Is a Bitcoin ETF Off the Table for 2019?

Previous ETF proposals have been rejected by the SEC over concerns of manipulation and fraud. Bitwise, however, is not giving up. Its presentation to SEC commissioners Robert Jackson, Hester Peirce, and Elad Roisman argues that the Bitcoin "market has materially improved in the past two years."

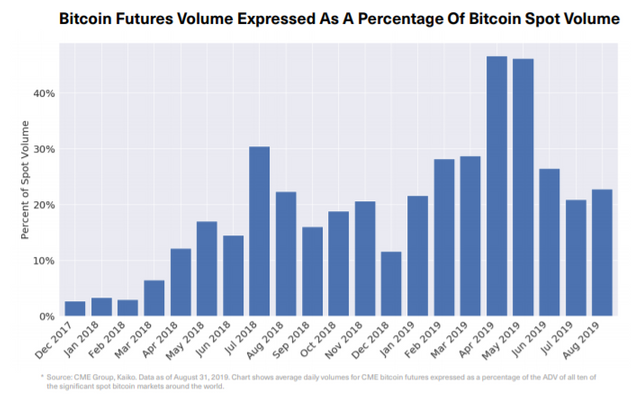

Fake volume, which was found to represent up to 95 percent of the reported Bitcoin trading volume when Bitwise released its May artificial volume and wash trading report, is now said to represent just 12 percent of trading activity. This is the result of reputable exchanges like CME carving out a bigger slice of the Bitcoin market, and smaller exchanges giving up the notorious practice of wash trading.

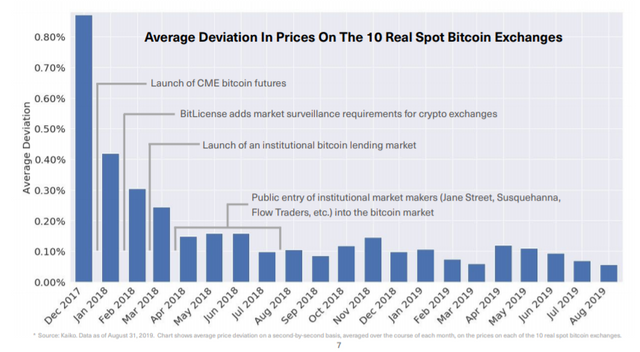

The average deviation in Bitcoin prices has also reduced significantly since 2017, which Bitwise attributes to the launch of institutional platforms, the introduction of market surveillance requirements, and the entry of big-name Wall Street firms as market makers.

These developments, however, still seem unlikely to convince the SEC that a Bitcoin ETF is ready for mainstream use. Comments made in a speech by SEC chairman Clayton two days after the presentation suggest Bitwise has failed to persuade the regulators.

“If [Bitcoin investors] think there’s the same rigor around price discovery as there is on the Nasdaq or New York Stock Exchange... they are sorely mistaken,” said Clayton in an opening discussion at the Delivering Alpha conference on Thursday, September 19th. "We have to get to a place where we can be confident that trading is better regulated."

Expect an ETF in 2022

Crypto lawyer Jake Chervinsky, who often deciphers legal issues around cryptocurrency for his Twitter audience, also suggests that the SEC is unlikely to be persuaded by Bitwise.

Speaking on the Ledger Cast podcast in early September, he gave his take on why Bitcoin ETFs have been rejected, and arguably sketchier ETFs for obscure assets like Uranium have been approved.

The SEC's major objection has been manipulation, which Bitwise has responded to by

pointing out the sources of fake volume, and excluding manipulated exchanges from those that make up the proposed ETF.

But as Chervinsky says, it's not about eliminating manipulation, "but making sure that the SEC or any other authority can detect and prosecute manipulation when it happens."

To achieve this, the SEC needs a "surveillance sharing agreement," where exchanges can share details on trades via a central agency with regulatory authority.

But even if such a surveillance system was in place, manipulation could still be a problem on Bitcoin exchanges the ETF doesn't draw data from, and which aren't necessarily going to cooperate with a government investigation into manipulation.

"I would say you can probably manipulate the price of Bitcoin if you have enough money by just going on Bitmex and Binance, and those two exchanges are not entering surveillance sharing agreements with Van Eck or Solid X," said Chervinsky on the Ledger Cast.

As the SEC runs on incentives from the legacy finance industry, it has little to gain from approving an ETF, leading them to make an "instinctual choice that they don't want to give their stamp of approval to Bitcoin markets."

This instinct could be credited with creating the pile of rejected ETF proposals, which includes several different incarnations of the Van Eck Solid X ETF, and the Winklevoss twins Bitcoin ETF from July 2018.

Nevertheless, the proposals keep on coming. After pivoting to offer an over-the-counter product exclusively for institutions, Van Eck have withdrawn their ETF proposal, but have not given up, with director Gabor Gurbacs tweeting that "bringing to market a physical, liquid and insured ETF remains a top priority."

In the meantime, the SEC is considering the proposal filed by Bitwise with NYSE Arca, which will be approved or rejected on October 13, and another hybrid ETF proposal from Wiltshire Phoenix which is based on both bitcoin and U.S. Treasury bonds and faces an initial deadline at the end of September. According to Chervinsky, however, these proposals are likely to be rejected.

"There will be no Bitcoin ETF until either (1) Bitcoin's market structure and reputation improve enough to satisfy Chairman Clayton's concerns, or (2) his term expires and someone with a more positive view takes over. If (2), expect an ETF in 2022 earliest," tweeted Chervinsky.