Gold & Silver Sill King Not Bitcoin / Crypto-currency

Personally I have invested in both gold and silver, as well as crypto currencies, and those who have traded along with me in my Crypto Splash Text have made huge gains. I wanted to take this opportunity to curb some enthusiasm and mania around crypto-currencies and reiterate why gold and silver are still king as far as the eye can see. This is my warning to crypto-traders about potential issues in the near-term.

The issue with Crypto-currencies

I have been covering the fact that institutional money and Wall Street are invested in Bitcoin. Contrary to what some have said, I do not believe that the crypto-currency market will survive a downturn in the US equity and bond markets, at least not initially.

In my previous article entitled “Wall Street Nailing Bitcoin, Manipulation?” I noted a correlation between the CBOE futures price of Bitcoin and the Bitcoin price. I have also noticed over the past few months a growing correlation between stock market action and the Bitcoin price. Thanks to the work of Gregory Mannarino, we know that there is a correlation between the bond market and the stock market since stocks are dependent on cheap money and credit. Hence the Federal Reserve keeping interest rates artificially low.

Today (January 10th, 2018) we had a selloff in the bond market which also put pressure on stocks. This panic also bled over into Bitcoin which was under pressure. It is clear to me that crypto-currency will not be a safe haven asset class if the bond market were to crash. I agree with Gregory Mannarino that inflation will cause cryptos to rise, but I disagree that they will be a safe haven in a crash.

This may not have been true a year ago, but institutional money is now in Bitcoin. The price action that we have seen --Bitcoin rising from thousands of dollars to tens of thousands of dollars in price-- is because the institutional money has moved in. And whether you like it or not, the big money controls the price movements of Bitcoin and subsequently all cryptos. This is true of all asset classes actually. The movers and shakers of the world have the funds necessary to influence price movement. When the inevitable bond and stock market crash comes, these institutions who are risk prone will move into what they know is safe. They will move out of Bitcoin because they believe it is a speculative asset.

Liquidity in this market is also a concern. Crypto-currency exchanges are primitive, glitchy, and hard to deal with. Those exchanges that provide an entry / exit point (crypto to USD and visa versa) have daily limits for withdraws and tend to have technical problems during times of heavy traffic when the cryptos rally or sell off. This is a bottleneck effect.

Institutional investors will panic sell Bitcoin because they believe it is too volatile to hold in a market downturn. They will do this even though they are wrong. On average, Bitcoin has gotten less volatile over they years. On a percentage basis, the Bitcoin crashes have become smaller and smaller.

The solution

These issues make it harder and much more risky to day trade, and a safer strategy may be to hold on for deal life (HODL). The idea of this strategy is to hold on to the long position in these cryptos until their price eventually rebounds, which, they always seem to do (at least in recent memory). A market downturn may force traders to become HODL’ers. Ultimately I believe that one or many of these crypto currencies will be used with more frequency to buy retail goods and may even be considered a systematic replacement of the dollar. Use this strategy. Otherwise I highly recommend that those invested take those profits out and / or roll those profits over into another asset.

A much better bet in this situation is to also hold gold and silver. The two metals have proven themselves to by a medium of exchange and a store of wealth long term for over 5000 years. Today, coins minted by governments are widely accepted and convertible into any currency with relative ease. Some banks in certain countries will exchange these coins for local currency on the spot. This makes them highly liquid and both metals are highly undervalued in my opinion.

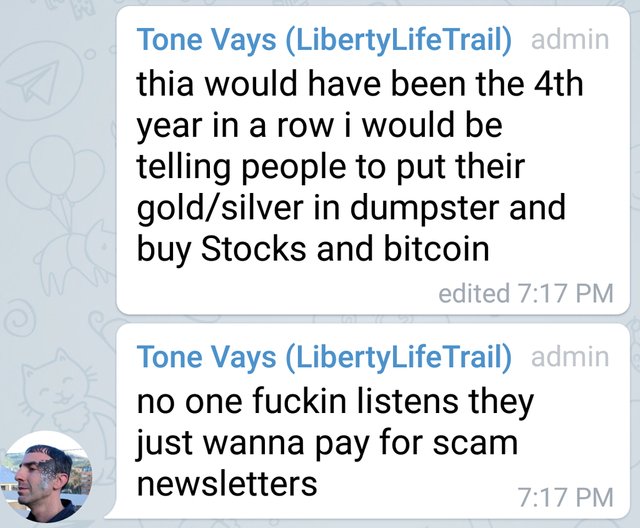

I have heard some very prominent crypto-currency advocates say that these metals are dead. Tone Vays in particular has told people to toss their gold and silver in the trash. Every time I hear a pro-crypto person say this, I cringe. These types of statements make the crypto space look bad.

Do they not understand that Bitcoin would not exist without silver? Every crypto-currency is held in a wallet on a phone or computer, both of which have silver in them. Every server farm that mines Bitcoin contains silver. Silver as an industrial product has a large amount of use in electronics. Gold may be a different story, it is no longer used as money or as much in industry, but central banks still continue to hoard it. In the future it will be used to settle global trade payments to some extent. If you need evidence that gold will be used by countries for trade payments, see any of my other work.

Bitcoin and crypto-currencies are an exciting, new, and promising space. However, they have major flaws still, and have a long way to go to prove themselves as a store of value over a long period of time.

If you would like to trade cryptos but would like to follow along with objective traders. Join my crypto splash text. https://steemit.com/bitcoin/@bretjfeller/trade-bitcoin-and-cryptos-along-with-us-splash-text

Are you considering the drop and subsequent panic selloff caused by https://coinmarketcap.com decoupling prices from the Korean markets? https://www.reddit.com/r/CryptoCurrency/comments/7oxivj/cmc_just_tumbled_the_whole_market_with_one_move/

Scotter:

That said, I think it is smart to put some silver rounds in a safe. I just wouldn't write off crypto so quickly. It could be my bias based on being through so many drops over the years.

Not sure what is causing the market action this morning, I know that Asian markets have a huge stake and influence a lot of the price action. However I do believe that 2018 will be good for cryptos. These are some general concerns that I needed to address. Yesterday China was able to rock our markets with just a rumor. I would make sure you position yourself for this environment if you haven't already done so. A rational approach is the way that I invest.

Interesting view, agree blockchain technology is new, much is still to be done. Each day new problems arise that require rethinking, I would think banks had the same problems when first setting up.

Any metals used in developing technology will make a good investment, technology is not going away.