Bitcoin Price Technical Analysis : Outlining the Price Manipulation and Long Term Trend/Targets

Bitcoin Price Analysis 6–27–2018

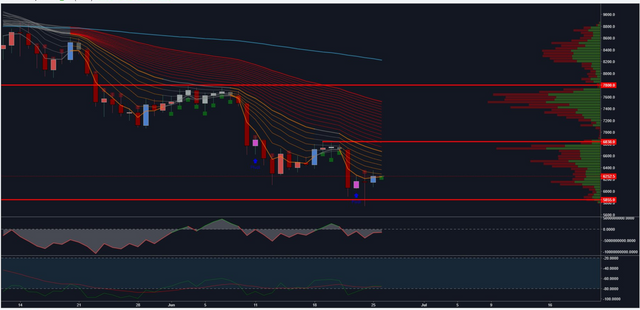

Bitcoin price has been falling through the floor for quite some time now. It's testing all support levels and breaking them one by one. The time of writing this article, Bitcoin price is hovering around $6000 and testing the very next support level.

Before we proceed further, let us look at whats affecting the BTC Price action:

The bear market still continues and there's no one specific fundamental reason why Bitcoin price is dropping. It's an amalgam of all the negative sentiment around Bitcoin for quite some time now.

However, the recent price drop was mainly due to fear over-regulation/ban of Bitcoin and all other Crypto Currencies in India. Supreme court is geared up for hearing on Bitcoin 5th of July. We should see furthermore price drop during this hearing.

When the fundaments are so strong, it's not advised to solely rely upon Technicals. However, am listing out the levels that you can target if you are a long-term trader. Even if you are a day trader, here am outlining few important levels for placing stop losses.

Without further ado, let's jump to Technicals:

Bitcoin has seen a major downside trend on 22nd June after a couple of bearish news breakout. The movement was pretty sharp and tested 5800 support price.

Whales Price Manipulation

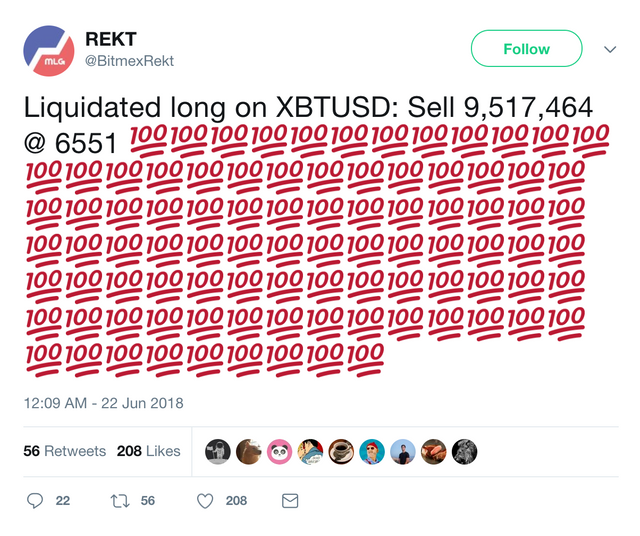

Once the price movement was sharp, all the long positions were liquidated on leveraged trading platforms like Bitmex.

Understanding Liquidation - Liquidated long means, all the open long positions have been liquidated/squared off as the position has reached its stop-loss limit.

Once the price started moving downwards, its a general tendency of traders to get FOMOed and open short positions immediately based on the market sentiment. This is where things turn ugly. Bitcoin has been heavily manipulated since a very long term. Though Bitcoin cannot be manipulated in the long-term trend, it can be easily manipulated in a short trend. This is where Whales make use of leveraged trading and maximize their profits.

As soon as the long positions are liquidated, the position underwent a short squeeze. Short Squeeze refers to a price movement - when a stock is heavily shorted, a rapid movement in the upward direction which leads to liquidation of the shorted position.

As soon as Whales saw the opportunity, they flooded Bitmex with long positions resulting in a sudden jump in the price action as shown below;

We all know Bitcoin is highly volatile but this kind of price movement within 2-4 hours is something liquidated both high leveraged long and short positions. Basically, Whales took this opportunity to heavily flood with orders to manipulate market for mass liquidation.

What's next immediately?

Bearish trend still continues. We see a further downside in the upcoming days testing $5500 level, upon breaking this leaving there could be a rapid sell off to $4200 - $4400 levels.

Long-Term Trend Analysis:

If you are a HODLER just like me, here's good news for you in the long term. In the upside movement, immediate resistance is at $6800 level, upon breaking this levels, $7800 could be easily achieved. However, there will be a bearish trend before the market moves further up from these levels.

Below is a weekly chart, which shows $4200 will remain a massive support and the market should bounce back from this price level.

Good study @bitpopsy