Every Bubble Finds its Pin

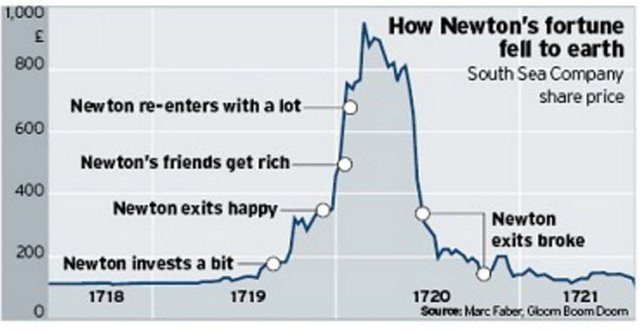

Sir Isaac Newton famously forbade people to speak the words “South Sea” to him after going broke in the South Sea Company stock crash in 1720:

If the inventor of calculus couldn’t recognize a bubble, what hope have we?

As Bitcoin's price trajectory tilts towards 90° and aims for the moon, more and more people are asking what cryptocurrencies are really worth. As stressed by the recent episode of The Big Bang Theory, we’re 8 years into the “internet of money” and still you can’t even buy a cup of coffee with your Bitcoin. So what's fueling this wild increase in price?

Its mass adoption? Impending mass adoption as money seems unlikely - who wants to spend a currency that's mooning in value, when it could be worth 10% more in one day? On the other hand, who wants to accept as payment one that's plunging?

Its competition with established monies? For now, Bitcoin isn’t very user-friendly, and can’t compete with most government-backed currency in making fast, free, and when needed, disputable transactions.

Its store of value? These days even minor cryptocurrency news seems to spark panic buying or selling of Bitcoin, and so we see that it can't yet be considered a store of value. So long as the price shoots wildly up and price discovery is avoided, people will fear a crash, and indeed fear alone could trigger one any moment. But if the price fails to appreciate, the price speculators could bail, also causing a crash.

Despite this last point, in my opinion the store of value case is the strongest in the short to medium term. Many people are eager to put some of their savings into Bitcoin with it's firmly capped supply, and ditch their local fiat before it looses anymore value to money printing. If, during the next banking crisis, a government confiscates its citizen's savings accounts like happened in Cyprus in 2013, people with Bitcoin may be able to keep their money safe. But until Bitcoin’s price stabilizes, buyers holding for these reasons are just speculating, hoping it will someday fulfill this store of value need.

So, to me, some interesting questions form out of this reasoning: will the Bitcoin store of value prophecy self-fulfill before a pin finds this bubble, or will it pop like the dot com’s bubble, allowing for mature cryptocurrencies to slowly rise out of the wreckage? Or will something else happen entirely?