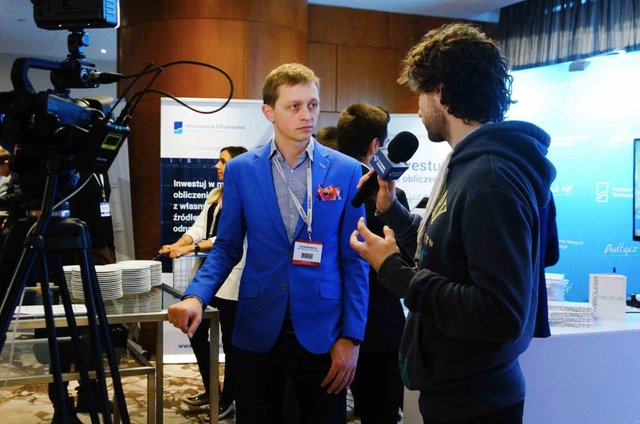

“Bitcoin is not a bubble, but a tiny pointed pin” – interview with Szczepan Bentyn

Do you remember the moment when you came into contact with the cryptocurrency market for the first time? How did it all start?

Well, it all began when I read an article on antiweb back in 2013, describing a conference on cryptocurrencies held in Toruń. I gave it a good read, became interest and came across a slogan presenting them as, among other things, a technology meant to change the world. Then I thought to myself: why not download this thing called Bitcoin onto my computer – which I did by getting Bicoin main client, only to find out in the process that synchronization with the network was going to take me seven days. It naturally got me thinking how on earth this could compete with, say, Paypal. That was back in March (April) 2013 and I gave that subject a total break.I came back to Bitcoin in December 2013, when it skyrocketed from 200 to over 1200 USD. I bought it almost at the very peak, getting hold of my first Bitcoin for 2700 Polish zloty (PLN). Then it kept tumbling down like crazy and I was merely learning that market at that time.

It was only when the price of Bitcoin went into free fall that I started reading extensively and learn what Bitcoin really is. That was the time, late as it was, that I started to discover why so many people claim that it is bound to change the world, and I fell in love head over heels. I got sucked in and fell right down the „rabbit hole” of the Blockchain technology, at the same time discovering in what direction it may push the world. Since that time, I’ve been a regular buyer, observer and a geek about those new, fascinating areas.

We would be eager to find out about the very beginning of your adventure, what was your goal back then and what it is right now?

Basically, I bought my first Bitcoin at the worst moment you could imagine. If you make the popular model of a speculative bubble as your point of reference, I bought it at the “Return to normal” stage.I bought my first Bitcoin on purely speculative grounds, simply thinking I will make a profit and I didn’t expect I would develop and popularize that technology in the future.

At the beginning of 2017, Bitcoin dominance level accounted for nearly 88%. Today it is just 43%. Do you think Bitcoin will remain the market leader and keep its position as the largest and most popular cryptocurrency? Or will it perhaps let altcoins take up the space?

In my opinion, trying to determine a leader using market cap as the key criterion is not a good yardstick. I view Bitcoin as something serving purposes that are totally different to, for example, Ethereum, and I can envisage a moment when ETH overtakes BTC in its market cap. However, this does not affect my perception of Bitcoin as gold and Ethereum as crude oil. No respectable trader compares crude oil to gold in terms of the market cap. This would be somehow loony.

Beginning of a new year/ ending of an old one, is a good occasion to draw some conclusions and make forecasts for the remaining part of the year. In your opinion, which cryptocurrency, within the next 12 months, stands the biggest chance of repeating Bitcoin’s success.

There have been plenty of interesting players that sprang up on the market and this is sort of one of those areas where I am wary of giving any tips or suggestions – nevertheless there are a few niches where several heroes may emerge.I look upon international settlements as one of such niches. We are talking about such players as Polkadot, Cosmos, Metronome or, in some respects, EOS. These types of cross-chain markets may turn out to be quite interesting and this is where I find it hard to pick my favourite. I think Polkadot is an interesting project that may come to the fore, particularly because it is supported by many “blockchain heroes” such as Gavin Wood.Projects such as IOTA or Raiblocks (recently rebranded as Nano) fit into one such niche that I would categorise as fee-less. Both of them are very interesting technologies; however, Nano seems to be more interesting in its very structure than IOTA. I don’t think they will repeat Bitcoin’s success, but both of them are niche solutions with a huge potential.

We have already seen the Bitcoin network split up by means of so called hard forks. Particularly the month of December abounded in them. Do you consider such diversification in the world of cryptocurrencies is a positive phenomenon or could it prove to be harmful to the market?

I am a big proponent of the Austrian school of economy and believe that the market will verify everything. I also think that, in a way, the market has already verified those hard forks and there is a certain niche for them. However, I am not able to say what it is like, nor how much it is worth or how it will work, so I can’t totally rule them out and say that hard forks make no sense and will never occur. If somebody can make money that way, they will take place and we aren’t able to prevent them from happening in any way.

Do you expect any hard forks through the rest of 2018?

Initially I came up with certain predictions that Bitcoin will be hard-forked extensively but it turns out that I wasn’t quite right, and it seems to me that this fashion for hard forks will go away and will stay here as a “mine of new economic theories” as this is something related to economy but has never been seen before. I think we won’t witness too many hard forks in the nearest future.

The growing popularity of cryptocurrencies among individual investors has naturally and increasingly been attracting the attention of regulatory authorities. Do you believe that regulation of cryptocurrencies is needed and, more importantly, possible at all?

In this case my answer will be contrary to prevailing opinions as there’s been a lot of talking about protection of individual investors and I am living proof of somebody who lost a lot of his savings investing in cryptocurrencies from the very beginning. I made all possible mistakes, like buying the very bottoms, selling even lower (after the bubble), then buying high, selling low, buying low and then buying extra coins at the very tops. I committed all possible mistakes that cost me tens of thousands of PLN. However, without them I wouldn’t have been able to draw the right conclusions. To be perfectly honest, I wish all investors same stupid mistakes that I made – and as quickly as possible.

Recently we have been witnesses to a historic bulls’ trend on the American stock market. Do you think that a possible crash and the emergence of a bears’ market may in any way strengthen or weaken the position of BTC and other cryptocurrencies as a means of value exchange?

As Lech Wilczyński and I like to keep repeating during our programme “Śniadanie z Bitcoinem” (Bitcoin Breakfast), Bitcoin is not a bubble, but a tiny poined pin and that is my answer to your question. We’ve been observing a bubble on shares, bonds or real estate that originates from excessive printing of money. We believe that Bitcoin is a pin that is going to, sooner or later, inevitably pierce this huge bubble.

I know that your investments are not limited to BTC only. How do you select coins for your wallet portfolio?

I actually take two significant factors into consideration:- The first criterion is whether I can believe that this may succeed.- The second key factor is for a technology in question to open up a new market that fascinates me. That’s why my portfolio includes e.g. Waves or Cardano, as I can see that they open up new markets which, from the perspective of rational thinking, must come into being sometime.

Do you invest in any assets other than cryptocurrencies?

I chiefly invest in myself, and that the book that I wrote is a manifestation of that, as well as my business activity and media engagements. Recently, I’ve been of the opinion that human attention is a resource with limited supply. If, as a journalist or an author, I am also able to attract a lot of attention, I perceive that as my capital. A vision of paying income tax on attention that one attracts seems plausible. [laughter]

What would you say is the most important tip that a person taking their first steps in crypto token investing should follow?

- Try to understand what you are investing in.

- Markets don’t care what you bought it for.

- Your portfolio balance will fluctuate more than you expect. It is bound to fall and rise much more intensely than you think. You need to be prepared for that.

- HODL is the best strategy – it costs the least time, nerves, attention and in the long-time perspective it allows you to earn more than through trading.

Tell us a bit about personal tokens. You have created Bentyn Coin, but also helped other Youtubers to develop their own coins. What’s the purpose behind them?

As I mentioned before, I am an enthusiast of new markets that this technology opens up. Personal tokens are nothing new in the context of blockchain, but require some sort of rerouting of you existing thought patterns, challenging some concepts that are imprinted on our minds.

A personal token is neither a share, nor a vote or a lottery ticket – nor an interest, bond, credit, loan - yet at the same time it encapsulates it all, while reaching beyond it all as something much larger. It is a souvenir of sorts, a collector’s coin. We must consider it in terms of an ordinary physical token. It is both everything and nothing, pure potential that can set a network effect in motion, i.e. if any people who bumped into me consider me as a person worth investing in, or they would like to have a share in my success, or in the attention that I generate, or in the influence I have on the society – they can have it all by getting hold of that token. This share translates into many other aspects and it demonstrates an extremely broad potential. When talking about personal tokens, one needs to make one thing clear – this is a new, fresh market, unintelligible to the old market and ever more by the old financial system. At the same time, it frees up incredible potential lying dormant in people.

In conclusion, I have one more question – when Bentyn Coin is going to make it to BitBay?

My priority is releasing my book and appearing on Kuba Wojewódzki’s show [laughter]. My dream is to finance an advertising campaign on TV at prime time from the sale of BentynCoins. That campaign would cover the whole Blockchain industry and cryptocurrencies – educational in its format, and then move on to a launch on BitBay.