GameStop buys for the first time Bitcoin for it´s Treasury!

GameStop Adds 4,710 Bitcoin to Balance Sheet in Historic $512 Million Purchase

May 28, 2025 - GameStop Corp. (NYSE: GME) announced today that it has acquired 4,710 Bitcoin worth approximately $512.4 million, joining the growing list of companies using Bitcoin as a strategic treasury asset.

Key Details

The purchase was officially announced via a BusinessWire press release at 10:50 UTC. With Bitcoin priced around $108,785, the investment represents approximately 8.2% of GameStop's total cash reserves of $6.28 billion.

The decision to add Bitcoin was unanimously approved by the board of directors on March 25, 2025, initially causing the stock price to surge 12%. However, when it became clear that the purchase would be financed through $1.48 billion in convertible bonds, the stock declined 23%.

Strategic Significance

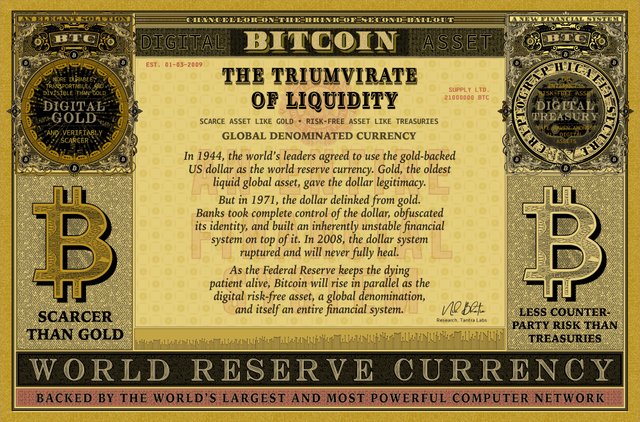

GameStop positions itself as one of the first major retail companies to embrace Bitcoin as a treasury asset, following in the footsteps of companies like MicroStrategy. The move aligns with GameStop's transformation from traditional retailer to a technologically progressive company.

Market Impact

Bitcoin adoption by GameStop could serve as a catalyst for other retail companies to consider similar strategies. It signals Bitcoin's growing acceptance as a legitimate corporate treasury option within traditional sectors.

The investment offers GameStop potential protection against inflation and exposure to Bitcoin's growth potential, though it also introduces volatility risks due to bitcoin's short term fluctuating value.

GameStop joins the growing trend of corporate Bitcoin adoption, which is a positive signal for broader institutional acceptance of Bitcoin as a digital reserve asset.

Source: Bitcoin Daily

Tip:

Read our post on the top 10 of crypto exchanges in the Netherlands