The Mayer Multiple Puts Bitcoin in a Balance Zone

An in-depth analysis of the key indicator that predicts whether Bitcoin is ready to explode or about to correct. Is it time to buy or sell?

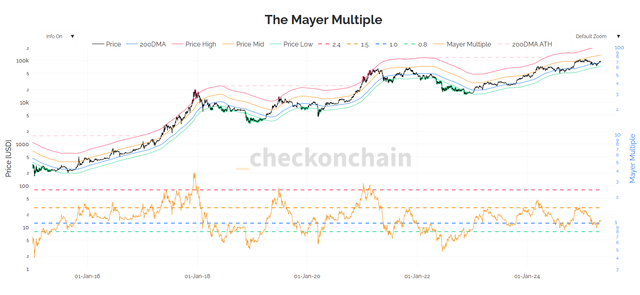

The price of Bitcoin (BTC), currently at $96,834, is being examined through a crucial indicator for long-term investors: the Mayer Multiple. With a current value of 1.0477 as of May 5, 2025, this ratio, which compares Bitcoin's price to its 200-day moving average (200DMA) of $90,535, offers a fascinating insight into its current valuation and future potential.

The Mayer Multiple of 1.0477 as of May 5, 2025, paints a picture of Bitcoin in a steady state, slightly bullish relative to its 200-day average. /TradingView

The Mayer Multiple Exposed: What Does 1.0477 Tell Us?

Developed by Trace Mayer, the Mayer Multiple has become an essential tool for assessing whether Bitcoin is in overbought or undervalued territory relative to its long-term trend. A value of 1.0477 indicates that Bitcoin's current price is slightly above its 200-day average. Historically, investors have considered values below 2.4 as strategic accumulation points, while much higher figures have preceded significant market corrections.

Neither a rampaging bull nor a sleeping bear: Bitcoin in equilibrium

The current value of the Mayer Multiple suggests that Bitcoin is neither experiencing uncontrolled euphoria nor is it in an extremely overbought phase, which could indicate that there is still room for sustained growth if the uptrend prevails. Importantly, however, the ratio is also not at levels historically associated with bargain-buying opportunities (generally below 1).

Outlook and Trends: Ready for the Next Wave?

Considering the current market context, a Mayer Multiple of 1.0477 paints a picture of a relatively modest valuation for Bitcoin compared to its long-term average. Despite the recent struggle to break above the $95,000 barrier, this indicator suggests that Bitcoin has not yet entered a phase of uncontrolled speculation. This could be interpreted as an encouraging sign for those seeking long-term investments, indicating that the asset still has the potential to appreciate before reaching levels historically considered high risk according to the Mayer Multiple.

The Mayer Multiple of 1.0477 as of May 5, 2025, paints a picture of Bitcoin in an equilibrium phase, slightly bullish relative to its 200-day average. While it does not offer an unequivocal signal of massive buying or warn of an impending bubble according to its own historical criteria, it suggests that the market could still have upside before reaching levels historically considered potentially overbought by this indicator. Astute investors will combine this valuable perspective with thorough technical and fundamental analysis to navigate the ever-turbulent waters of the cryptocurrency market.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency trading is highly volatile and carries significant risks, including the total loss of your invested capital. Consult a financial advisor before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.