Investing in ICOs

Investing in ICO’s has to be looked at from the venture capital perspective as it is essential venture capital fundraising with the world.

The investment strategy for venture capital is different than other investments. With venture capital, investors realize that 90% of what they invest in are going to fail. But, they also know that 1-2 winners will pay huge returns and hence pay for a lot of losers. So if you invest in 100 ICO’s and 95 of them fail, 4 break even, and 1 goes 150x you still made a good return on your investment.

So keeping this in mind its best to invest in ICO’s that have a high reward potential, as all ICO’s inherently already have high risk.

Think of it as being a very large and powerful homerun batter in baseball. Your swing is the fastest and most powerful in the major leagues, but it's also the most unreliable and very rarely to you get a hit. However, when you do hit it you hit it 1000 yards.

In fact your batting average is .01 or 1% of the time you get a hit. But if you hit it 1000 yards nobody cares about all the strikeouts you are the baseball hero anyway. That is ICO investing. But, its still important that you practice your swing, do your research, and swing at the right pitches. Otherwise chances are you will never hit a homerun.

ICO’s Introduction

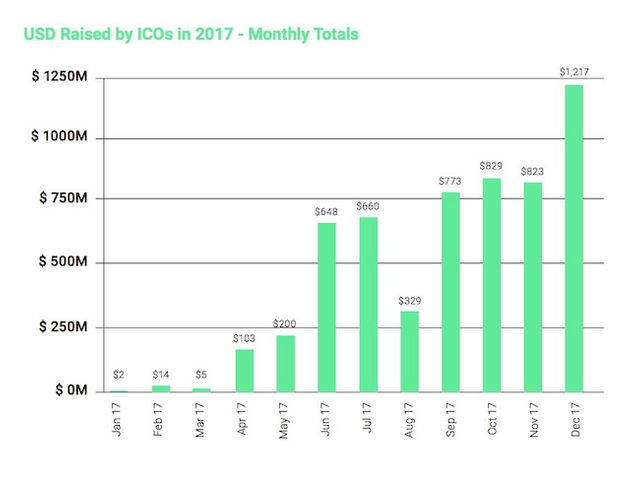

From January - July of 2017, Initial Coin Offerings (ICOs) has raised a staggering USD $1.25B. That’s well over a Billion USD in less than a year. Cryptocurrency, having a total market capitalization of over One Billion dollars in just 7 months drew a lot of attention from traders wanting to make a quick buck, but to experts lack of transparency was concerning.

Total Capital Raised from ICOs in the first 7 months of 2017

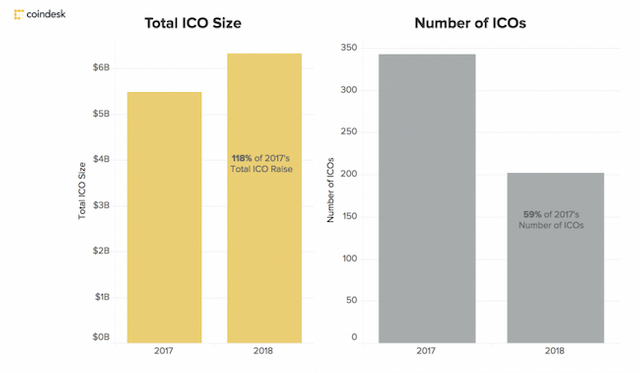

Furthermore, in just the first 3 months of 2018 (which turned out to be the top of the hype cycle), ICO’s has raised more money than the whole of 2017, according to data collected by CoinDesk.

First quarter 2018 ICO funding was a staggering $6.3 billion, which is 118% more than the total for 2017.

What’s an ICO?

An initial coin offering (ICO) is a means of venture capital crowdfunding , through the release of a new cryptocurrency or token to fund project development.

Now we have over 1,000 different coins/currencies available on various exchanges, and hundreds more are on their way to being listed. Another essential thing to understand is that, not all cryptocurrencies have their own Blockchain. Most are created on top of another coin’s blockchain, like ERC-20 tokens, which represents a standard of interoperability within the Ethereum Blockchain

Most ICO’s are not new blockchains themselves rather tokens built on top of other cryptocurrencies blockchains. Being a general blockchain Ethereum has become the standard for issuing tokens. The protocol for these tradable tokens is referred to as ERC20 tokens. So when you hear ERC20 just think tokens built using Ethereum, not a new blockchain or anything original.

Advantages of ICO

Global Access: ICOs gives people around the world access a venture capital type of investments with the big boys. “High risk = High reward” investments are now no longer just for the banks or for venture capital! Anyone in the world can now invest.

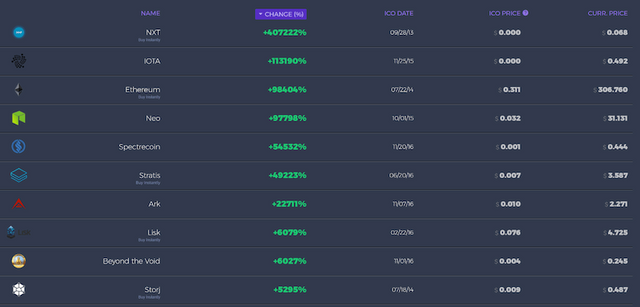

High Reward Potential:" People are looking for the "Next Bitcoin" and the change to get thousands of times return on their investment. ICO's have actually been an effective way to do this. Just look at some of the extremely high returns below.

Returns on Investments (USD)

(Source: https://icostats.com/roi-since-ico)

Main Issues

No clear Regulation: Investors are used to having regulations protect them from bad investments. However, in crypto investors are responsible for protecting themselves. There are no regulators so it’s important to do your own research as their is a chance that the investment your researching is just a scam and nobody is going to bail you out if you make a bad investment.

No Track Record: Many ICO's are just ideas without products yet, just an outline of how the coin will work in a conceptual white paper. Not only that, ICOs have been asking for an incredibly large amount of funding. The recent Tezos ICO raised 232 Million! That is an unheard of amount in venture capital. And they didn't even have a working product at the time (currently the tezos network is now live and functioning).

How Can I Participate?

Step 1: Research on Upcoming ICOs

A lot of websites lists upcoming and ongoing ICOs. Knowing about ICOs before they come out, gives you time to plan ahead. Most popular ICOs usually have limited coins to offer, so you have to register in advance to be included in whitelist.

- Website that Lists Upcoming and Ongoing ICOs

- Community Sources/Forums that feature ICO discussions

Step 2: Perform Your Due Diligence

You should research on your own and judge an ICO yourself if it’s a project good enough for you to invest in. Look at reviews and analysis by others. Good ICO review resources usually include:

- Fundamental analysis of ICOs through a dedicated website like Crush Crypto

- Reviews done by community members like Reddit, bitcoingarden.com, bitcointalk.org and the likes.

Step 3: Manage your own keys

If you are going to participate in an ICO it's important that you do it from a wallet you manage not from an exchange like poloniex or a non-custodial wallet like coinbase.

There are many wallets out there, CryptoROI recommends Coinomi. Coinomi is a non-custodial meaning (you ALONE own your crypto). We recommend this wallet as its easy to use and generally a good multi-wallet for all bip-39 cryptocurrencies. But the main reason we recommend it is that it is very easy to add/send/receive ERC20 tokens.

MAKE SURE YOU KEEP YOUR BACKUP PHRASE SECURE. I am sure coinomi will instruct you this I just want to emphasize as if you lose the backup phrase you lose all the crypto for that wallet.

Step 4: Participate in the token sale

Token sale procedures are different for every ICO so it's hard to inform you how to do this. However, most if not all of them will accept BTC and ETH which you can send from your coinomi wallet.

Wrap up:

Again I want to emphasize that ICO investing is extremely risky. It is likely that most if not all of the ICO’s you invest in will fail or not make you any returns. It is also possible that as regulators continue to crack down on ICO’s even some good ones could get shut down by governments.

But, at the same time, if its a good enough idea with a huge potential impact all it takes is 1 winner out of 100 losers to make a profit. As such only invest a maximum of 1% of funds you have allocated for ICO’s (max 10% of portfolio should be ICO) in any 1 particular ICO.

Go at ICO investing like a home run hitter in baseball. You'r either going to strike out or hit it 1000 ft. If you bat enough times, do your research, and pick the right pitches to swing at you too can hit a ICO home run and profit off of ICO’s.

Congratulations @bitcoinlending! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Congratulations @bitcoinlending! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: