Bitcoin will kill Banks not Banking

"Once the free money music stops, Banks will change much faster than we think”

"Once the free money music stops, Banks will change much faster than we think”

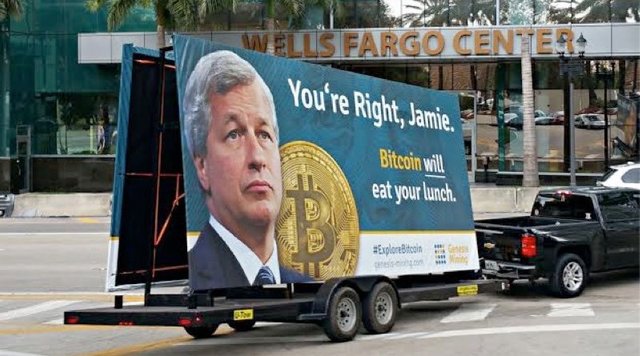

Revisiting the statement “Bitcoin is a fraud” from one of the worlds largest banks CEO JP Morgan CEO Jamie Dimon. I think it is important to remind people that banking is a legitimate service that is here to stay. Notice I said banking and not banks, as anyone who understands cryptocurrency knows the current fiat banking system is a horse and buggy system with cryptocurrency being the introduction of the car.

In this analogy of a horse (fiat money)

buggy (current banks)

it's important we remember banking = transportation. Doesn’t matter how you do it, banking is at its core allocating money over time for benefit of both parties and profit. But, this is a very easy to confuse as today as when we think of banking we primarily think the buggy and our ride is and forget about the horse.

Bitcoin does not allow you to be your own bank

First I want to clarify that their are some who will say Bitcoin allows you to be your own bank. This is completely false as you cannot borrow money to yourself.

What is the Banking Service?

Simplified a bank provides the following services.

- Make Money Digital and Easier to use

- Provide High Security at a Low Cost

- Holds and lends out deposits to make loans and generate interest

+$ +$+$+$

- Provides Credit to Borrowers

- Interest Bearing Savings Accounts

If you polled the general population of 1st world countries and ask them what services banks provide? I think, #3 “Make Money Digital and Easier to use” would be a very popular answer. It is only a part of banking, but it's the part users pay attention to. As the world has gone digital, Banks (buggy) have given customers what they wanted and for this analogy they have added radio, climate control, air ride suspension, and everything else the user could want in their buggy. These features require a lot of modification to the buggy generators, batteries...but the buggy is still pulled by a horse.

For one that understands cryptocurrency. We realize it's much easier to have all these nice features on a car. After all, the car already has an engine and electronics so adding these comfort features is much easier when you already have an engine. And with an engine you are no longer limited by the horse (fiat money) and you can do many more things and go much much faster.

Why is fiat money a horse?

Fiat money is the horse in this analogy because it is restrictive to the main goal which is travel. But, like the horse, until the automobile came about it was the best and fastest form of travel out there.

The word fiat means “by decree”. So fiat money means “money by decree”. Without going into detail governments simply decree that this money they made has value and because people believe in governments it gets value. Fiat money is not backed by gold or anything valuable. It is printed out of thin air by governments.

Governments are slow and restrictive.

For anyone that has interacted with the government this statement will make sense and the analogy of governments being horses will make sense. Like horses compared to cars, Governments are slow and full of shit. If you look at anything the government does (besides war) its years behind in technology and moves at a snail pace (US postal service for example)

Banks can make their buggy as nice as they want, but when they are reliant on governments for issuing, monitoring, regulating, and taxing the money they made out of thin air they can only do so much.

How Banking Service looks with Cryptocurrency

Just like back in the day when travel without horses was hard to imagine. It's hard to imagine banking today without fiat. And while its completely speculative now envisioning how the world of cryptocurrency banking will look, there are already some examples of banking services being provided using cryptocurrency.

#1 Make Money Digital and Easier to use

This service is innate to cryptocurrency as it’s already digital money. However, one could argue it’s not that easy to use yet. Fiat money isn’t digital by nature, but it is easy to use. Just slide your credit card here and even though the horse is moving behind the scenes, it’s easy for the user.

Cryptocurrency is quickly becoming easy to use though. A good example is the Bitcoin Cash wallet HandCash. Download, backup to google drive, and send money to others in many denominations instantly and almost for free using $cashhandles such as $devon. It’s one of the first examples of cryptocurrency being as easy to use as an email account. Overtime it can safely be assumed that cryptocurrency will become easier and easier for users to use.

#2 Provide Security

Many depositors in traditional banks only deposit their funds for the security and actually receive little to no interest on their holdings. This is a viable service with fiat money as it is not efficient for everyone to have a large vault and security system in their homes. So banks can install good security and serve many people a high level of security at just a fraction of the price.

Cryptocurrency by its nature is extremely secure. If done correctly a cryptocurrency wallet can more security than the multi-million dollar systems banks use. So while this is the case, the weakest point of cryptocurrency security is always the user. However, it is becoming easier and easier for average users access a higher level of security at little to no cost. 2FA enabled custodial wallets such as EDGE wallet, and hardware devices like ledger help users access high security in a easy affordable way.

#3 Holds deposits and lends out money to generate interest  +$ +$+$+$

+$ +$+$+$

This is arguable the most important, profitable, and difficult things banks do. Making the decision on how much credit should be granted to someone and at what interest rate is no easy task. In normal banks, professional bankers take on this tasks and a vast amount of historical data is there to assist them in accurately determining credit. Bankers are then rewarded for providing a good service in the form of profit from interest.

With cryptocurrency this problem is not effectively solved yet but there are companies and solutions starting to take shape. Btcpop.co for example is a 4 year old P2P cryptocurrency lending platform and exchange that has been making progress on this service. Btcpop provides tools for borrowers and depositors to interact directly without a banker in the middle to do finance. Borrowers verify their identity and create loan offers at their terms (length, payment frequency, APR%, collateral) and publish them to the loan market. On the other side depositors act as their own bankers and choose whether or not to invest their funds in those loan offers to earn interest on their deposit.

The system seems to work well, however it’s still very new and without an established identity and credit rating system the only way to get a loan is with lots of collateral in the form of altcoins. Also with the volatility of Bitcoin and cryptocurrency in general (+- 1000% within months) the industry has learned the hard way that banking in these currencies is very hard and multiple companies like btcjam failed.

-

Fiat/Crypto Hybrid Banking

In the meantime hybrid cryptocurrency banking has been dramatically rising in popularity. Multiple platforms such as SALT, NEBEUS, Blockfi and multiple others offer the ability to take out loans in a stable fiat currency using cryptocurrency. Like Btcpop because there really isn’t a good identity/credit score system they primarily offer loans with 100%+ cryptocurrency as collateral.

-

Decentralized Lending Platforms

Taking it one step further some organizations such as EthLend.io have implemented a completely decentralized banking solution using the Ethereum Blockchain. Like the other platforms users can create loan offers using ERC20 tokens as collateral for ETH loans. While still very early Ethlend gives us a glimpse so some decentralized alternatives to banking made possible with cryptocurrency.

#4 Merchant Services

With today's banks this service is quite complex, expensive, and has many people and moving parts. Credit card companies, clearing companies, ACH, SWIFT and move money from customers to merchants and on to their suppliers. While most of this is done behind the scenes, it is all done by horse. For example you can deposit a check from someone else instantly using your phone, but that money doesn’t get to your bank for up to 5 days as it goes through the different services moving that money.

With cryptocurrency this is all done on the blockchain. There are people in the middle required at all. Payments are made P2P and settle in minutes. All accounting is stored on the blockchain forever.

#5 Interest Bearing Savings Account

Today at most banks you are encouraged to open a savings account to earn interest on your funds. But this risk free interest rate is far lower than inflation and last time I checked it was .1% APR.

While nothing is ever completely risk-free due to platform risk. Cryptocurrency companies have stepped up to fulfill this service. They vary from regulated institutional risk free interest bearing accounts from LedgerX back to P2P savings accounts like Btcpop.co. With current volatility there are never any set rates, but in an open market their shouldn’t be.

Future Headline “Horse Buggy Makers to Build Automobiles”

So while it's not completely clear how banking with cryptocurrencies will look or how long it will take for buggy makers to unhitch the horse. It is clear that banking is here to stay and cryptocurrency is here to stay as well. It will be exciting to see the companies and technologies that bring banking into the 21st century.

Congratulations @bitcoinlending! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPCryptocurrency is like a car, it features much easier and you can do many more things and go faster. Here in SophiaTX, they are improving supply chain efficiency and integrated with enterprise systems in cooperation with Malaysia's National Automotive Industry.

https://medium.com/@sophiatx.social/sophiatx-blockchain-chosen-to-accelerate-the-development-of-malaysias-national-automotive-industry-b628ad46b5da