Bitcoin registers the lowest transaction fees in the last six months

The Bitcoin network has recorded the lowest processing rates since six months ago due to the fact that different actors in the ecosystem have adopted the SegWit transaction processing method and the Lightning Network in their platforms.

According to data from the blockchain, for today the mining rates of the Bitcoin network are of $ 2.15 -according to the average, calculated as the sum of the value of the transactions divided by the amount of different values recorded-, being the average of 0.204 cents, that is, a calculation of the highest and lowest records. This decline has not been recorded in the platform for six months and that is found as lower than the rates of Bcash, blockchain that has built an advertising system around the offer of lower rates than the Bitcoin blockchain.

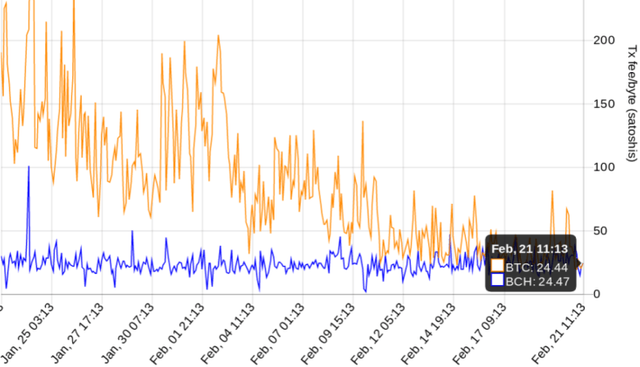

In terms of satoshis - which is the smallest unit to measure a cryptocurrency such as Bitcoin - a rate of 10,000 sats generates lower rates than the same minimum transaction in Bcash; being the difference in graphs of 24.44 stats per tariff for BTC and 24.47 stats for BCH on day 21 of the month of February.

The fall would mark a decrease of 97% in the price of tariffs, according to information from other sources. That is, around 0.79 cents less than the previous rates, which had reached up to 34 dollars per transaction during the months of greatest congestion.

This considerable decrease in the price of the rates in the Bitcoin network is accompanied by the recent adoption of SegWit and Ligthning Network in various community networks. SegWit has made it possible for 2MB blocks to be mined and has allowed faster transactions, although it has not been fully adopted by all users of the network; also more than 13 exchange houses and 12 purse services have also decided to adopt segregated witnesses in their BTC addresses.

On the other hand, Lightning Network has also capitalized important supports, updates and adoptions; As in the case of Microsoft, which spoke in favor of the application of this network, the first ATM also has the services of this platform incorporated into its system and the presentation of new tools that continue to specialize Lightning Network for the combination of multiple payments.

These two scalability proposals have captured the attention of the users and the bitcoin exchange and storage services. Specifically, they seek to generate better processing times, lower tariffs and greater storage capacity for the BTC; an approach that applied in macro seems to be beginning to give problems to Bcash's promises.

It was only a matter of time before the transaction fee problem got solved. If this trend continues via Segwit and other, future innovations, I wonder what it means for the long-term viability of BCash and competing blockchains. Bitcoin has first mover advantage and by far the largest mining and developer networks after all.