CoinDesk Releases 2018 Bitcoin and Blockchain Industry Report

CoinDesk Releases 2018 Bitcoin and Blockchain Industry Report

In the event that bitcoin is in an air pocket, it is one of only a handful few ever – if not the first – that extended with unimportant utilization of credit.

That is only one of the interesting takeaways from CoinDesk's State of Blockchain 2018 report, the most recent in the quarterly arrangement setting out our inside and out research on the quickly advancing universe of digital forms of money and the advancements they've motivated.

Discharged Wednesday, the report gives a 160 or more slide examination of a portion of the information focuses impelling this story forward.

The report covers open blockchains, DLT, consortium chains, introductory coin offerings (ICOs), exchanging and speculations, and control, and furthermore includes the aftereffects of our 70 or more inquiry supposition overview, which gives understanding from more than 3,000 CoinDesk perusers.

Here are five of the most noteworthy patterns that characterized both Q4 and 2017:

- This isn't your dad's venture bubble

Bitcoin went on a super keep running in 2017 with returns for the year at 1,278 percent. Alongside all the standard consideration came dialog of whether the first and still biggest digital currency was in an air pocket.

Our own perusers were part on this, with around 49 percent replying "yes," 39 percent saying "no" and 11 percent who were nonpartisan. More profound than this split of feeling, our overview gave a genuinely necessary information point around the entire theoretical air pocket discussion.

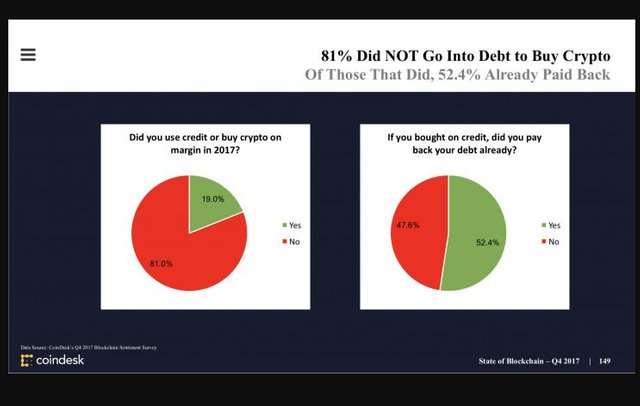

Just 19 percent of our respondents strayed into the red to purchase crypto, and of the individuals who did, over half paid back their advances. The vital and noteworthy takeaway is that if bitcoin is to be sure an air pocket, it is the uncommon kind that has swelled with little use or acquired cash. (Edge exchanging on the trades was as of late presented, yet it is constrained and commonly offered on a shared premise.)

To put it plainly, bitcoin has made it this far without assistance from Wall Street or banks (unless you tally the discount shutting of records to specific enterprises and geologies by hazard opposed budgetary foundations, which may accidentally drive those de-saved money clients to utilize a permissionless framework).

This denotes the first run through in late memory normal individuals have been in front of the supposed "shrewd cash" – another part in the continuous account that bitcoin and digital currencies are the most fascinating story worldwide in fund and financial matters.

- The market has fundamentally broadened

In January 2017, bitcoin's esteem spoken to more than 90 percent of the digital currency showcase. Ethereum had an immense engineer following, yet its exchange volumes were still very little. Be that as it may, when its first "executioner application," the ERC-20 keen contract to create tokens and ICOs, started to pick up footing in Q2 2017, the entire story changed.

Interest for ether (for the most part expected to take an interest in numerous ICOs) developed, thus did the capacity to fund and make new blockchains. This wore down bitcoin's predominance in the market until Q3, when bitcoin turned around the downtrend.

The planning of that move seems to agree with bitcoin's selection of Segregated Witness and the finish of disarray around the bitcoin money fork. While bitcoin consistently won back its predominance score, it melted away again in December as ethereum had its greatest month of the year, driven by the ICO blast.

The market additionally broadened with the ascent of an institutional crypto purchase side, as several new finances shaped to get presentation to this new resource class.

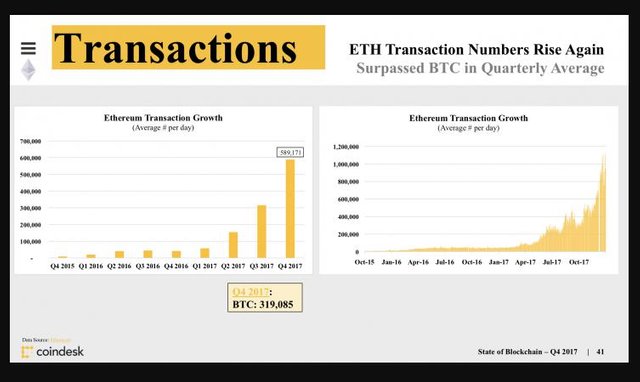

- Ethereum keeps on setting untouched exchange records

ICOs helped drive interest for ethereum in 2017, yet they weren't the main application that made news.

CryptoKitties surprised the world in December, adding another fascinating wrinkle to ethereum's enchantment year. While numerous reprimanded the preposterousness of the Kitties, the novel blockchain utilize case in any case made its check.

While ethereum had officially softened its exchange records up the second from last quarter, the computerized collectibles application, alongside the redesigns from the Byzantium hard fork, helped ethereum almost twofold the volumes accomplished only a couple of months sooner.

Unconventional however it might be, CryptoKitties helped illustrate ethereum's present abilities.

- Korea fills the void left by China

From the beginning of 2017, China flagged the year would have been not quite the same as before.

This all happened as intended in September when China restricted ICOs, at that point close down bitcoin trades in the nation.

Any take a gander at exchange volumes and markets pre-2017 would have driven the peruser to trust that bitcoin and digital forms of money would experience the ill effects of this misfortune. Be that as it may, even with every single Chinese trade shutting on the last day of Q3, bitcoin quickly went on its most prominent bull run ever.

So, it appeared to be nobody minded that China was out. Or maybe, it was an open door for new players.

South Korea, for one, turned into a vital digital money exchanging center point in Q3 and Q4 – taking up a great part of the void left by China. The Korean won wound up noticeably one of the most noteworthy volume matched monetary standards in the business, with especially high XRP and ETH volumes.

- ICOs were huge, yet forks and airdrops were significantly greater

While the whole beginning period financing industry heard the call of ICOs in 2017, they were a blip when contrasted with other token-producing occasions.

Forks and airdrops accompany an implicit client base (for the most part bitcoin HODLers) and were substantially more huge to the general market top in cryptographic forms of money.

The bitcoin money fork was the first to astonish the business with the premium it produced, getting a few trades level footed when clients requested their acquired property. Stellar too offered airdrops of its local cash, lumens, to bitcoin holders, persuading this will be an all the more broadly utilized procedure going ahead.

dosto amar ae id flow koro r ato dolar passo ki kora ami pai na kno help me

Coins mentioned in post: